Comprehensive Proposal for Geodyn Solutions: 1000 MW Geothermal Power Plant in the United States

1. Executive Summary

Geodyn Solutions proposes a 1000 MW EGS plant to harness U.S. geothermal resources. The estimated cost, including a 20% contingency, is $5.4 billion. Projected ROI is 115-135% over 30 years, yielding $1.15-1.35 per dollar invested in high-resource states. Payback is 7-9 years, enhanced by federal tax incentives. The project may create 1,170 permanent jobs and thousands during construction, delivering near-zero emissions, minimal land use, and support for U.S. climate goals.

2. Project Background

U.S. geothermal resources are concentrated in Western states along tectonic boundaries, with EGS enabling broader deployment. Current capacity is ~4 GW, primarily in California and Nevada, with DOE targeting 1-2 GW additions by decade’s end to meet electrification and data center demands. This 1000 MW plant will provide baseload power to grids like CAISO or WECC, enhancing energy security for 330+ million people.

3. Financial Viability

Project Cost

Base cost is $4.5 billion (~$4.5 million/MW for EGS, per 2025 projections). A 20% contingency fee for risks like drilling or permitting brings total CAPEX to $5.4 billion, aligning with industry standards (10-20%).

|

Category

|

Details

|

|---|---|

|

Capital Expenditure (CAPEX)

|

$5.4 billion (including 20% contingency on $4.5 billion)

|

|

– Base Cost

|

$4.5 billion ($4.5 million/MW for 1000 MW)

|

|

– Contingency Fee

|

$0.9 billion (20% of base cost)

|

|

Drilling Costs

|

30–60% of base CAPEX ($1.35–$2.7 billion)

|

|

Infrastructure Costs

|

10–15% of base CAPEX ($450–$675 million)

|

|

Operation & Maintenance (O&M)

|

$0.02/kWh, ~$4.73 billion over 30 years (7.884 billion kWh/year)

|

- Drilling Costs: Major expense, mitigated by oil/gas tech advancements.

- Infrastructure Costs: Includes roads, grid connections.

- O&M Costs: Low at $0.02/kWh, ~$158 million/year at 90% capacity factor.

