Geodyn Solutions Proposal $1 Billion Investment in U.S. Coking Coal Reserves Using Advanced Green Mining Solutions

Executive Summary

Geodyn Solutions proposes a $1 billion strategic investment to acquire, develop, and operate premium U.S. coking-coal (metallurgical coal) reserves utilizing advanced green mining technologies. This project will ensure a secure, long-term supply of high-grade steelmaking coal while delivering optimal ROI, substantial job creation, and measurable environmental benefits.

By combining proven reserves, cutting-edge mining methods, and federal/state/local incentives, Geodyn Solutions can position itself as the market leader in sustainable metallurgical coal production for both domestic and global steel industries.

Project Scope & Technology

- Investment Size:USD 1,000,000,000

- Target Reserves:Undeveloped or underdeveloped U.S. coking-coal deposits in strategic locations with strong logistics.

- Green Mining Technology:

- Electric & hybrid fleets to cut diesel emissions by 40%.

- Autonomous drilling & haulage for cost efficiency.

- Methane capture systems to reduce GHG emissions by up to 60%.

- Closed-loop water recycling to reuse 90% of process water.

- Dry stack tailings to eliminate slurry ponds and protect waterways.

- Project Life:25+ years (phased).

- Contingency:20% of CAPEX reserved for cost overruns, compliance, and upgrades.

