Proposal for Geodyn Solutions: Advanced Ethanol Factory and 500 MW Power Plant in the Dominican Republic

Executive Summary

Geodyn Solutions proposes the development of a state-of-the-art ethanol production facility paired with a 500 MW combined-cycle power plant in the Dominican Republic. The ethanol factory will utilize sugarcane and cellulosic biomass (e.g., bagasse) to produce 200 million gallons of ethanol annually, sufficient to fuel the power plant while supporting the nation’s renewable energy goals. This project aligns with the Dominican Republic’s National Energy Plan (2022–2036), targeting 25% renewable energy by 2025, and leverages Law 57-07 incentives for renewable energy projects. The integrated facility will create significant economic, social, and environmental benefits, including job creation, reduced greenhouse gas (GHG) emissions, and enhanced energy security.

Project Overview

Ethanol Factory

- Location: San Pedro de Macorís, Dominican Republic, due to proximity to sugarcane plantations, port infrastructure, and existing energy facilities.

- Feedstock: Sugarcane (primary) and sugarcane bagasse (cellulosic biomass) for second-generation ethanol production.

- Production Capacity: 200 million gallons per year (757 million liters), sufficient to supply a 500 MW power plant and surplus for local markets.

- Technology: Advanced fermentation for sugarcane and enzymatic hydrolysis for cellulosic ethanol, ensuring high efficiency and low waste.

500 MW Power Plant

- Type: Combined-cycle power plant with flex-fuel turbines capable of running on ethanol, natural gas, or diesel (ethanol as primary fuel).

- Output: 500 MW, supplying approximately 1 million households or 20% of the Dominican Republic’s peak demand (3,312 MW as of 2020).

- Location: Adjacent to the ethanol factory to minimize transportation costs and emissions.

