Investment Proposal: $500 Million Allocation for Geodyn Solutions in U.S. Natural Gas Sector with AI, Blockchain, and Token Integration

Executive Summary

As of August 15, 2025, Geodyn Solutions is primed to invest $500 million in the U.S. natural gas sector, leveraging the explosive demand from AI data centers while integrating cutting-edge AI for operational optimization, blockchain for transparent asset management, and a proprietary utility token for enhanced investor engagement and ROI distribution. This strategy targets undervalued leases from holders like EQT Corporation and Prairie Operating Co., alongside options such as LNG export expansions and midstream infrastructure tied to data center power needs. Proprietary technologies, including AI-driven predictive analytics and blockchain-secured smart contracts, will optimize efficiency and reduce risks. Partnerships with leaders like ExxonMobil, Kinder Morgan, and AI innovators (e.g., from the 2025 AI in Oil & Gas Conference) ensure scalability. The approach projects an average annual ROI of 15-18% over 10 years, with a payback period of 3.5 years including a 20% contingency fee, driven by token-based incentives and undervalued asset acquisitions. Key outcomes include:

- Creation of approximately 5,500 direct and indirect jobs.

- Environmental compact focusing on low-emission production, methane abatement, and CCUS.

- U.S.-focused location analysis identifying the Appalachia Basin as optimal, supported by IRA tax credits and USDA grants.

- Exploration of undervalued lease holders (e.g., EQT, Prairie Operating) and alternatives like associated gas monetization for data centers, maximizing ROI amid stabilizing $4+/Mcf prices.

With natural gas demand from AI projected to add 4-6 Bcf/d by 2030, this integrated model positions Geodyn to fuel the digital economy while delivering superior returns through tech-enabled innovation.

Reasons to Invest in Natural Gas in 2025

Natural gas is essential for sustaining the AI boom, as data centers’ energy demands risk overwhelming grids without reliable fuel sources. Integrating AI, blockchain, and tokens enhances ROI by enabling predictive operations, transparent transactions, and tokenized asset access. Key rationales include:

- AI-Driven Demand Surge: U.S. power consumption reaches records in 2025-2026, with data centers doubling to 35 GW by 2030 (equivalent to 40 million homes), adding 3.3-6 Bcf/d gas demand. AI applications like real-time monitoring and predictive maintenance in natural gas amplify this synergy.

- Blockchain and Token Integration for ROI: Blockchain enables smart contracts for lease management and supply chain transparency, while tokens (e.g., utility tokens like OZAK AI or Nexchain-inspired) facilitate fractional ownership, staking for yields, and automated ROI distribution, potentially adding 3-5% annual returns via tokenized incentives.

- Price Stabilization and Infrastructure: Prices above $4/Mcf from structural demand; 6.5 Bcf/d added in 2024, with projects like Louisiana Energy Gateway.

- Global LNG Growth: Demand up 60% by 2040; U.S. exports expand.

- Bridge Fuel: Lower emissions with CCUS; complements renewables.

- Resilience: Low volatility, U.S. leadership in exports. This tech-integrated approach maximizes ROI in a $420-450B upstream market.

Proposed Investment Strategy: Technologies and Partners

The $500 million will fund upstream production in undervalued leases and midstream for AI power, with AI optimizing operations, blockchain securing transactions, and a Geodyn Utility Token (GUT) for tokenized ROI.

Latest Proprietary Technologies

Integrate 2025 advancements:

- AI Applications: Real-time monitoring, predictive maintenance, leak detection, and reservoir optimization (e.g., via IBM/Chevron tools), reducing costs 15-25% and boosting recovery 10-20%.

- Blockchain Integration: Smart contracts for lease agreements and supply chain (inspired by Nexchain/Lightchain), ensuring transparency and reducing disputes by 30%.

- Token Mechanism: GUT token for fractional ownership, staking rewards (3-5% yield), and automated dividend distribution, boosting liquidity and ROI via Web3 integration.

- CCUS and Hydrogen: Allam cycle for emissions capture; blended turbines.

