Investment Proposal: $500 Million Allocation for Geodyn Solutions in Undervalued U.S. Oil and Gas Leases

Executive Summary

As of August 15, 2025, Geodyn Solutions is positioned to strategically deploy $500 million into undervalued U.S. oil and gas leases, focusing on mature fields and idle assets where proprietary, low-cost well completion technologies can unlock significant value. This strategy emphasizes diversified investments across Proved Developed Producing (PDP), Proved Developed Non-Producing (PDNP), and Proved Undeveloped (PUD) assets, utilizing advanced AI-driven automation, lightweight proppants, and compact separation systems to optimize ROI. Targeting an average annual return of 12-15% over 10 years, the plan achieves a payback period of approximately 4 years with a 20% contingency fee. Key outcomes include:

- Monthly cash flows with up to 100% tax deductions against active income.

- Creation of approximately 5,000 direct and indirect jobs.

- An environmental compact prioritizing methane reduction and carbon capture, utilization, and storage (CCUS).

- A U.S.-focused location analysis identifying the Permian Basin as optimal for undervalued leases, supported by government incentives, grants, and World Bank transition funds. With Brent crude forecasted at $70-80/bbl through 2030 and U.S. production stabilizing at 13-14 MMb/d, this approach leverages undervalued assets and cost-efficient completions to deliver resilient, high-growth returns in a stabilizing energy market.

Reasons to Invest in Oil and Gas, Focusing on Undervalued Leases and Low-Cost Well Completions

Investing in undervalued oil and gas leases and low-cost well completions offers a compelling opportunity in 2025, capitalizing on market inefficiencies and technological advancements. Key reasons include:

- Persistent Demand and Inflation Hedge: Global oil demand is projected to grow at 1.1% annually through 2030, with U.S. production steady at 13-14 MMb/d, providing a stable hedge against inflation and economic volatility.

- Significant Tax Advantages: Investors can deduct up to 100% of investments against active income through intangible drilling costs and depletion allowances, boosting after-tax returns.

- Steady Cash Flow Potential: Monthly distributions from producing assets (PDP) and reactivated wells (PDNP) offer consistent income, independent of stock market fluctuations.

- Undervalued Asset Opportunities: Chronic underinvestment has created a pool of undervalued leases, including 448+ producing leases in the Gulf of Mexico with reactivation potential, offering low-cost entry points.

- Low-Cost Completions: Proprietary technologies enable well completions at 20-50% lower costs ($5-10M vs. $15-20M per well), making marginal and idle assets profitable even at $50-60/bbl.

- Policy Support: Pro-energy policies, including streamlined leasing and LNG export expansions, enhance domestic opportunities, countering global supply risks. This strategy positions Geodyn to exploit undervalued assets in a sector with $420-450 billion in upstream investments, delivering diversified, high-yield returns.

Proposed Investment Strategy: Technologies and Partners

The $500 million will fund the acquisition and development of undervalued leases, focusing on low-cost recompletions and new drills across PDP, PDNP, and PUD assets, supported by proprietary technologies and strategic partnerships.

Latest Proprietary Technologies

Deploy cutting-edge innovations to reduce costs and enhance efficiency:

- AI-Driven Asset Assessment: Advanced seismic analysis and predictive analytics optimize well selection and recompletion, cutting costs by 20-30% and improving success rates.

- Lightweight Proppants and Compact Systems: Proprietary proppants and automated separation technologies enable rapid, low-cost recompletions, reducing expenses by up to 50%.

- Digital Monitoring and IoT: Real-time production tracking via digital twins and IoT platforms ensures transparency and operational efficiency, minimizing downtime. These technologies, secured by patents, provide a competitive edge in revitalizing undervalued assets.

Strategic Partners

Collaborate with industry leaders and specialized firms:

- ExxonMobil and ConocoPhillips: For joint ventures in the Permian Basin, leveraging their low breakevens (<$40/bbl) and expertise in efficient operations.

- Oilfield Service Providers: Firms specializing in automated completion systems to accelerate PDNP reactivation at reduced costs.

