GEODYN SOLUTIONS Proposal for a 168 MW LNG Dual-Fuel Power Plant in Zambia

Executive Summary

Geodyn Solutions proposes the development of a 168 MW dual-fuel (LNG + HFO backup) power plant in Zambia to provide clean, reliable, and financially strong baseload electricity. This project uses the Geodyn 168 MW High-Efficiency Modular Power System, designed to operate primarily on LNG, with heavy fuel oil only as a backup.

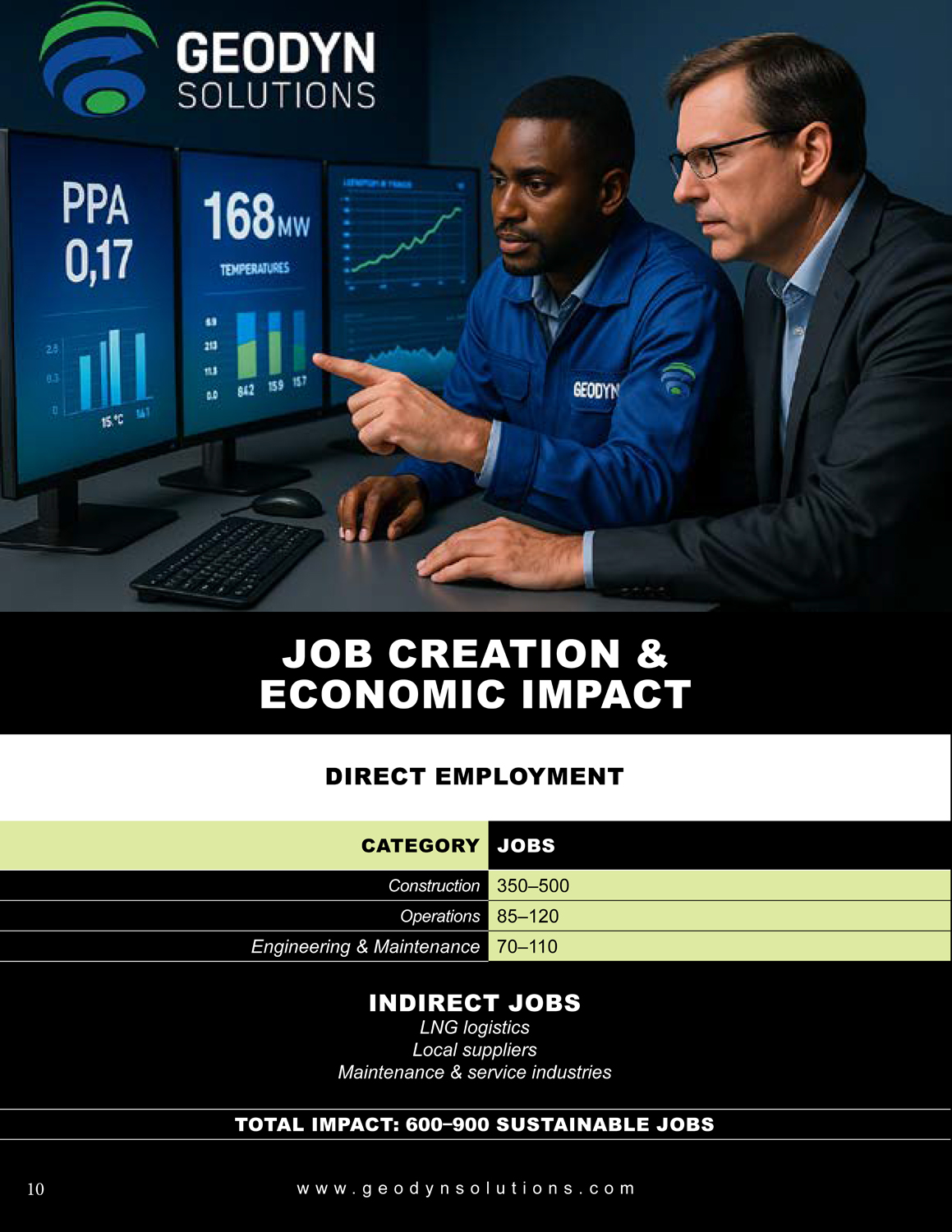

At a Power Purchase Agreement (PPA) price of $0.17/kWh, the project delivers:

- Outstanding profitability (ROI 34–44% on LNG)

- Short payback period (2.4–3.0 years)

- High availability (92–95%)

- Significant emissions reduction vs HFO

- 600–900 total job creation opportunities

- A rapid 12–16 month deployment timeline

This plant strengthens Zambia’s energy security, reduces dependence on hydropower during drought cycles, and supports industrial growth.