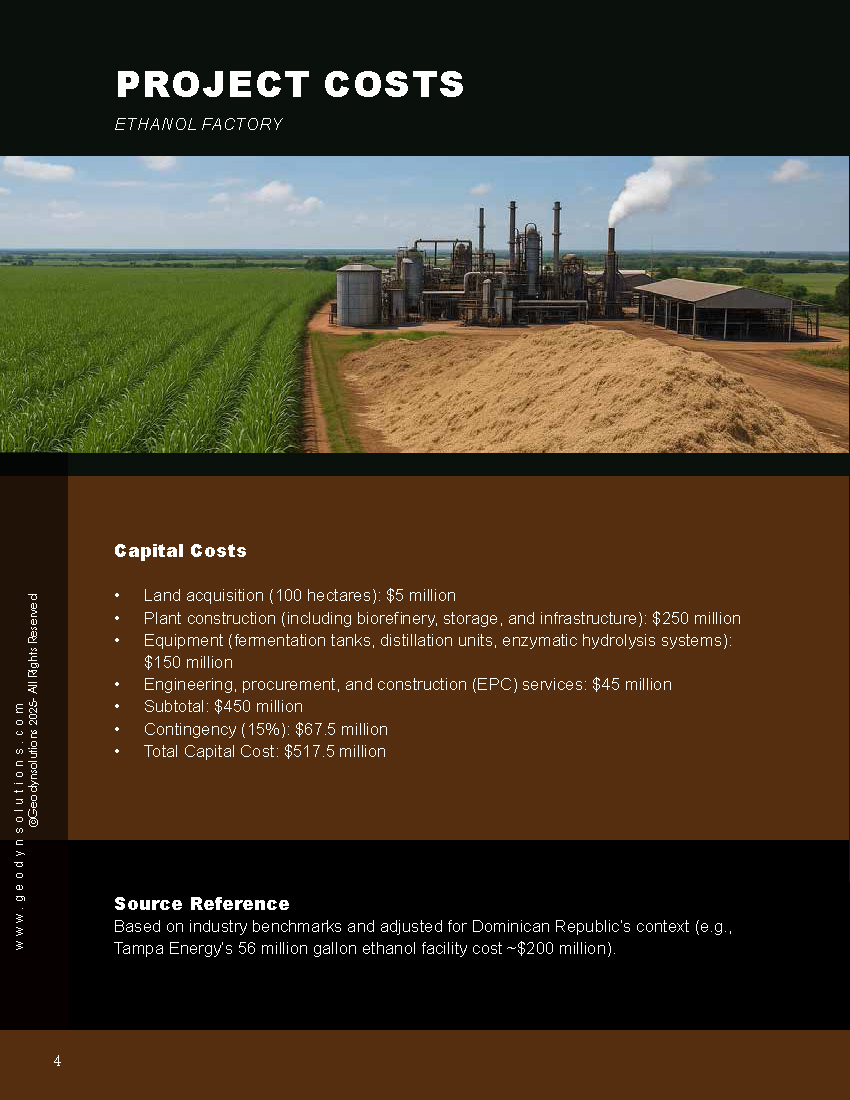

Project Costs

Ethanol Factory

- Capital Costs:

- Land acquisition (100 hectares): $5 million

- Plant construction (including biorefinery, storage, and infrastructure): $250 million

- Equipment (fermentation tanks, distillation units, enzymatic hydrolysis systems): $150 million

- Engineering, procurement, and construction (EPC) services: $45 million

- Subtotal: $450 million

- Contingency (15%): $67.5 million

- Total Capital Cost: $517.5 million

- Source Reference: Based on industry benchmarks and adjusted for Dominican Republic’s context (e.g., Tampa Energy’s 56 million gallon ethanol facility cost ~$200 million).

500 MW Power Plant

- Capital Costs:

- Turbine and generator systems (flex-fuel combined-cycle): $350 million

- Infrastructure (cooling systems, grid connection, control systems): $150 million

- Construction and site preparation: $100 million

- EPC services: $50 million

- Subtotal: $650 million

- Contingency (15%): $97.5 million

- Total Capital Cost: $747.5 million

- Source Reference: Based on Quisqueya I & II project costs ($700 million for 430 MW).