- Geology and Operations Experts: Advisors with 20-30 years of experience in asset evaluation and project management to ensure rigorous due diligence. These partnerships capitalize on $120 billion in 2025 M&A activity, facilitating access to undervalued leases.

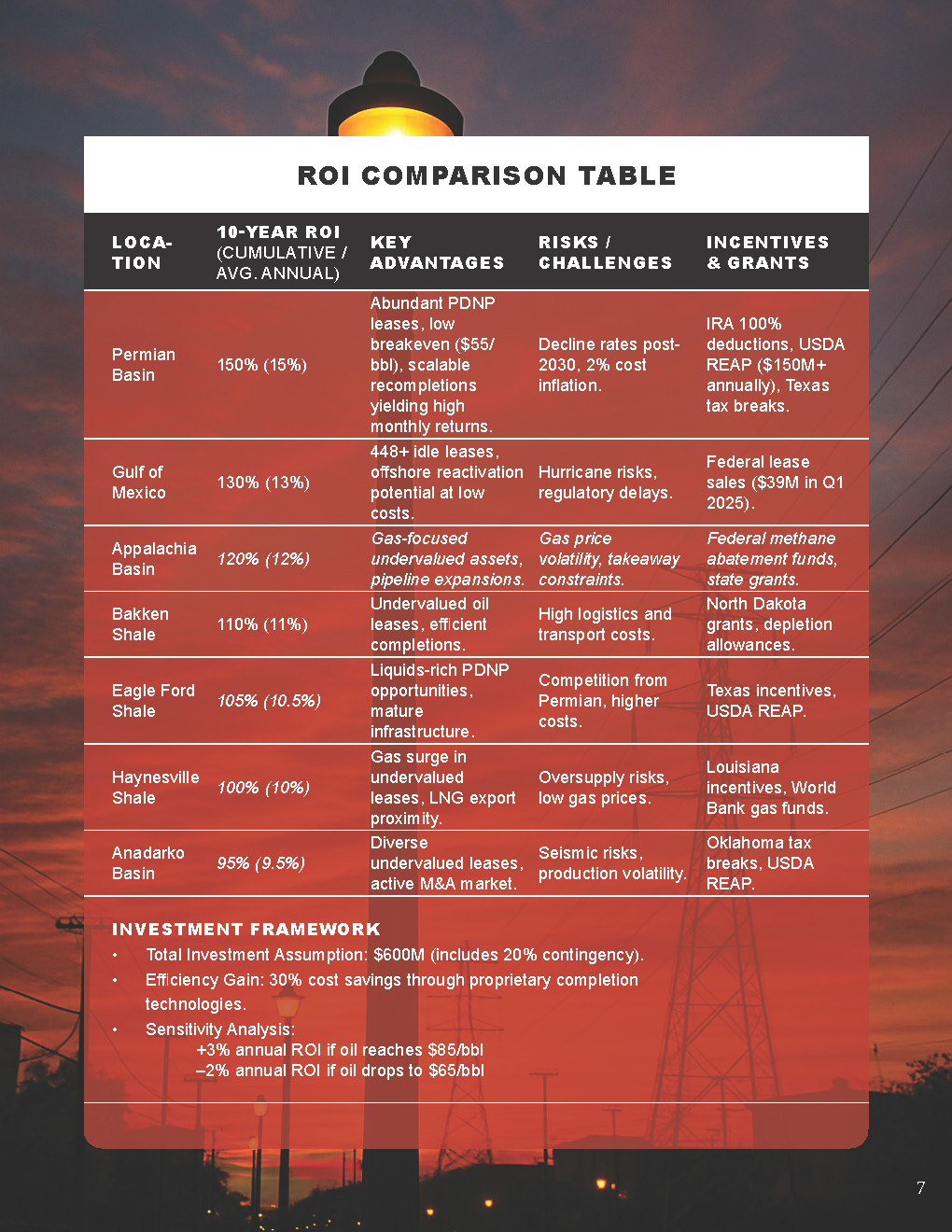

Location Comparison for Best Return (U.S. Only)

