Mongolia Clean Hydrogen & Ammonia Export Hub

Proposal Title: Mongolia Clean Hydrogen & Ammonia Export Hub

Presented by: Geodyn Solutions

Total Project Cost: USD $650 million

Location: Mongolia

Project Timeline: 3 years construction and ramp-up; 25+ year operational lifespan

Executive Summary

Geodyn Solutions proposes the development of a $650 million Clean Hydrogen and Ammonia Export Hub in Mongolia. This project leverages coal gasification, carbon capture, and renewable energy to produce blue and green hydrogen, convert it to ammonia for safe export, and create carbon credits. It positions Mongolia as a key supplier in the Asia-Pacific hydrogen economy while driving economic growth, job creation, and climate leadership.

Project Components

- Hydrogen Production via Coal Gasification ($250M CAPEX)

- 50 MW-equivalent gasification plant.

- Produces hydrogen from Mongolian coal with integrated CO2 capture (blue hydrogen).

- Geodyn microbes reduce sulfur and nitrogen impurities biologically.

- Renewable Hydrogen Expansion Phase ($150M CAPEX)

- Electrolyzer units powered by solar/wind.

- Produces green hydrogen for blended output.

- Ammonia Conversion & Export Terminal ($150M CAPEX)

- Converts hydrogen into liquid ammonia for export.

- Includes cryogenic storage, loading facilities, and pipelines.

- Carbon Capture, Utilization & Storage (CCUS) System ($50M CAPEX)

- Captures 90%+ of CO2 emissions from coal-based hydrogen.

- Stored underground or used in building materials, algae growth.

- Shared Infrastructure & Grid Integration ($50M CAPEX)

- Includes roads, grid tie-in, and water recycling systems.

Total Operating Expenses (OPEX): $100 million/year

OPEX Breakdown:

- Labor and Personnel: $30 million/year

- Maintenance and Spare Parts: $15 million/year

- Utilities and Water: $20 million/year

- Electricity (for electrolyzers and compression): $10 million/year

- Chemical Reagents and Gas Purification: $10 million/year

- Logistics, Transport & Export Operations: $10 million/year

- Environmental Monitoring & Compliance: $5 million/year

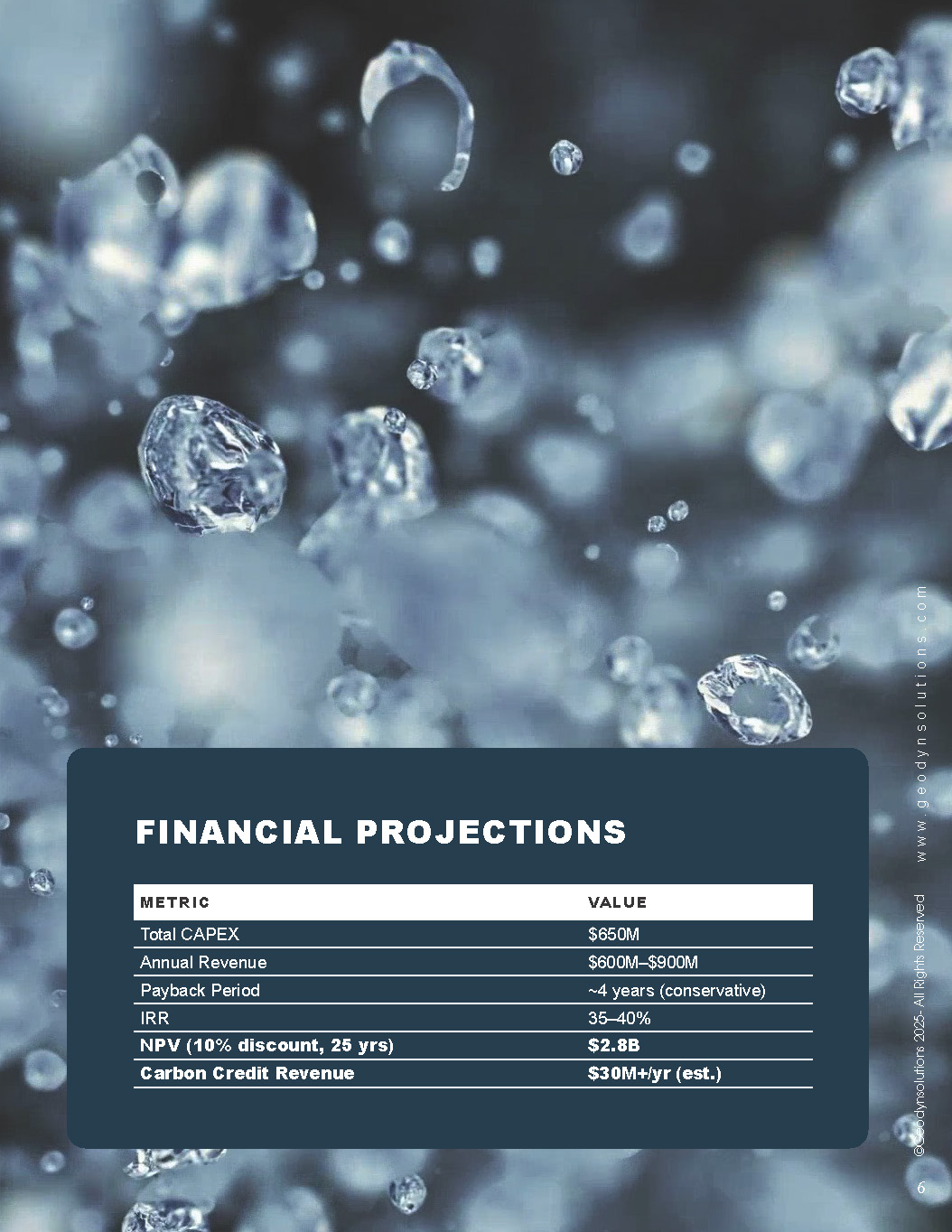

Financial Projections

Metric | Value |

Total CAPEX | $650M |

Annual Revenue | $600M–$900M |

Payback Period | ~4 years (conservative) |

IRR | 35–40% |

NPV (10% discount, 25 yrs) | $2.8B |

Carbon Credit Revenue | $30M+/yr (est.) |

Payback Period Explanation:

While annual revenues of $600M–$900M suggest a potential for rapid capital recovery, actual net cash flow after OPEX, taxes, and ramp-up considerations yields approximately $300M–$500M per year. Accounting for a 1–1.5 year ramp-up phase and staggered revenue realization, the conservative payback period estimate is ~4 years. However, actual financial modeling indicates breakeven could occur as early as year 3:

Year | Assumptions | Net Cash Flow (USD) | Cumulative |

1 | 30% capacity (ramp-up) | $90M | $90M |

2 | 70% capacity | $210M | $300M |

3 | Full operation | $350M | $650M |

4+ | Profit phase | $350M+/yr |

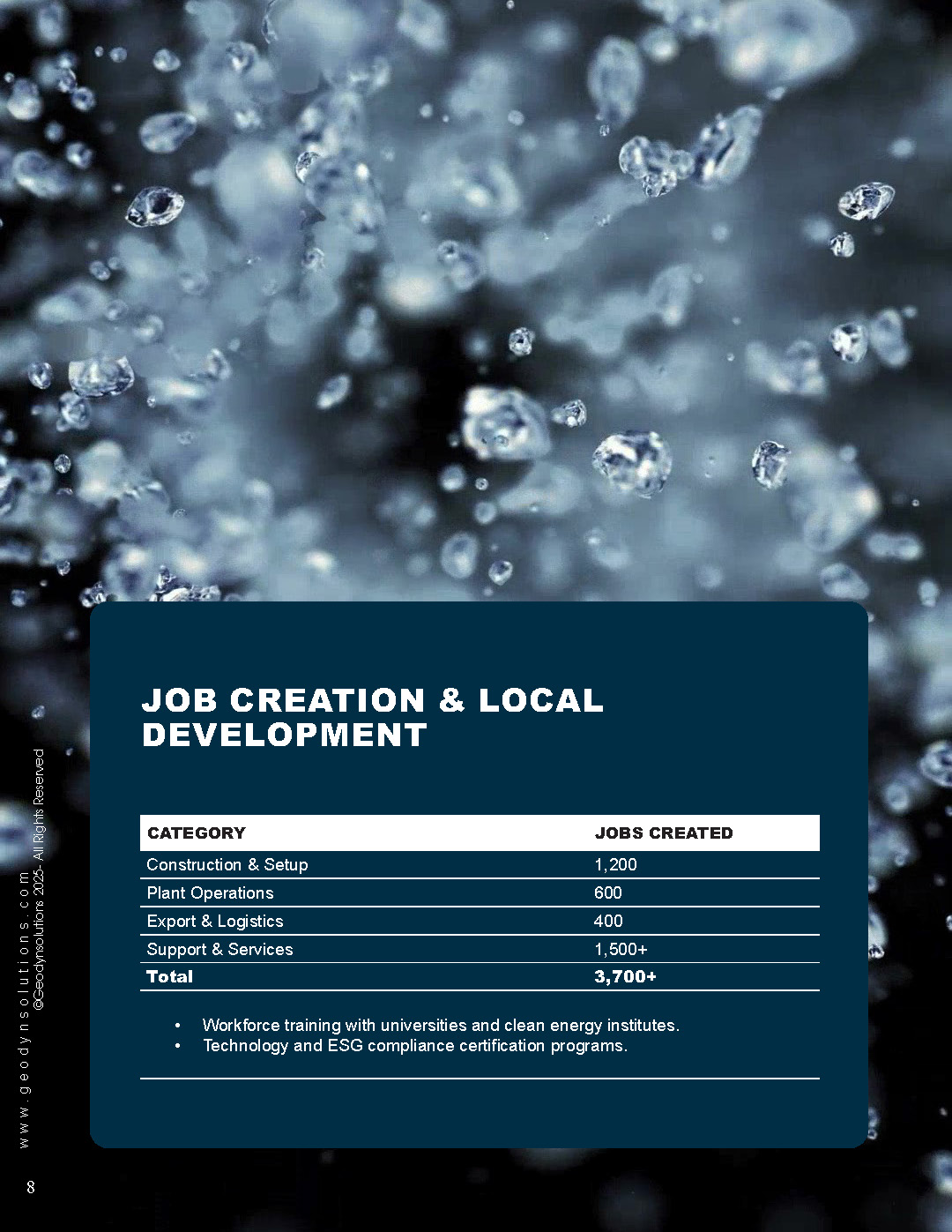

Job Creation & Local Development

Category | Jobs Created |

Construction & Setup | 1,200 |

Plant Operations | 600 |

Export & Logistics | 400 |

Support & Services | 1,500+ |

Total | 3,700+ |

- Workforce training with universities and clean energy institutes.

- Technology and ESG compliance certification programs.

Environmental & ESG Commitments

- Blue hydrogen with 90% carbon capture; transition to green hydrogen.

- Recycled water systems and waste heat recovery.

- Alignment with Paris Agreement and UN Sustainable Development Goals.

- Full life-cycle emissions reporting and carbon offset sales.

Export Markets & Strategic Value

- Ammonia shipped to Japan, Korea, and the EU.

- Integrated into regional clean energy corridors and port hubs.

- Long-term offtake MoUs with hydrogen buyers and maritime fuel users.

Strategic Partnerships

- Collaboration with Japanese and Korean energy importers.

- Co-financing from green climate funds and development banks.

- Public-private partnerships for infrastructure and R&D.

Conclusion

The Mongolia Clean Hydrogen & Ammonia Export Hub offers unmatched financial returns, strategic alignment with global energy transitions, and environmental stewardship. Geodyn Solutions welcomes investors, government partners, and offtake buyers to shape a cleaner, more prosperous future from the heart of Asia.