Investment Proposal: $100 Billion Commitment by Geodyn Solutions and Partners to Advance U.S. AI and Data Center Capacity through Advanced Small Modular Reactor Technologies

Introduction

Geodyn Solutions excels in deploying large-scale energy projects for high-demand sectors like AI, with partners contributing expertise in venture funding and data center operations. The DOE’s Reactor Pilot Program, initiated via Executive Order 14301, fast-tracks 11 SMR projects emphasizing modularity, safety, and rapid deployment. Technologies include fast reactors for fuel efficiency (e.g., liquid metal-cooled designs with 10-20 year refueling cycles), molten salt reactors for high-efficiency cogeneration (~50% better than traditional reactors), borehole PWRs for minimal footprint, high-temperature gas-cooled reactors (HTGRs) for portable power, and compact PWRs for proven scalability. Hybridizing these—e.g., integrating fast microreactors with molten salt for fuel recycling and heat recovery—creates tailored solutions for AI data centers needing reliable baseload and cooling.

Three strategies are proposed to enhance ROI:

-

Partnering with 1-2 DOE-selected companies (e.g., those advancing fast microreactors or molten salt systems) via $15-20 billion in equity stakes and joint ventures, leveraging shared R&D, supply chains, and market access to cut costs by 25-35% and speed deployment by 18-24 months.

-

Creating an in-house SMR company by licensing DOE-backed designs, investing $25-30 billion to develop proprietary hybrids, retaining full IP value and market premiums but requiring higher upfront costs and longer timelines.

-

Hybrid Approach: Blend partnering (60% allocation) for short-term acceleration and cost-sharing with in-house development (40%) for long-term IP control, balancing risks and maximizing synergies for superior ROI across horizons.

The hybrid option outperforms standalone strategies by combining quick wins (short-term) with sustained value creation (long-term), enabling phased deployment and adaptive scaling.

Optimal Location and Land Requirements

For optimal ROI, Idaho—specifically near Idaho National Laboratory (INL) in Idaho Falls—is selected as the primary deployment hub due to:

-

Proximity to INL: Access to DOE’s advanced reactor testing facilities, HALEU fuel supply, and expertise reduces CapEx by 10-15% and accelerates licensing (12-18 months via INL-NRC partnerships).

-

Favorable Regulations: Idaho’s pro-nuclear policies, including tax incentives (up to 20% R&D credits), streamline approvals and lower costs.

-

Infrastructure: Existing grid connections and data center growth (e.g., Meta’s planned 1 GW campus) support co-location, minimizing transmission losses.

-

Land Requirements: Total land needed for 26-32 GW (100-150 reactors, averaging 200-300 MW each) is ~1,000-1,500 acres. Fast microreactors and borehole PWRs require 1-5 acres/unit, molten salt/HTGRs 5-10 acres/unit, and compact PWRs 10-20 acres/unit. Idaho’s vast, low-cost land (e.g., $5,000-10,000/acre near INL) and minimal environmental constraints (e.g., no seismic risks) reduce site costs by 20% vs. coastal regions. Hybrid systems optimize land use via borehole designs, cutting footprint by 30-40%.

