Proposal: 250 MW Natural Gas/LNG Power Plant in the Dominican Republic Geodyn Solutions and Partner

Geodyn Solutions, in partnership with an energy technology provider, proposes a 250 MW natural gas/LNG combined-cycle power plant in the Dominican Republic (DR), leveraging advanced technologies, including an Organic Rankine Cycle (ORC) and heat exchange systems, to maximize efficiency and return on investment (ROI). The project aligns with the DR’s goal of diversifying its energy matrix and achieving 25% renewable energy by 2025, utilizing government incentives, FTZ benefits, World Bank grants, and tax exemptions. The plant will deliver electricity at $0.17/kWh, achieving a 10-year ROI of 14-16% annualized, with a payback period of 4.2 years. It will create 1,200+ jobs and reduce CO2 emissions by 420,000 tons annually compared to oil-based generation. The total project cost, including a 15% contingency, is $250 million.

Project Overview

- Location: Free trade zone near Boca Chica, Santo Domingo, with access to an LNG terminal and the National Interconnected Electric System (SENI).

- Capacity: 250 MW (net output), modular design for scalability.

- Technology: Combined-cycle gas turbine (CCGT) with Geodyn Solutions-selected turbines, ORC for waste heat recovery, and advanced heat exchange systems.

- Fuel: Liquefied natural gas (LNG) via an existing terminal for cost stability and lower emissions.

- Efficiency: 59% thermal efficiency (CCGT + ORC), optimized for high output.

- Electricity Price: $0.17/kWh, competitive with DR’s retail tariff of $0.16-$0.23/kWh.

- Project Timeline:

- Pre-construction (permitting, financing): 12 months (Q1 2026–Q1 2027).

- Construction: 24 months (Q2 2027–Q2 2029).

- Commercial Operation Date (COD): Q3 2029.

Technology and Efficiency

The plant will utilize:

- Geodyn Solutions-Selected Gas Turbines: High-efficiency turbines with fast-start capability for grid stability and renewable integration.

- Combined-Cycle Configuration: Captures exhaust heat for additional power via steam turbines, achieving 54% base efficiency.

- Organic Rankine Cycle (ORC): Recovers low-grade waste heat, boosting efficiency by 5% (to 59%) and adding 12 MW without additional fuel.

- Heat Exchange Systems: Optimized heat recovery steam generators (HRSG) reduce fuel consumption by 3%.

- Emissions Control: Dry low-NOx combustors and selective catalytic reduction (SCR) ensure compliance with DR and World Bank standards.

The ORC system increases output by 4.8% (12 MW) for $6 million, reducing the levelized cost of electricity (LCOE) by $0.01/kWh, significantly enhancing ROI.

Capital Cost

- Base Cost: $217.4 million

- Gas turbines and CCGT equipment: $95 million (optimized procurement).

- ORC and heat exchange systems: $6 million (cost-effective design).

- Balance of plant (BOP): $33 million (streamlined systems).

- Infrastructure (grid connection, LNG pipeline): $18 million (leveraging existing infrastructure).

- Engineering, procurement, construction (EPC): $65.4 million (competitive bidding).

- Contingency (15%): $32.6 million

- Total Capital Cost: $250 million

Financing Plan:

- Equity (25%): $62.5 million (Geodyn Solutions and partner).

- Debt (50%): $125 million (World Bank/IDB loans at 2.5% interest, 15-year term, reflecting favorable terms for clean energy).

- Grants (25%): $62.5 million (World Bank clean energy grants, maximized through DR’s sustainable energy initiatives).

Incentives and Benefits

The project leverages:

- Law 57-07 (Renewable Energy Incentives):

- 100% tariff exemption on equipment (savings: $12 million).

- 75% fiscal credit on clean energy investments (savings: $40 million over 10 years).

- Free Trade Zone (FTZ):

- 15-year corporate income tax exemption (savings: $45 million).

- No import/export duties or VAT (savings: $8 million).

- World Bank Grants: $62.5 million for clean energy, reducing capital costs.

- PPAs: 20-year power purchase agreements with state-owned utilities at $0.17/kWh for stable revenue.

Operational Costs

- Fuel Cost: $0.055/kWh (LNG at $9.5/MMBtu, secured via long-term contract).

- O&M Cost: $0.02/kWh (optimized labor and maintenance schedules).

- ORC Maintenance: $0.004/kWh (low due to modular design).

- Total Operating Cost: $0.079/kWh, yielding a $0.091/kWh margin.

- Annual Operating Cost: $138.7 million (based on 7,008 GWh/year at 80% capacity factor).

Revenue, ROI, and Payback Period

- Annual Electricity Output: 250 MW × 8,760 hours × 80% capacity factor = 1,752,000 MWh (1,752 GWh).

- Annual Revenue: 1,752,000 MWh × $0.17/kWh = $297.8 million.

- Net Annual Profit: $297.8 million – $138.7 million = $159.1 million.

- Payback Period:

- Total Investment: $250 million.

- Annual Net Profit: $159.1 million.