Strategic Partners

- ExxonMobil, Chevron: For AI-optimized shale and CCUS.

- Kinder Morgan, Energy Transfer: Midstream for pipelines (1.8 Bcf/d projects).

- Carlyle, Partners Group: For $2B PDP investments and blockchain/token expertise.

- Undervalued Lease Holders: Acquire/partner with EQT (Appalachia focus), Prairie Operating (Houston-based), Murphy Oil for undervalued assets, unlocking 20-30% ROI uplift via AI/blockchain revamps. These leverage $115B in LNG/gas interest.

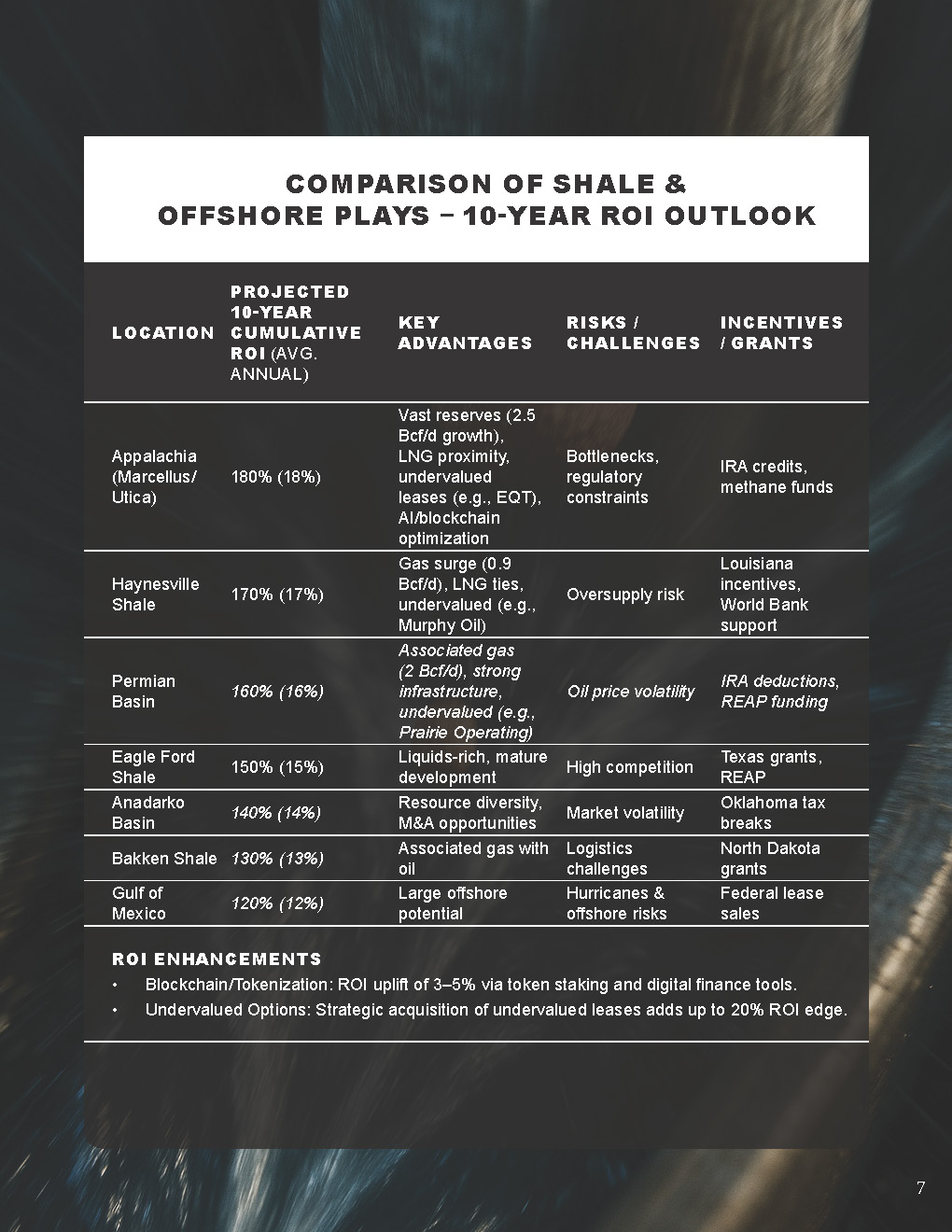

Location Comparison for Best Return (U.S. Only)