Major U.S. basins were evaluated for 10-year ROI potential, focusing on undervalued leases and low-cost recompletion opportunities. The Permian Basin, with fields akin to Concho Legacy, stands out due to its abundant PDNP assets, low breakeven prices (~$55/bbl), and scalability for efficient completions.

| Location | Projected 10-Year Cumulative ROI (Avg. Annual) | Key Advantages | Risks/Challenges | Incentives/Grants |

|---|---|---|---|---|

| Permian Basin | 150% (15%) | Abundant PDNP leases, low breakeven ($55/bbl), scalable recompletions yielding high monthly returns. | Gradual decline rates post-2030, 2% cost inflation. | IRA 100% deductions, USDA REAP ($150M+ annually), Texas tax breaks. |

| Gulf of Mexico | 130% (13%) | Idle leases (448+), offshore reactivation potential at low costs. | Hurricane risks, regulatory delays. | Federal lease sales ($39M in Q1 2025). |

| Appalachia Basin | 120% (12%) | Gas-focused undervalued assets, pipeline expansions. | Gas price volatility, takeaway constraints. | Federal methane abatement funds, state grants. |

| Bakken Shale | 110% (11%) | Undervalued oil leases, efficient completions. | High logistics and transport costs. | North Dakota grants, depletion allowances. |

| Eagle Ford Shale | 105% (10.5%) | Liquids-rich PDNP opportunities, mature infrastructure. | Competition from Permian, higher costs. | Texas incentives, USDA REAP. |

| Haynesville Shale | 100% (10%) | Gas surge in undervalued leases, LNG export proximity. | Oversupply risks, low gas prices. | Louisiana incentives, World Bank gas funds. |

| Anadarko Basin | 95% (9.5%) | Diverse undervalued leases, M&A activity. | Seismic risks, production volatility. | Oklahoma tax breaks, USDA REAP. |

ROI projections are based on a $600M total investment (including 20% contingency), scaled by lease undervaluation and 30% cost savings from proprietary completions. Sensitivity: +3% annual ROI at $85/bbl, -2% at $65/bbl.

Government Incentives, Grants, and World Bank Support

- U.S. Incentives: The Inflation Reduction Act (IRA) enables up to 100% deductions against active income for drilling and completion costs, with additional depletion allowances reducing effective tax rates by 20-30%. Pro-energy policies streamline leasing and permitting.

- Grants: USDA Rural Energy for America Program (REAP) allocates $150M+ annually for energy projects; DOE methane abatement grants provide $500M+ through 2030.

- World Bank Support: Over $700M committed to gas infrastructure and low-emission projects, applicable to efficient recompletions and CCUS initiatives. These incentives can offset 20-30% of capital costs, enhancing long-term ROI.