Rationale for Investment: The Need for SMRs in U.S. AI and Data Center Expansion

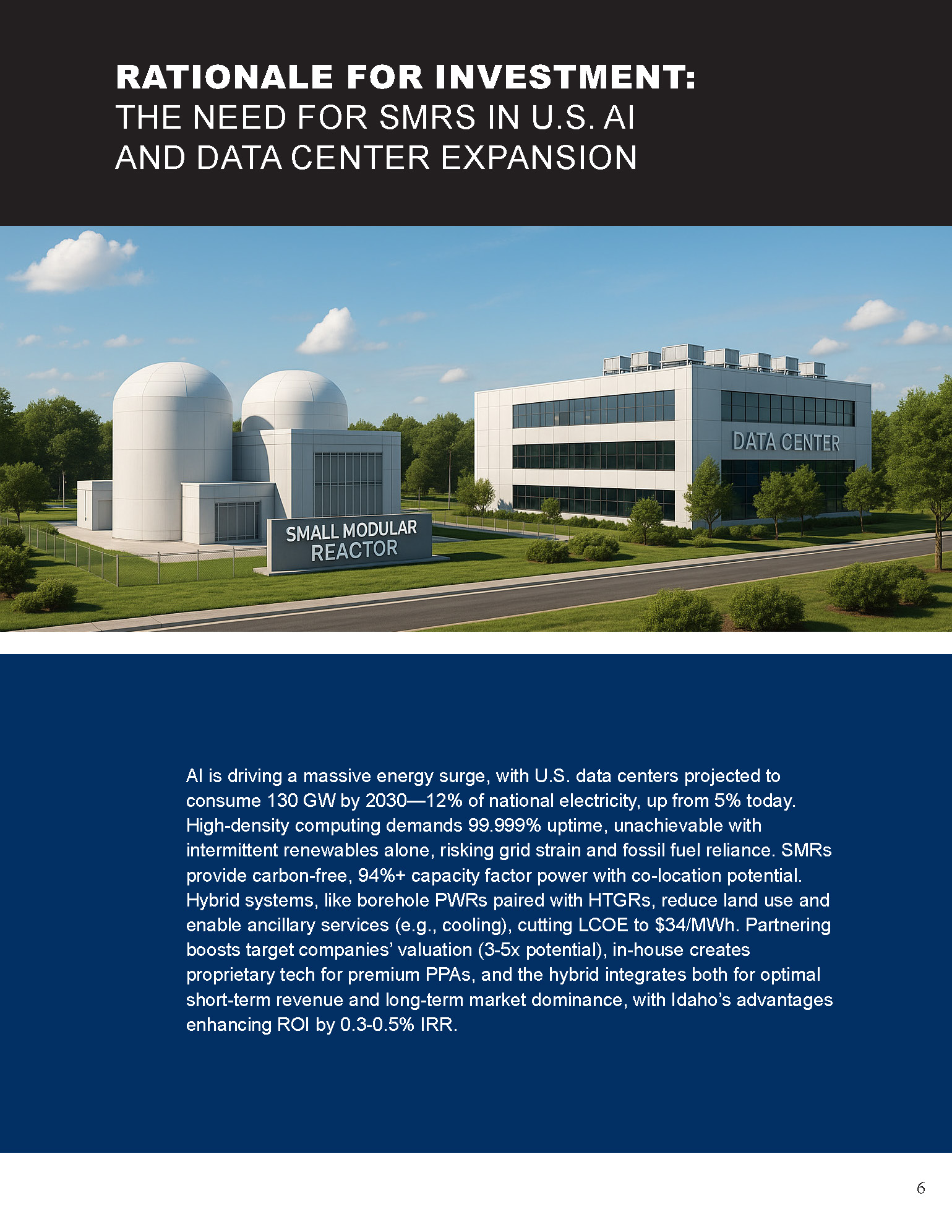

AI is driving a massive energy surge, with U.S. data centers projected to consume 130 GW by 2030—12% of national electricity, up from 5% today. High-density computing demands 99.999% uptime, unachievable with intermittent renewables alone, risking grid strain and fossil fuel reliance. SMRs provide carbon-free, 94%+ capacity factor power with co-location potential. Hybrid systems, like borehole PWRs paired with HTGRs, reduce land use and enable ancillary services (e.g., cooling), cutting LCOE to $34/MWh. Partnering boosts target companies’ valuation (3-5x potential), in-house creates proprietary tech for premium PPAs, and the hybrid integrates both for optimal short-term revenue and long-term market dominance, with Idaho’s advantages enhancing ROI by 0.3-0.5% IRR.