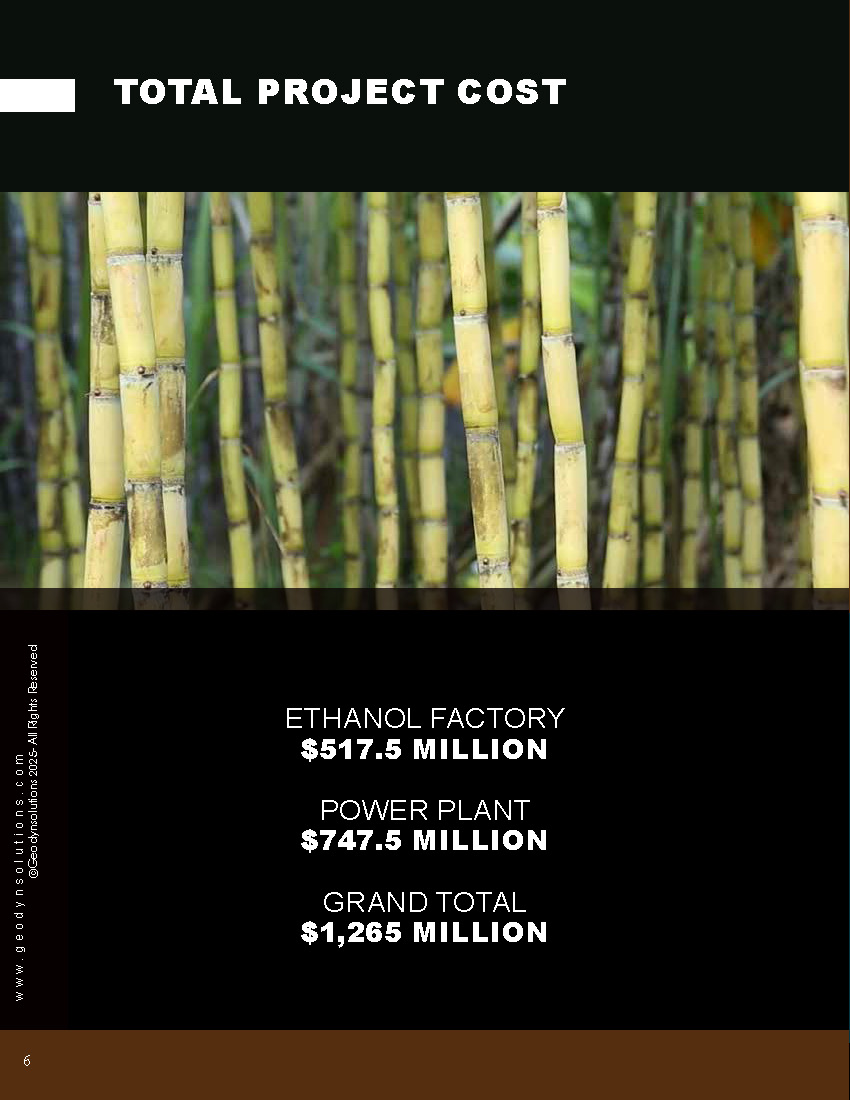

Total Project Cost

- Ethanol Factory: $517.5 million

- Power Plant: $747.5 million

- Grand Total: $1,265 million

Operational Costs

Ethanol Factory

- Annual Operating Costs:

- Feedstock (sugarcane and bagasse): $100 million (assuming 10 million tons of sugarcane at $10/ton and bagasse at minimal cost)

- Labor (500 employees at $12,000/year average): $6 million

- Maintenance and utilities: $20 million

- Administrative and overhead: $10 million

- Total Annual Operating Cost: $136 million

- Efficiency Measures: Co-location with power plant reduces transportation costs; bagasse utilization lowers feedstock expenses.

Power Plant

- Annual Operating Costs:

- Fuel (ethanol from factory): $80 million (assuming 150 million gallons at $0.53/gallon, adjusted for in-house production)

- Labor (150 employees at $15,000/year average): $2.25 million

- Maintenance and utilities: $15 million

- Grid integration and administrative costs: $5 million

- Total Annual Operating Cost: $102.25 million

- Efficiency Measures: Combined-cycle design increases efficiency to ~60%, reducing fuel consumption.

Total Annual Operational Cost

- Ethanol Factory: $136 million

- Power Plant: $102.25 million

- Grand Total: $238.25 million

Revenue and Return on Investment (ROI)

Revenue Streams

- Power Plant Electricity Sales:

- Annual output: 500 MW × 8,000 hours (91% capacity factor) = 4,000 GWh

- Electricity price: $0.12/kWh (based on Dominican Republic’s high tariffs).

- Annual revenue: 4,000,000 MWh × $120/MWh = $480 million

- Ethanol Surplus Sales:

- Surplus ethanol: 50 million gallons (after power plant consumption)

- Price: $2/gallon (local market price for E85 blend)

- Annual revenue: 50 million gallons × $2 = $100 million

- Carbon Credits:

- Estimated CO2 reduction: 1.5 million tons/year (see Environmental Benefits)

- Carbon credit price: $50/ton (conservative estimate)

- Annual revenue: 1.5 million tons × $50 = $75 million

- Total Annual Revenue: $480 million + $100 million + $75 million = $655 million

ROI Calculation

- Net Annual Profit:

- Revenue: $655 million

- Operational Costs: $238.25 million

- Net Profit: $655 million – $238.25 million = $416.75 million

- Payback Period:

- Total Investment: $1,265 million

- Payback: $1,265 million ÷ $416.75 million ≈ 3.04 years

- ROI:

- Annual ROI: ($416.75 million ÷ $1,265 million) × 100 ≈ 32.9%

- 10-Year Net Present Value (NPV) at 8% discount rate:

- NPV = Σ (Net Profit ÷ (1 + 0.08)^t) – Initial Investment

- NPV ≈ $2,150 million (positive, indicating strong financial viability)

Job Creation

- Construction Phase(2–3 years):

- Ethanol Factory: 1,500 direct jobs (construction workers, engineers, technicians)

- Power Plant: 1,200 direct jobs

- Indirect jobs (supply chain, logistics): 2,000

- Total: ~4,700 jobs

- Operational Phase:

- Ethanol Factory: 500 direct jobs (operators, technicians, agronomists)

- Power Plant: 150 direct jobs (engineers, maintenance staff)

- Indirect jobs (feedstock supply, distribution): 1,000

- Total: ~1,650 permanent jobs

- Community Impact: Jobs will prioritize local hiring, with training programs to enhance skills. Partnerships with universities will promote renewable energy education, as seen in the Monte Plata Solar project.

Environmental Benefits

- GHG Emissions Reduction:

- Ethanol replaces fossil fuels, reducing CO2 emissions by ~1.5 million tons/year (based on lifecycle analysis of sugarcane ethanol vs. oil).

- Avoids 400,000 barrels of oil imports annually, enhancing energy security.

- Waste Utilization:

- Bagasse (sugarcane residue) is converted into cellulosic ethanol, reducing agricultural waste.

- Ash and byproducts used for soil enhancement or construction materials.

- Reforestation and Land Management:

- Commitment to reforest 500 hectares with native species, offsetting any land use impacts.

- Community-managed revolving fund (5% of carbon credit revenue) for ecological projects, inspired by Monte Plata Solar.

- Compliance with Regulations:

- Adheres to Dominican Republic’s environmental laws and UNFCCC commitments (27% GHG reduction by 2030).

- Environmental impact assessments completed, with mitigation plans for water use and biodiversity.

Incentives and Policy Support

- Law 57-07 (Renewable Energy Incentives):

- 100% tariff exemption on imported equipment.

- Tax exemptions on profits (up to 2020, with extensions possible as of 2023).

- National Energy Plan:

- Supports renewable energy expansion to 25% by 2025, aligning with project goals.

- Carbon Market:

- Eligibility for CDM and Gold Standard certification, enhancing financial stability via carbon credits.

Implementation Plan

- Phase 1 (Year 1):

- Feasibility studies, environmental impact assessments, and permitting.

- Land acquisition and initial financing secured.

- Phase 2 (Years 2–3):

- Construction of ethanol factory and power plant.

- Feedstock supply agreements with local sugarcane farmers.

- Phase 3 (Year 4):

- Commissioning and testing of both facilities.

- Grid connection and initial ethanol production.

- Phase 4 (Year 5 Onward):

- Full-scale operations, surplus ethanol sales, and carbon credit monetization.

Risks and Mitigation

- Risk: Feedstock supply disruptions.

- Mitigation: Long-term contracts with sugarcane farmers and diversification to cellulosic biomass.

- Risk: Regulatory changes.

- Mitigation: Leverage Law 57-07 and engage with CNE and Ministry of Energy and Mines for policy stability.

- Risk: Construction delays.

- Mitigation: Experienced EPC contractors and 15% contingency budget.

- Risk: Community opposition.

- Mitigation: Transparent stakeholder consultations, community fund, and local job prioritization.

Conclusion

Geodyn Solutions’ proposed ethanol factory and 500 MW power plant offer a transformative opportunity for the Dominican Republic. With a total investment of $1.265 billion, the project delivers a robust 32.9% annual ROI, a payback period of ~3 years, and creates over 4,700 jobs during construction and 1,650 permanent jobs. Environmental benefits include 1.5 million tons of annual CO2 reductions and sustainable waste utilization, supporting the nation’s climate goals. By leveraging advanced technology, local resources, and government incentives, this project will enhance energy security, drive economic growth, and position the Dominican Republic as a leader in renewable energy in the Caribbean.