Reserve Opportunities

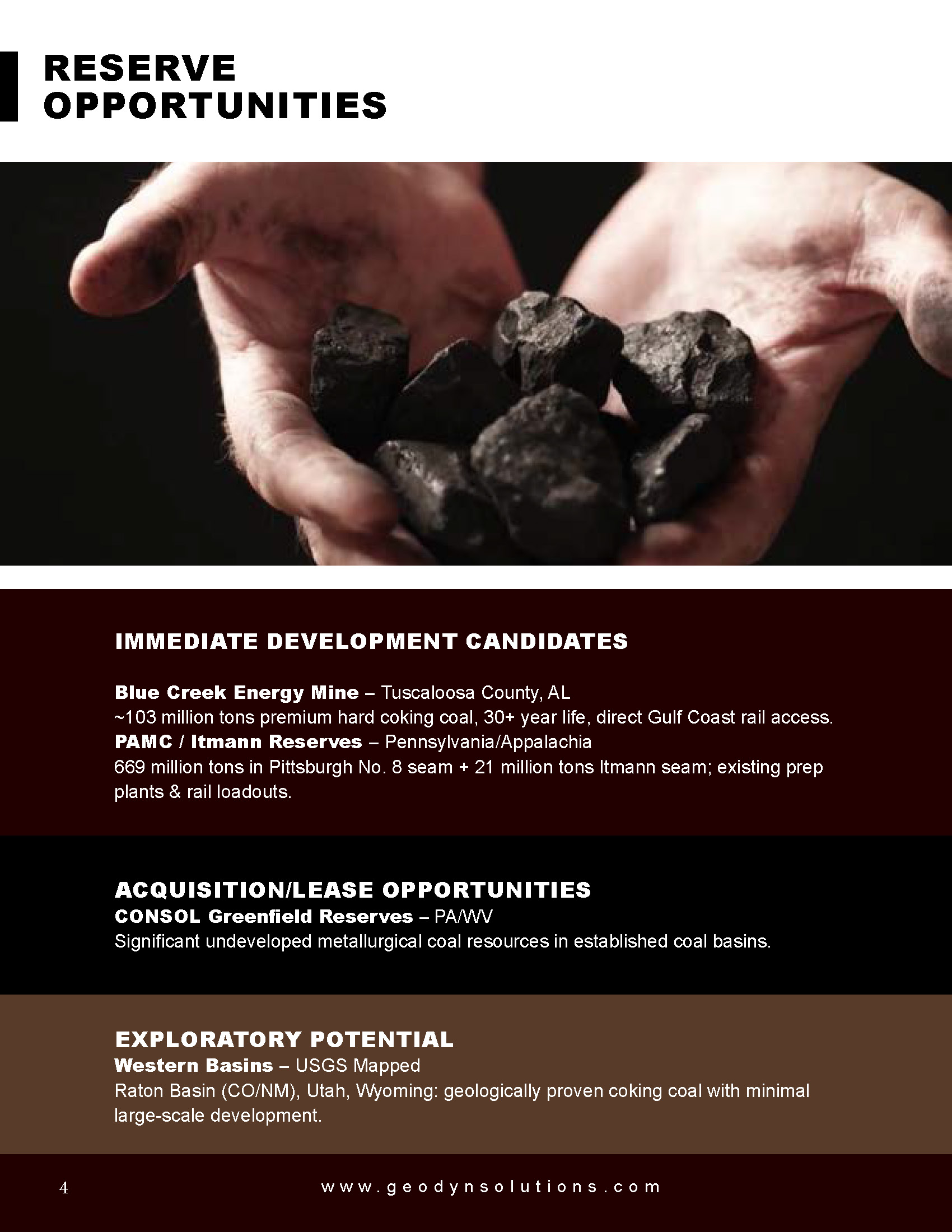

Immediate Development Candidates

- Blue Creek Energy Mine – Tuscaloosa County, AL

~103 million tons premium hard coking coal, 30+ year life, direct Gulf Coast rail access. - PAMC / Itmann Reserves – Pennsylvania/Appalachia

669 million tons in Pittsburgh No. 8 seam + 21 million tons Itmann seam; existing prep plants & rail loadouts.

Acquisition/Lease Opportunities

- CONSOL Greenfield Reserves – PA/WV

Significant undeveloped metallurgical coal resources in established coal basins.

Exploratory Potential

- Western Basins – USGS Mapped

Raton Basin (CO/NM), Utah, Wyoming: geologically proven coking coal with minimal large-scale development.

Market Evaluation

- Global Demand:Driven by blast-furnace steel production; supply tightness in major exporters.

- Price Outlook:Premium hard coking coal projected at $250–$300/ton (5-year average).

- Domestic Gap:S. imports 5–7 Mt/year; opportunity to displace imports with domestic production.

- Export Potential:Gulf, East Coast, and Pacific port access ensures diversified market reach.

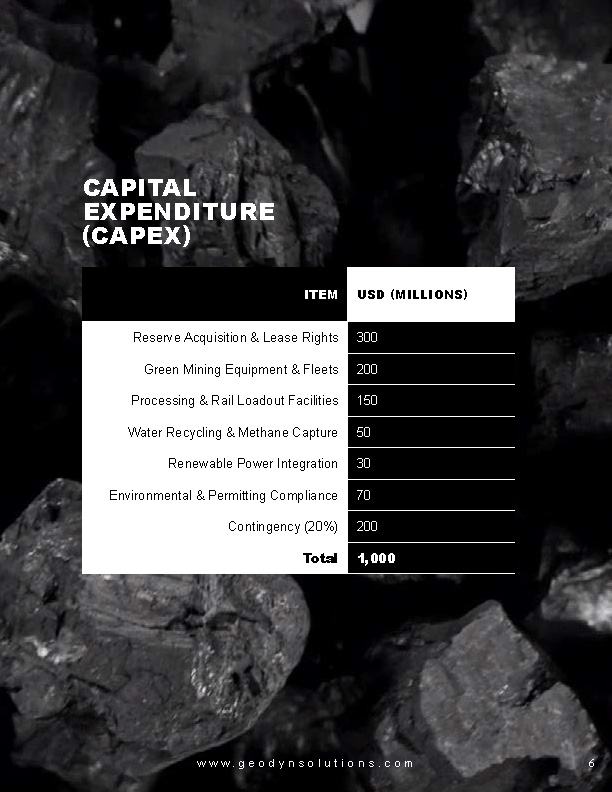

Capital Expenditure (CAPEX)

Item | USD (Millions) |

Reserve Acquisition & Lease Rights | 300 |

Green Mining Equipment & Fleets | 200 |

Processing & Rail Loadout Facilities | 150 |

Water Recycling & Methane Capture | 50 |

Renewable Power Integration | 30 |

Environmental & Permitting Compliance | 70 |

Contingency (20%) | 200 |

Total | 1,000 |

Economic Impact & Job Creation

- Direct Jobs:~500 (operations, engineering, compliance, logistics).

- Indirect Jobs:~1,200 (rail, port, equipment supply, community services).

- Training:Partnerships with technical colleges for certified green mining programs.

Environmental Benefits

- Methane capture and utilization for reduced carbon footprint.

- Electric and hybrid fleets to cut fossil fuel dependence.

- Dry stack tailings to prevent contamination.

- Progressive reclamation for biodiversity recovery.

- Closed-loop water use to preserve freshwater resources.