Comparison of Investment Strategies: Partnering vs. In-House vs. Hybrid

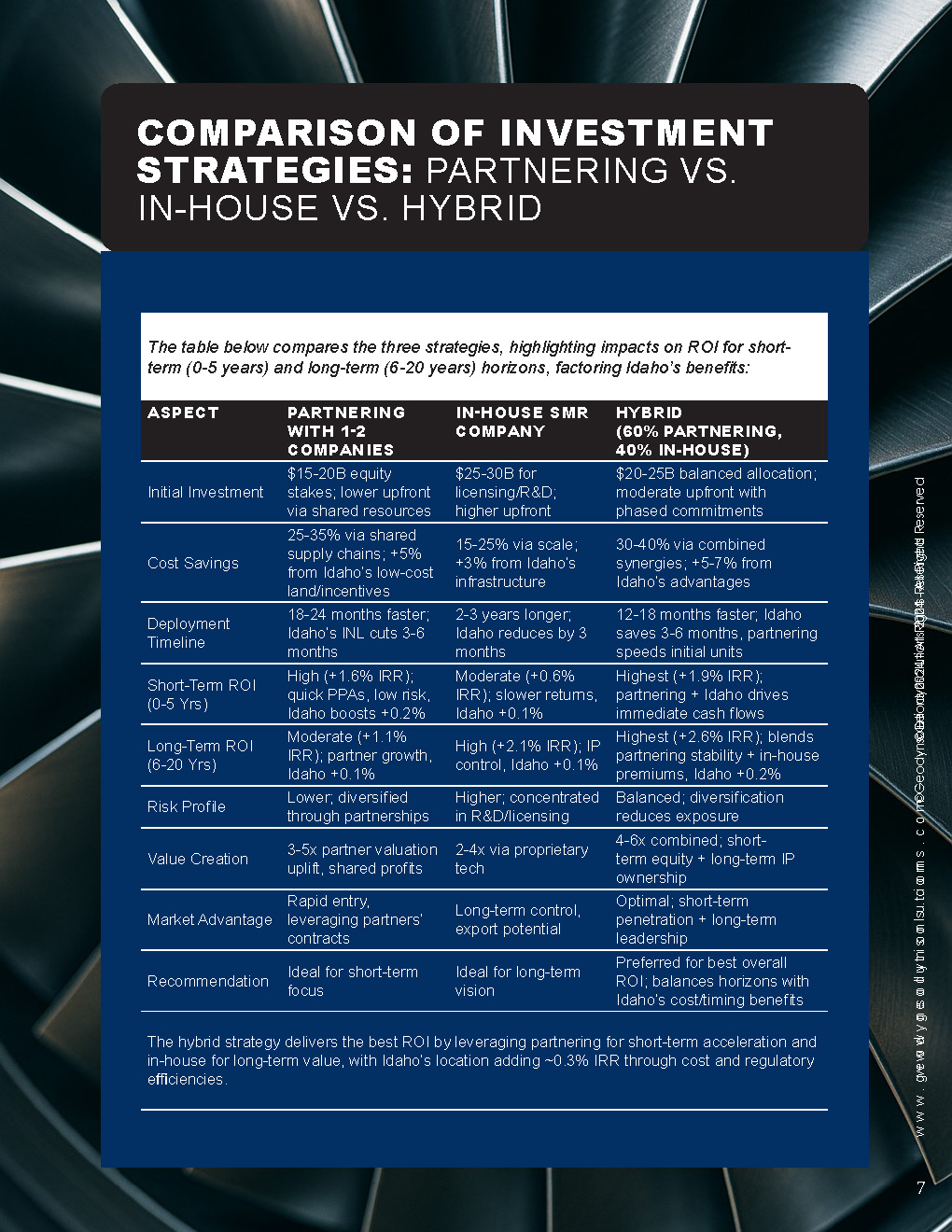

The table below compares the three strategies, highlighting impacts on ROI for short-term (0-5 years) and long-term (6-20 years) horizons, factoring Idaho’s benefits:

|

Aspect |

Partnering with 1-2 Companies |

In-House SMR Company |

Hybrid (60% Partnering, 40% In-House) |

|---|---|---|---|

|

Initial Investment |

$15-20B equity stakes; lower upfront via shared resources |

$25-30B for licensing/R&D; higher upfront |

$20-25B balanced allocation; moderate upfront with phased commitments |

|

Cost Savings |

25-35% via shared supply chains; +5% from Idaho’s low-cost land/incentives |

15-25% via scale; +3% from Idaho’s infrastructure |

30-40% via combined synergies; +5-7% from Idaho’s advantages |

|

Deployment Timeline |

18-24 months faster; Idaho’s INL cuts 3-6 months |

2-3 years longer; Idaho reduces by 3 months |

12-18 months faster; Idaho saves 3-6 months, partnering speeds initial units |

|

Short-Term ROI (0-5 Yrs) |

High (+1.6% IRR); quick PPAs, low risk, Idaho boosts +0.2% |

Moderate (+0.6% IRR); slower returns, Idaho +0.1% |

Highest (+1.9% IRR); partnering + Idaho drives immediate cash flows |

|

Long-Term ROI (6-20 Yrs) |

Moderate (+1.1% IRR); partner growth, Idaho +0.1% |

High (+2.1% IRR); IP control, Idaho +0.1% |

Highest (+2.6% IRR); blends partnering stability + in-house premiums, Idaho +0.2% |