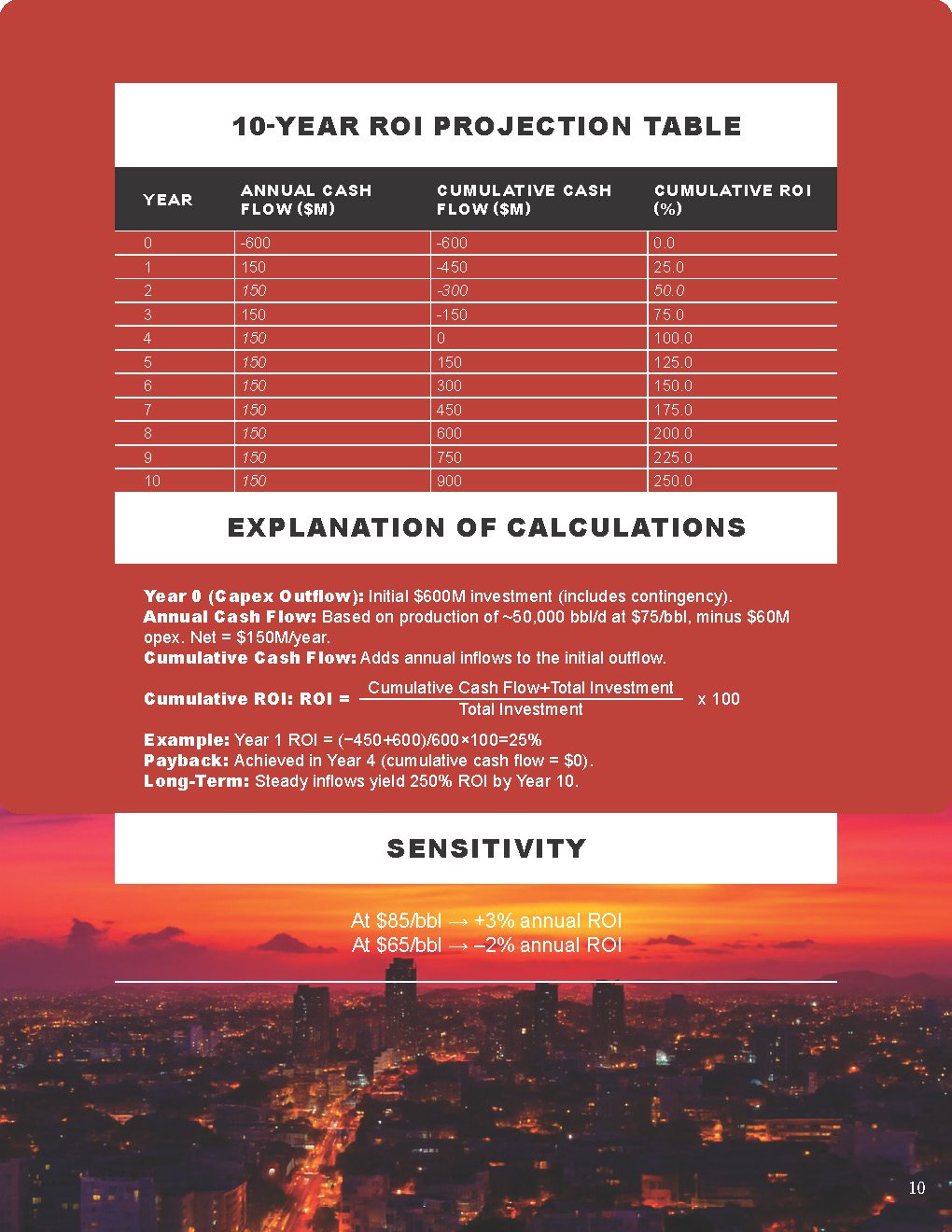

Financial Projections: Optimal 10-Year ROI Chart (Permian Basin)

The model assumes a $500M investment with a 20% contingency ($600M total capex). Annual opex is $60M (10% of investment, adjusted for 2% inflation in net flows). Net cash flow is $150M/year, derived from ~50,000 bbl/d production via low-cost recompletions at $75/bbl, reflecting 30% cost savings from proprietary technologies. Payback occurs in Year 4, with a cumulative ROI of 250% by Year 10.