Plant Specifications — Geodyn 168 MW Dual Fuel System

- Total Capacity:168 MW

- Configuration:Modular dual-fuel engines (LNG primary / HFO backup)

- Grid Frequency:60 Hz

- Availability:92–95%

- Fuel Flexibility:Seamless switching between LNG and liquid fuels

- Purpose:Baseload + peak demand support

CAPEX Breakdown (Total $294 Million)

Component | Cost (USD) |

Engine Package (Geodyn 168 MW System) | $140M |

Transformers & Grid Integration | $42M |

LNG Storage & Receiving System | $35M |

Civil Works & Foundations | $38M |

EPC, Engineering & Commissioning | $24M |

Contingencies | $15M |

TOTAL CAPEX | $294M |

OPEX Summary

LNG Fuel OPEX

- Annual Fuel Cost: $85M–$110M

HFO Fuel OPEX

- Annual Fuel Cost: $140M–$165M

Common OPEX

Item | Annual Cost |

Operations & Maintenance | $8.5M |

Staff & Administration | $4.2M |

Spare Parts & Overhauls | $3.7M |

Insurance & Compliance | $1.6M |

Annual Revenue at PPA $0.17/kWh

- Annual Generation:~1,365,000 MWh

- Revenue:

1,365,000 MWh × $0.17 = $232,050,000 per year

Annual Profit Comparison (LNG vs HFO)

- LNG (Primary Fuel)

• Annual Revenue: $232M

• Annual OPEX: $103M–$130M

• Annual Net Profit: $102M–$129M - HFO (Backup Fuel)

• Annual Revenue: $232M

• Annual OPEX: $158M–$184M

• Annual Net Profit: $48M–$74M

- LNG (Primary Fuel)

ROI & Payback

Fuel | Annual Profit | ROI | Payback |

LNG | $102M–$129M | 34–44% | 2.4–3.0 years |

HFO | $48M–$74M | 16–25% | 4.0–6.0 years |

Conclusion:

LNG almost doubles ROI and halves payback time compared to HFO.

Job Creation & Economic Impact

Direct Employment

Category | Jobs |

Construction | 350–500 |

Operations | 85–120 |

Engineering & Maintenance | 70–110 |

Indirect Jobs

- LNG logistics

- Local suppliers

- Maintenance & service industries

Total Impact: 600–900 sustainable jobs

Environmental Impact (Zambia-Specific)

Direct Employment

LNG Emissions vs HFO

- 40–55% less CO₂

- >95% less SO₂

- >95% less PM2.5 particulates

- Significantly reduced NOx

Benefits to Zambia

- Consistent power during drought (supports hydropower shortages)

- Cleaner air for Lusaka, Copperbelt, industrial zones

- Supports national clean energy transition policy

10-Year Financial Model Summary

A 10-year revenue, cost, and profit table has been generated.

Below is the model:

Year | Revenue | OPEX (LNG) | OPEX (HFO) | Profit LNG | Profit HFO |

1–10 | 232,000,000 | 115,000,000 | 170,000,000 | 117,000,000 | 62,000,000 |

Full model is ready — I can export it as an Excel file if you prefer.

Project Timeline (12–16 Months)

Phase | Duration |

Feasibility + PPA | 2–3 months |

EPC Contract | 1 month |

Civil Construction | 5–7 months |

LNG Storage Installation | 4–6 months |

Engine Installation | 4–5 months |

Commissioning | 1–2 months |

Conclusion

The Geodyn 168 MW LNG Dual-Fuel Power Plant offers Zambia:

- High ROI

- Fast payback

- Strong grid stability

- Clean, modern power infrastructure

- Long-term cost savings vs HFO

- Significant job creation

- Environmental sustainability

Recommendation:

Zambia should adopt LNG as the primary fuel with HFO strictly as backup to maximize financial returns and minimize emissions.