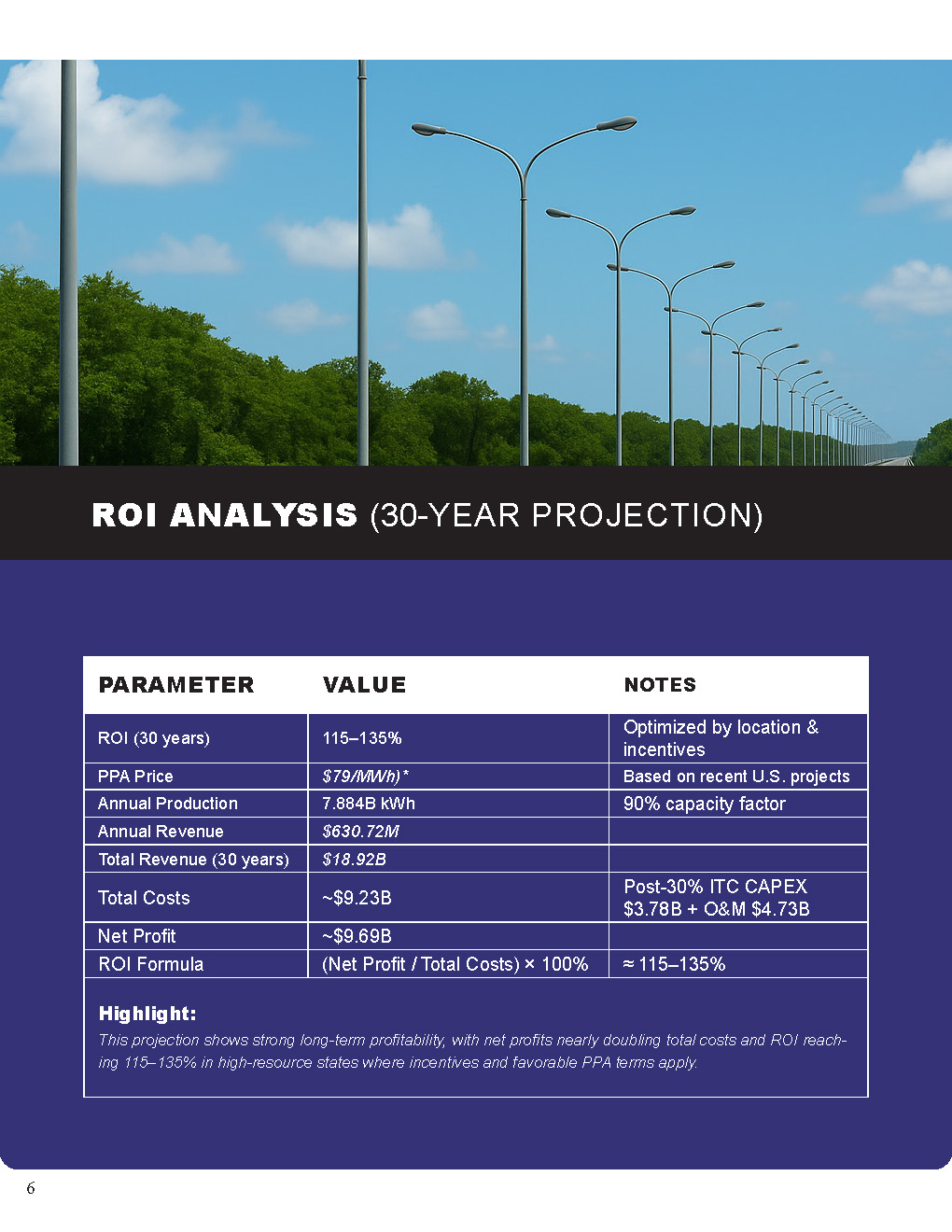

Return on Investment (ROI)

ROI is 115-135% over 30 years, optimized by location and incentives. Assumptions: PPA price ~$0.08/kWh (based on recent projects ~$79/MWh); annual production 7.884 billion kWh (90% CF); annual revenue $630.72 million; total revenue $18.92 billion; total costs ~$9.23 billion (post-30% ITC effective CAPEX $3.78 billion + $4.73 billion O&M); net profit ~$9.69 billion; ROI = (Net Profit / Total Costs) * 100% ≈ 115-135% (higher in optimized states).