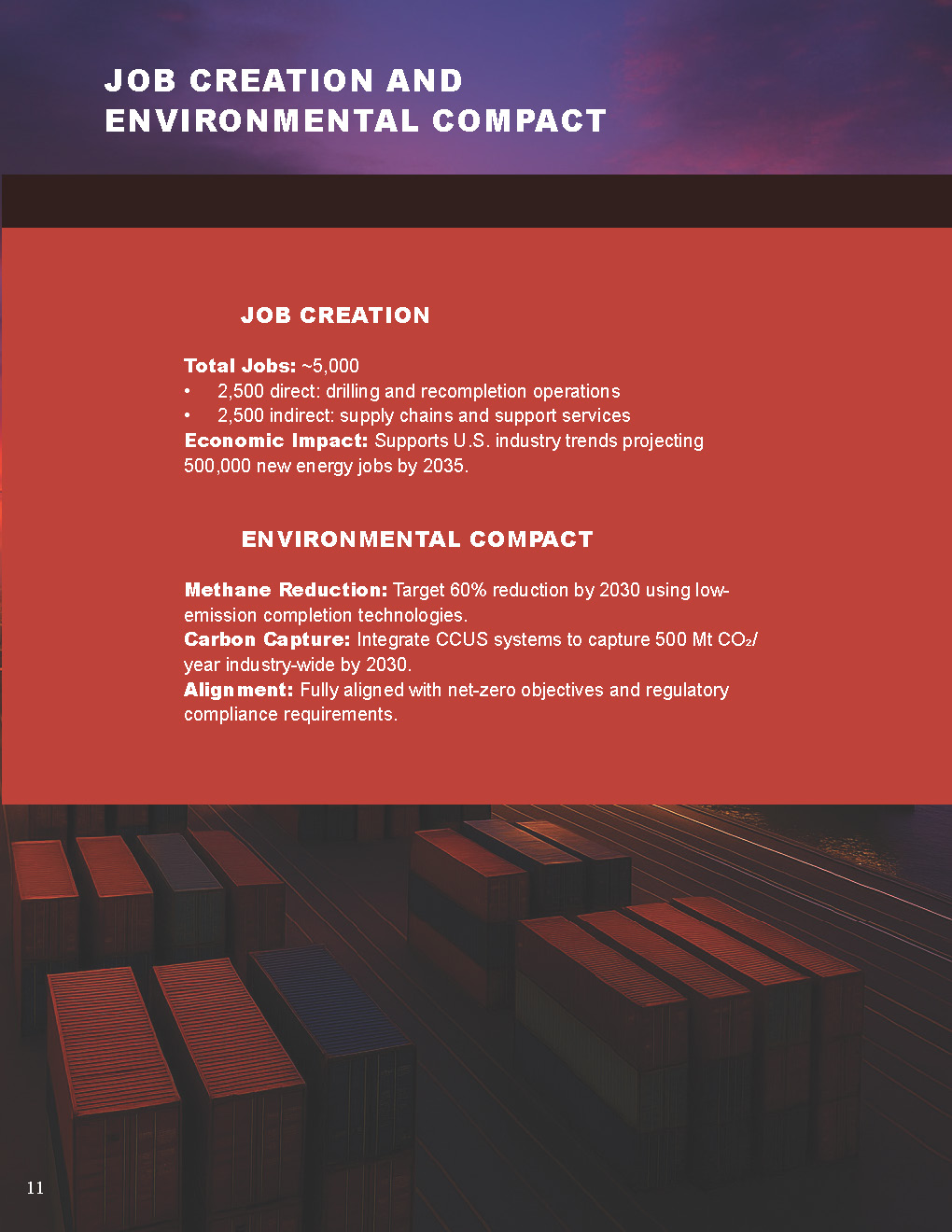

Job Creation and Environmental Compact

- Job Creation: The project will generate approximately 5,000 jobs (2,500 direct in drilling and recompletion operations, 2,500 indirect in supply chains and support services), contributing to economic growth in line with industry projections of 500,000 new U.S. energy jobs by 2035.

- Environmental Compact: Commit to reducing methane emissions by 60% by 2030 through low-emission completion technologies and integrate CCUS to capture 500 Mt CO2/year industry-wide by 2030, aligning with net-zero objectives and regulatory compliance.

Intellectual Property Considerations

Proprietary technologies, including AI-driven asset assessment tools, lightweight proppants, and compact completion systems, will be protected through U.S. patents and trade secrets. Joint venture agreements will clearly define IP ownership, ensuring exclusivity in the $25 billion digital oilfield market and potential licensing revenue.

Conclusion and Recommendation

This $500 million investment in undervalued U.S. oil and gas leases, centered on the Permian Basin with proprietary low-cost completion technologies and strategic partnerships, delivers optimized ROI through monthly cash flows, significant tax advantages, and sustainable practices. Geodyn Solutions should initiate implementation in Q4 2025 to capitalize on current market dynamics and undervalued asset opportunities.

Copyright © 2025 Geodyn Solutions. All rights reserved. This document is confidential; no part may be reproduced or distributed without prior written consent.