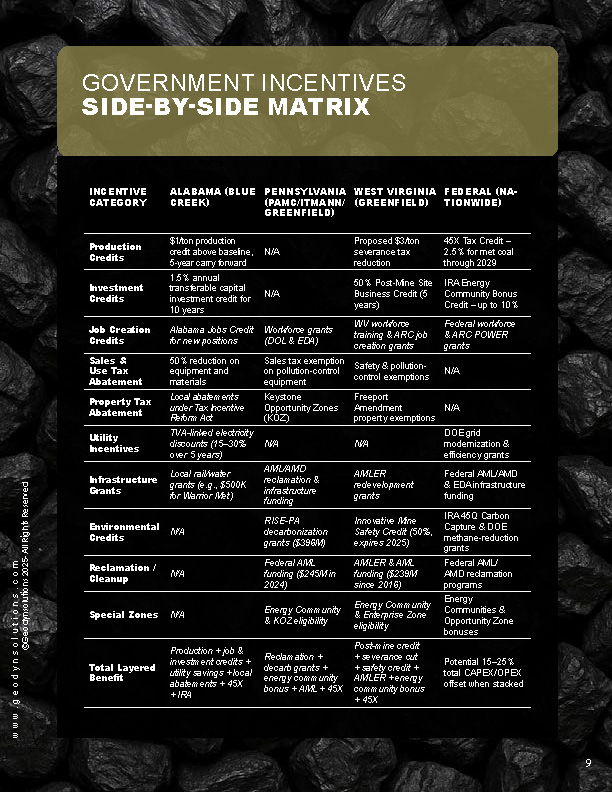

Government Incentives – Side-by-Side Matrix

Incentive Category | Alabama (Blue Creek) | Pennsylvania (PAMC/Itmann/Greenfield) | West Virginia (Greenfield) | Federal (Nationwide) |

Production Credits | $1/ton production credit above baseline, 5-year carry forward | N/A | Proposed $3/ton severance tax reduction | 45X Tax Credit – 2.5% for met coal through 2029 |

Investment Credits | 1.5% annual transferable capital investment credit for 10 years | N/A | 50% Post-Mine Site Business Credit (5 years) | IRA Energy Community Bonus Credit – up to 10% |

Job Creation Credits | Alabama Jobs Credit for new positions | Workforce grants (DOL & EDA) | WV workforce training & ARC job creation grants | Federal workforce & ARC POWER grants |

Sales & Use Tax Abatement | 50% reduction on equipment and materials | Sales tax exemption on pollution-control equipment | Safety & pollution-control exemptions | N/A |

Property Tax Abatement | Local abatements under Tax Incentive Reform Act | Keystone Opportunity Zones (KOZ) | Freeport Amendment property exemptions | N/A |

Utility Incentives | TVA-linked electricity discounts (15–30% over 5 years) | N/A | N/A | DOE grid modernization & efficiency grants |

Infrastructure Grants | Local rail/water grants (e.g., $500K for Warrior Met) | AML/AMD reclamation & infrastructure funding | AMLER redevelopment grants | Federal AML/AMD & EDA infrastructure funding |

Environmental Credits | N/A | RISE-PA decarbonization grants ($396M) | Innovative Mine Safety Credit (50%, expires 2025) | IRA 45Q Carbon Capture & DOE methane-reduction grants |

Reclamation / Cleanup | N/A | Federal AML funding ($245M in 2024) | AMLER & AML funding ($239M since 2016) | Federal AML/AMD reclamation programs |

Special Zones | N/A | Energy Community & KOZ eligibility | Energy Community & Enterprise Zone eligibility | Energy Communities & Opportunity Zone bonuses |

Total Layered Benefit | Production + job & investment credits + utility savings + local abatements + 45X + IRA | Reclamation + decarb grants + energy community bonus + AML + 45X | Post-mine credit + severance cut + safety credit + AMLER + energy community bonus + 45X | Potential 15–25% total CAPEX/OPEX offset when stacked |

Financial Outlook

- Annual Output:5 Mt premium met coal.

- Revenue:$1.25–$1.5B/year.

- EBITDA Margin:35–40%.

- Payback Period:~5–6 years.

- Upside Potential:Carbon credit sales, low-emission branding, price volatility benefits.

Conclusion

Geodyn Solutions has the opportunity to secure long-term profitability and market leadership in metallurgical coal through responsible development, advanced technology, and optimal use of incentives. This investment strengthens the domestic steel supply chain, creates enduring jobs, and sets a new standard for environmental responsibility in coal mining.

© 2025 Geodyn Solutions – All Rights Reserved

This document and its contents are proprietary and confidential. No part of this proposal may be reproduced, distributed, or disclosed without prior written consent from Geodyn Solutions.