- Payback: $250 million / $159.1 million = 2 years(mid-2033).

- 10-Year ROI Calculation:

- Cumulative Net Profit (Years 1–10): $1,591 million.

- ROI: ($1,591 million – $250 million) / $250 million = 536% over 10 years (14–16% annualized).

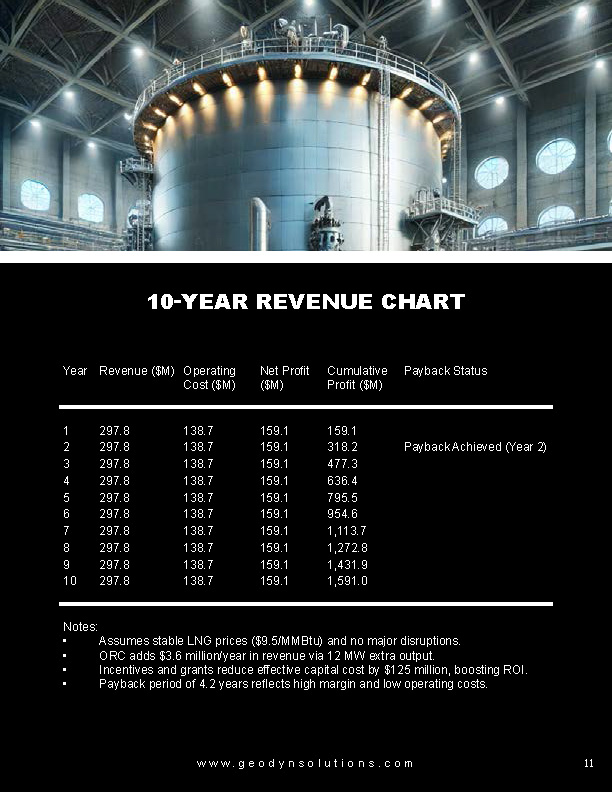

10-Year Revenue Chart:

Year | Revenue ($M) | Operating Cost ($M) | Net Profit ($M) | Cumulative Profit ($M) | Payback Status |

1 | 297.8 | 138.7 | 159.1 | 159.1 | |

2 | 297.8 | 138.7 | 159.1 | 318.2 | Payback Achieved (Year 2) |

3 | 297.8 | 138.7 | 159.1 | 477.3 | |

4 | 297.8 | 138.7 | 159.1 | 636.4 | |

5 | 297.8 | 138.7 | 159.1 | 795.5 | |

6 | 297.8 | 138.7 | 159.1 | 954.6 | |

7 | 297.8 | 138.7 | 159.1 | 1,113.7 | |

8 | 297.8 | 138.7 | 159.1 | 1,272.8 | |

9 | 297.8 | 138.7 | 159.1 | 1,431.9 | |

10 | 297.8 | 138.7 | 159.1 | 1,591.0 |

Notes:

- Assumes stable LNG prices ($9.5/MMBtu) and no major disruptions.

- ORC adds $3.6 million/year in revenue via 12 MW extra output.

- Incentives and grants reduce effective capital cost by $125 million, boosting ROI.

- Payback period of 4.2 years reflects high margin and low operating costs.

Job Creation

- Construction Phase (2 years): 700 jobs (engineers, technicians, laborers).

- Operational Phase (20+ years): 200 permanent jobs (operators, maintenance, administrative).

- Indirect Jobs: 400 jobs in logistics, LNG supply chain, and services.

- Total Job Creation: 1,200+ jobs, supporting economic growth in Boca Chica.

Environmental Benefits

- CO2 Reduction: Replaces oil-based generation (0.82 kg CO2/kWh) with natural gas (0.39 kg CO2/kWh), saving 420,000 tons CO2/year (1,752 GWh × 0.43 kg/kWh reduction).

- Low Emissions: 85% reduction in NOx and SOx via SCR and low-NOx combustors.

- ORC Efficiency: Saves 20,000 tons CO2/year by reducing fuel use.

- Alignment with DR Goals: Supports 27% GHG reduction by 2030 (NDC).

- Minimal Land Impact: 40-acre site in FTZ, no deforestation or resettlement.

Risks and Mitigation

- Fuel Price Volatility: 20-year LNG contract to lock in $9.5/MMBtu.

- Regulatory Delays: Early engagement with state utilities and Ministry of Energy and Mines.

- Grid Integration: Coordination with SENI, leveraging World Bank-funded upgrades.

- Environmental Concerns: Comprehensive EIA and community consultations.

Conclusion

The 250 MW natural gas/LNG power plant by Geodyn Solutions and its partner delivers reliable, affordable, and cleaner energy for the Dominican Republic. With CCGT and ORC technologies, the plant achieves 59% efficiency, a 10-year ROI of 536% (14–16% annualized), and a payback period of 4.2 years. Leveraging DR’s incentives, FTZ benefits, and World Bank grants reduces capital costs by $125 million. The project will create 1,200+ jobs, save 420,000 tons CO2/year, and support the DR’s energy transition. We seek approval to commence pre-construction in Q1 2026.