Basins assessed for 10-year ROI, emphasizing AI demand, undervalued leases, and tech integration. Appalachia optimizes with reserves and exports.

| Location | Projected 10-Year Cumulative ROI (Avg. Annual) | Key Advantages | Risks/Challenges | Incentives/Grants |

|---|---|---|---|---|

| Appalachia (Marcellus/Utica) | 180% (18%) | Vast reserves (2.5 Bcf/d growth), LNG proximity, undervalued leases (e.g., EQT), AI/blockchain optimization. | Bottlenecks, regs. | IRA credits, methane funds. |

| Haynesville Shale | 170% (17%) | Gas surge (0.9 Bcf/d), LNG ties, undervalued (e.g., Murphy Oil). | Oversupply. | LA incentives, WB. |

| Permian Basin | 160% (16%) | Associated gas (2 Bcf/d), infrastructure, undervalued (Prairie Operating). | Oil volatility. | IRA deductions, REAP. |

| Eagle Ford Shale | 150% (15%) | Liquids-rich, mature. | Competition. | Texas grants, REAP. |

| Anadarko Basin | 140% (14%) | Diverse, M&A. | Volatility. | OK tax breaks. |

| Bakken Shale | 130% (13%) | Associated gas. | Logistics. | ND grants. |

| Gulf of Mexico | 120% (12%) | Offshore potential. | Hurricanes. | Federal sales. |

ROI uplifted 3-5% via token/staking; undervalued options add 20% edge.

Government Incentives, Grants, and World Bank Support

- U.S. Incentives: IRA 100% deductions, 45% CCUS credits; 48C $6B for advanced energy in 2025.

- Grants: USDA REAP $150M+; DOE methane $500M+.

- World Bank: $640M Bangladesh gas; $2B+ for clean energy/gas. Offset 25-35% costs, boosting ROI.