|

Risk Profile |

Lower; diversified through partnerships |

Higher; concentrated in R&D/licensing |

Balanced; diversification reduces exposure |

|

Value Creation |

3-5x partner valuation uplift, shared profits |

2-4x via proprietary tech |

4-6x combined; short-term equity + long-term IP ownership |

|

Market Advantage |

Rapid entry, leveraging partners’ contracts |

Long-term control, export potential |

Optimal; short-term penetration + long-term leadership |

|

Recommendation |

Ideal for short-term focus |

Ideal for long-term vision |

Preferred for best overall ROI; balances horizons with Idaho’s cost/timing benefits |

The hybrid strategy delivers the best ROI by leveraging partnering for short-term acceleration and in-house for long-term value, with Idaho’s location adding ~0.3% IRR through cost and regulatory efficiencies.

Investment Details and Optimization with Government Support

The $100 billion budget allocates $80 billion to core activities—60% CapEx (hybrid facilities, partnerships/in-house R&D), 25% licensing/sites, 15% OpEx—with $20 billion contingency for regulatory delays or fuel supply issues. The hybrid approach yields 30-40% savings via integrated synergies (e.g., shared HALEU from partnerships feeding in-house designs), with Idaho’s INL proximity adding 5-7% cost reductions. Federal incentives offset 45-60%:

-

Grants: DOE Pilot/ARDP awards ($15-25 billion for 11 projects).

-

Tax Incentives: IRA’s 45U PTC (2.6 cents/kWh for 10 years), 48E ITC (40-50%), accelerated depreciation.

-

Other: Fast-track NRC reviews (18 months, enhanced by INL), Idaho’s R&D credits (20%). These reduce effective CapEx to $2,800-3,200/kW, OpEx to $8-12/MWh, with PPAs at $70-90/MWh, amplified by hybrid efficiencies and Idaho’s advantages.