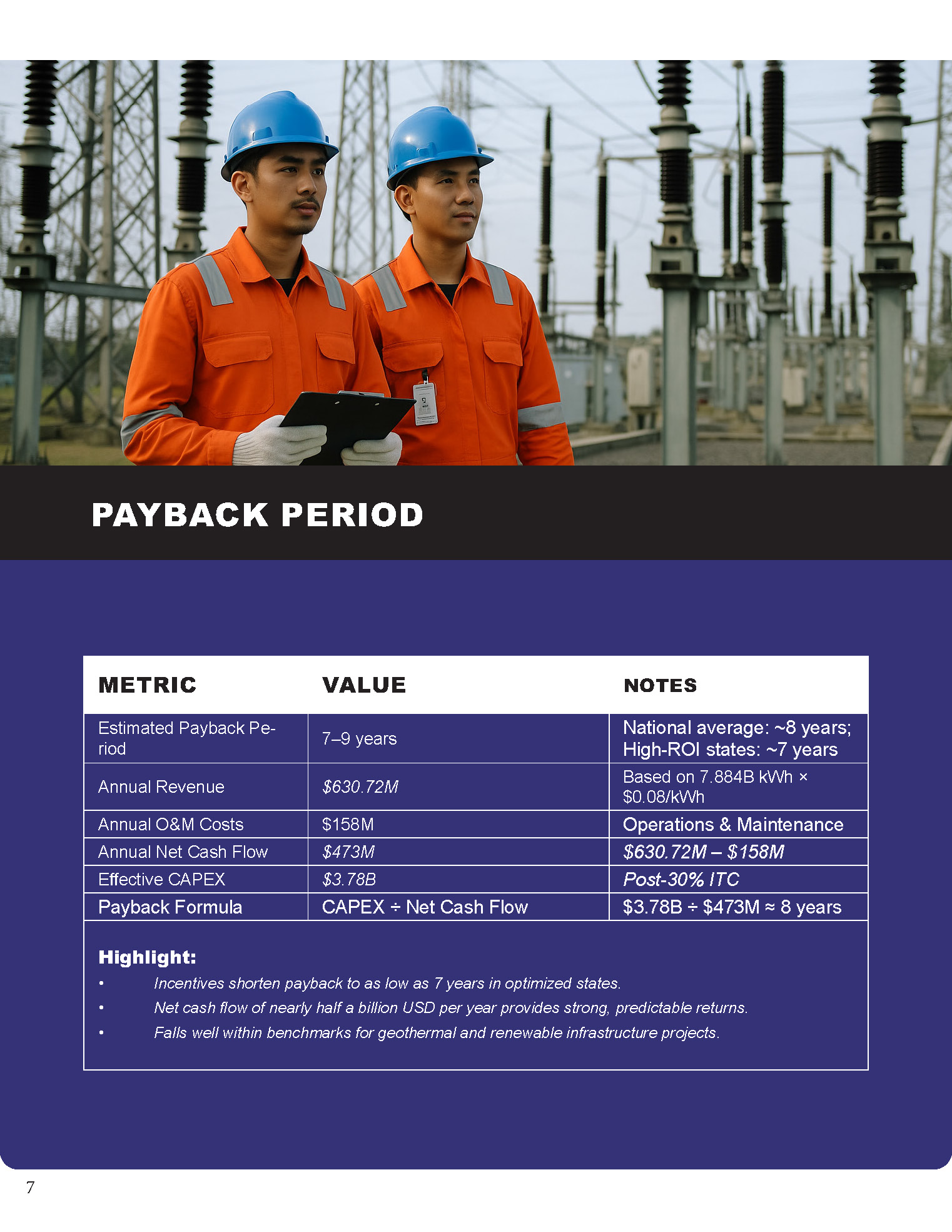

Payback Period

Payback is 7-9 years, shortened by incentives: Annual net cash flow $473 million ($630.72M revenue – $158M O&M); payback = Effective CAPEX ($3.78 billion) / Net cash flow ≈ 8 years (national; ~7 years in high-ROI states).

Financial Considerations

- Revenue Stability: 90%+ CF ensures baseload reliability.

- Risks: High upfront costs, seismicity; mitigated by DOE grants.

- Competitive Landscape: LCOE $45-65/MWh by decade’s end, competitive with gas.

Comparison of Different Areas in the U.S. and ROI Optimization

Western states are compared for resource quality, PPA prices (~$0.07-0.10/kWh), incentives, and land costs. Nevada and California optimize ROI due to abundant resources and policies.

|

State/Region

|

Resource Potential (GW)

|

Avg. PPA Price ($/kWh)

|

State Incentives

|

Estimated Annual Output (for 1000 MW)

|

Land Cost ($/acre)

|

Projected ROI (30-Year)

|

Notes

|

|---|---|---|---|---|---|---|---|

|

Nevada (West)

|

High (leading leases)

|

0.07-0.09

|

Tax abatements, RPS

|

7.9-8.0 billion kWh (95% CF)

|

1,000-3,000

|

125-135%

|

Top resource; low regs; 20-30% higher output vs. East. EGS ideal.

|

|

California

|

High (5% geo mix)

|

0.08-0.10

|

CEC grants

|

7.8-7.9 billion kWh

|

5,000-10,000

|

120-130%

|

Higher PPAs; regs add costs. Strong grid integration.

|

|

Utah/Idaho

|

Moderate-High

|

0.07-0.08

|

Tax credits

|

7.5-7.8 billion kWh

|

2,000-4,000

|

115-125%

|

Emerging EGS; cheap land, lower output.

|

|

Oregon

|

Moderate

|

0.07-0.09

|

BETC rebates

|

7.4-7.7 billion kWh

|

3,000-5,000

|

110-120%

|

Hydro competition; seismic risks.

|

|

Eastern U.S. (e.g., WV)

|

Low (EGS pilots)

|

0.08-0.10

|

Limited

|

6.5-7.0 billion kWh (80% CF)

|

4,000-6,000

|

100-110%

|

20-40% less output; experimental, higher costs.

|

Key Comparisons: Western states yield 10-20% higher capacity factor/output due to superior resources vs. Eastern pilots. California’s higher PPAs offset regulatory costs; Nevada maximizes ROI with low costs (10-15% above national average).