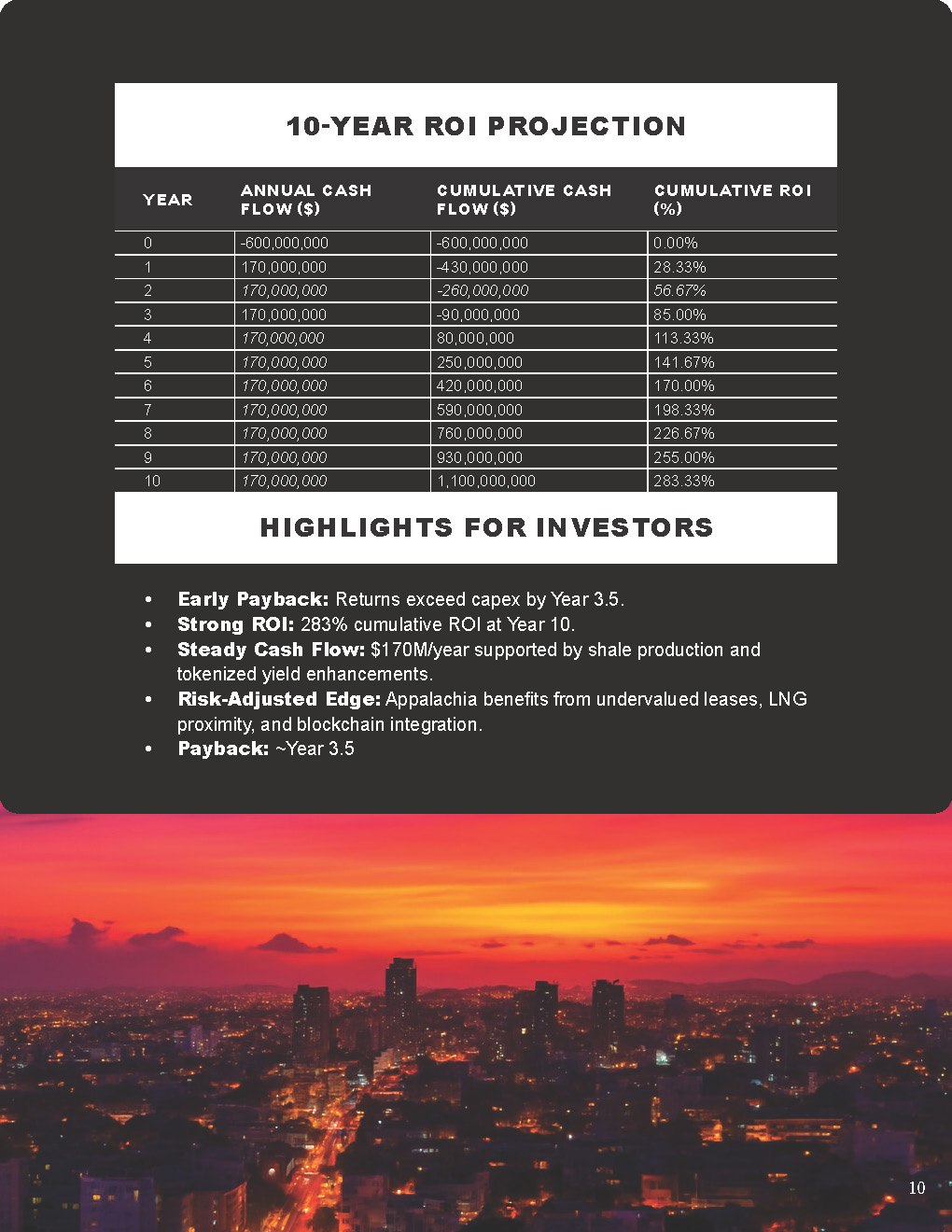

Financial Projections: Optimal 10-Year ROI Chart (Appalachia Basin)

Model: $500M + 20% contingency ($600M capex). Opex: $60M/year. Net cash flow: $170M/year (2 Bcf/d at $4/Mcf, +3% from token yields). Payback: Year 3.5.