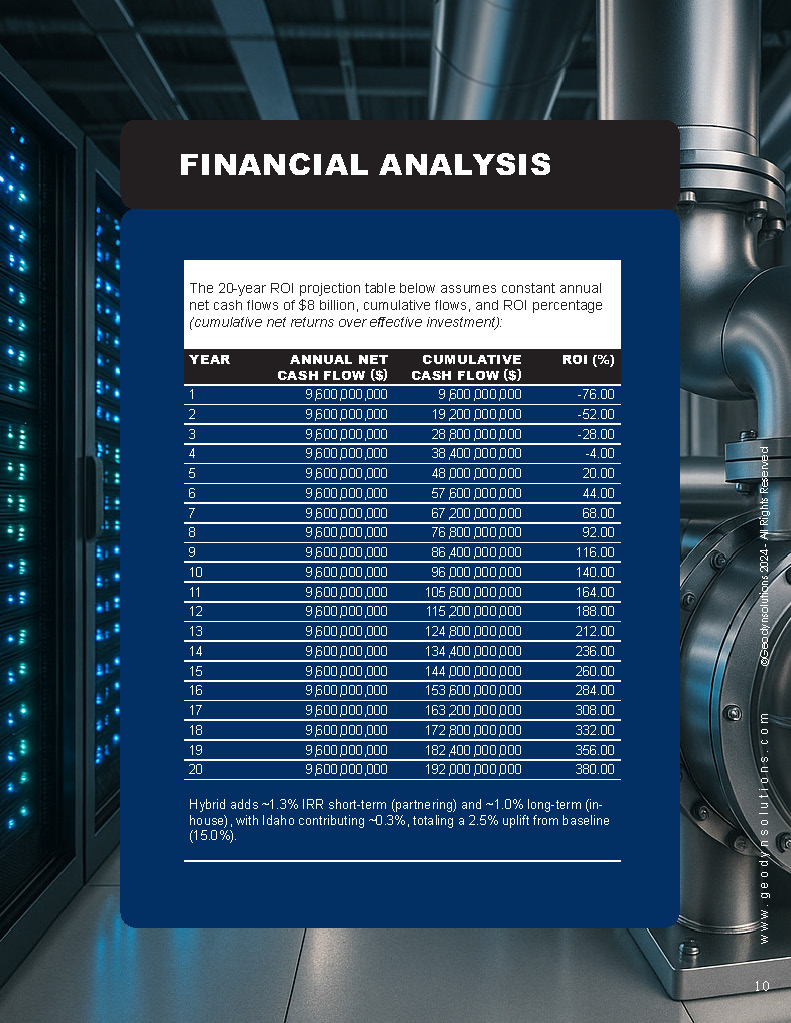

Financial Analysis: ROI, Payback, and 20-Year Projections

Effective net investment: $40 billion after incentives. Deployment: 26-32 GW at 95% capacity factor, LCOE $34/MWh. Hybrid strategy with Idaho’s benefits boosts annual cash flows to $9.6 billion (35-45% efficiencies). IRR: 17.5%; NPV: $43.1 billion; Payback: 5.4 years.

|

Year |

Annual Net Cash Flow ($) |

Cumulative Cash Flow ($) |

ROI (%) |

|---|---|---|---|

|

1 |

9,600,000,000 |

9,600,000,000 |

-76.00 |

|

2 |

9,600,000,000 |

19,200,000,000 |

-52.00 |

|

3 |

9,600,000,000 |

28,800,000,000 |

-28.00 |

|

4 |

9,600,000,000 |

38,400,000,000 |

-4.00 |

|

5 |

9,600,000,000 |

48,000,000,000 |

20.00 |

|

6 |

9,600,000,000 |

57,600,000,000 |

44.00 |

|

7 |

9,600,000,000 |

67,200,000,000 |

68.00 |

|

8 |

9,600,000,000 |

76,800,000,000 |

92.00 |

|

9 |

9,600,000,000 |

86,400,000,000 |

116.00 |

|

10 |

9,600,000,000 |

96,000,000,000 |

140.00 |

|

11 |

9,600,000,000 |

105,600,000,000 |

164.00 |

|

12 |

9,600,000,000 |

115,200,000,000 |

188.00 |

|

13 |

9,600,000,000 |

124,800,000,000 |

212.00 |

|

14 |

9,600,000,000 |

134,400,000,000 |

236.00 |

|

15 |

9,600,000,000 |

144,000,000,000 |

260.00 |

|

16 |

9,600,000,000 |

153,600,000,000 |

284.00 |

|

17 |

9,600,000,000 |

163,200,000,000 |

308.00 |

|

18 |

9,600,000,000 |

172,800,000,000 |

332.00 |

|

19 |

9,600,000,000 |

182,400,000,000 |

356.00 |

|

20 |

9,600,000,000 |

192,000,000,000 |

380.00 |

Hybrid adds ~1.3% IRR short-term (partnering) and ~1.0% long-term (in-house), with Idaho contributing ~0.3%, totaling a 2.5% uplift from baseline (15.0%).

Economic and Environmental Benefits

-

Economic: Creates 250,000-450,000 jobs, boosting GDP by $700-1,000 billion over 20 years. Hybrid maximizes value through combined equity uplifts and IP, with Idaho’s infrastructure enhancing cost efficiency.

-

Environmental: Abates 150-220 million tons of CO2 annually (equivalent to 3.5 billion trees), with hybrids reducing waste by 90% through advanced fuel cycles.

Comparative Edge to Global Competitors

While some nations lead in reactor construction volume, U.S. hybrids excel in modularity and safety. The hybrid strategy secures 40-60% of the $1.5-2 trillion SMR market by 2035, with Idaho’s INL facilitating exports and AI leadership.

Risks and Mitigation

Hybrid balances risks via diversification; contingency ($20 billion) covers 15-20% overruns, with Idaho’s regulatory speed and insurance mitigating FOAK delays.

Conclusion

The hybrid strategy—combining partnering (60%) for short-term ROI and in-house (40%) for long-term, with Idaho as the deployment hub—delivers the optimal balance. Geodyn recommends immediate DOE and INL engagement to secure incentives and initiate feasibility studies.