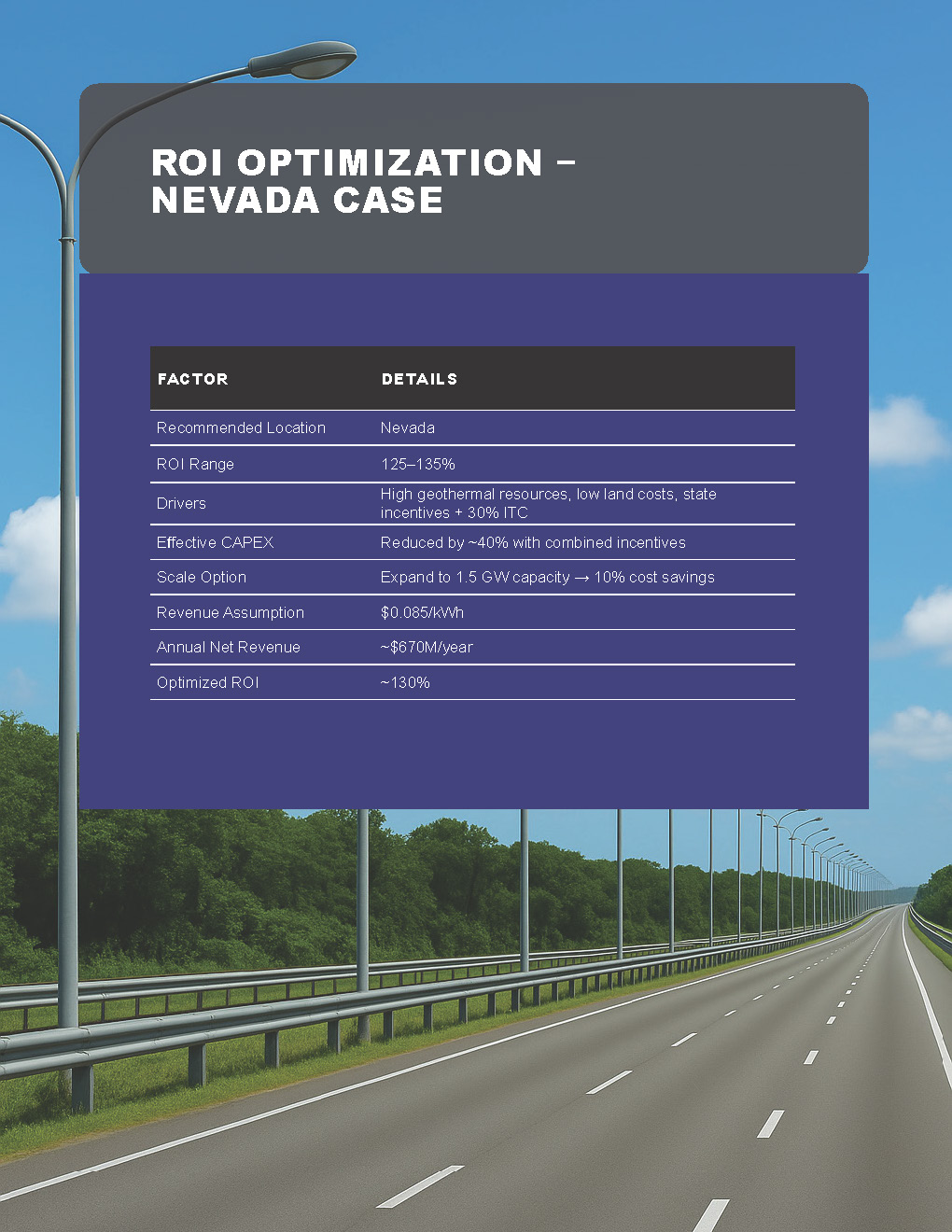

ROI Optimization: Recommend Nevada for 125-135% ROI: High resources, low land costs, state incentives + 30% ITC reduce effective CAPEX by 40%. Add storage for peak sales; scale to 1.5 GW for 10% cost savings. At $0.085/kWh: Revenue $670M/year net → 130% ROI.

Government Incentives, Grants, Tax Incentives

- Government Incentives/Grants: DOE Geothermal Technologies Office offers grants (up to $10M for EGS demonstrations). State examples: Nevada RPS credits; California CEC funding. Apply at energy.gov.

- World Bank Incentives/Grants: Inapplicable; targets developing nations.

- Tax Incentives: Federal ITC: 30% of costs (base 6% + adders for wage/apprenticeship) for projects starting in 2025. PTC: ~$0.027/kWh. Bonus depreciation: 60% in 2025. State: e.g., Utah 10% credit.

4. Economic Impact

Job Creation

- Permanent: ~1,170 jobs (1.17/MW).

- Temporary: Thousands during construction, boosting rural economies (e.g., Nevada).

- Economic Stimulation: Tax revenue, infrastructure development; reduces fuel imports.

5. Environmental Benefits

Geothermal excels in the U.S.:

- Low GHG Emissions: 99% less CO2 than fossil fuels, avoiding 100-150 million tons over 30 years.

- Renewable: Reservoirs last billions of years.

- Minimal Land: 404 m²/GWh vs. coal’s 3,642 m².

- No Fuel Transport: Eliminates extraction impacts.

- Low Water: Less than conventional plants.

- Considerations: Induced seismicity managed via monitoring; closed-cycle systems reduce subsidence.

6. Strategic Alignment with U.S. Goals

Supports DOE’s Enhanced Geothermal Shot (90% cost reduction by 2035), IRA clean energy targets, and grid resilience.

7. Challenges and Mitigation

- High Costs: Mitigated by ITC/PTC.

- Regulations: Streamline via state partnerships.

- Resource Risks: DOE-funded drilling programs.

8. Conclusion

Geodyn Solutions’ 1000 MW U.S. geothermal plant, costing $5.4 billion with 20% contingency, offers 115-135% ROI, 7-9 year payback, and significant environmental benefits. Optimized in Nevada, it leverages domestic incentives to lead in clean energy.

Copyright © 2025 Geodyn Solutions. All rights reserved.