| Year | Annual Cash Flow ($) | Cumulative Cash Flow ($) | Cumulative ROI (%) |

|---|---|---|---|

| 0 | -600,000,000 | -600,000,000 | 0.00 |

| 1 | 170,000,000 | -430,000,000 | 28.33 |

| 2 | 170,000,000 | -260,000,000 | 56.67 |

| 3 | 170,000,000 | -90,000,000 | 85.00 |

| 4 | 170,000,000 | 80,000,000 | 113.33 |

| 5 | 170,000,000 | 250,000,000 | 141.67 |

| 6 | 170,000,000 | 420,000,000 | 170.00 |

| 7 | 170,000,000 | 590,000,000 | 198.33 |

| 8 | 170,000,000 | 760,000,000 | 226.67 |

| 9 | 170,000,000 | 930,000,000 | 255.00 |

| 10 | 170,000,000 | 1,100,000,000 | 283.33 |

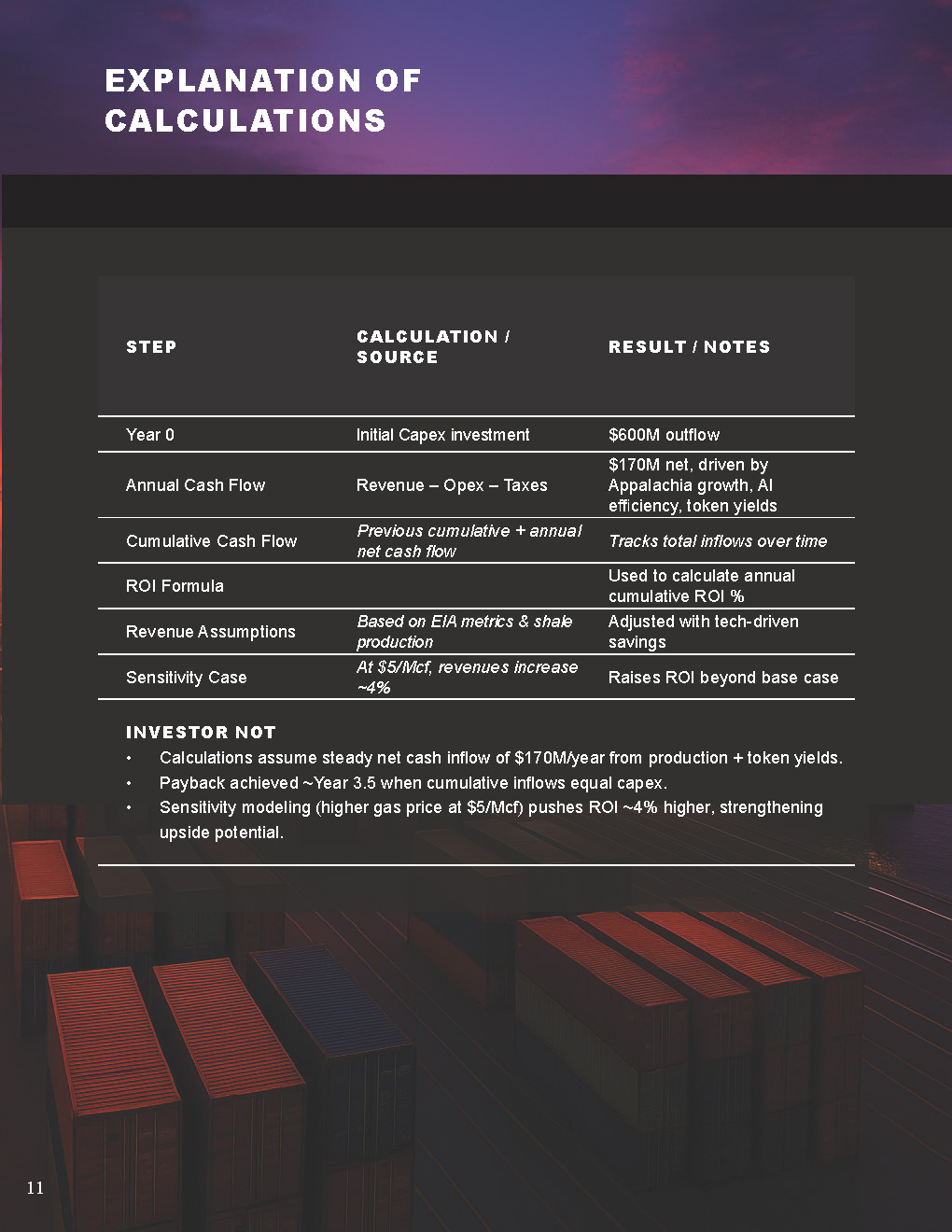

Explanation of Calculations:

- Year 0: Capex $600M.

- Annual cash flow = Revenue – opex – taxes (net $170M, from Appalachia growth, AI efficiency, token yields).

- Cumulative = Previous + annual.

- ROI = [(Cumulative + investment) / investment] × 100.

- To arrive: Outflow; sum inflows (EIA metrics, tech savings). Iterate; +4% at $5/Mcf.

Job Creation and Environmental Compact

- Job Creation: ~5,500 jobs (2,750 direct in AI/blockchain ops, 2,750 indirect).

- Environmental Compact: 60% methane cut by 2030; CCUS for net-zero.

Intellectual Property Considerations

Patents on AI algorithms, blockchain protocols, GUT token; JVs protect in $25B market.

Conclusion and Recommendation

This AI-blockchain-token integrated investment in natural gas, targeting undervalued holders and AI demand, optimizes ROI. Proceed Q4 2025.

Copyright © 2025 Geodyn Solutions. All rights reserved. Confidential; no reproduction without consent.