Deploying a Fleet of Floating Nuclear Power Vessels for Geodyn Solutions and Strategic Partners

Geodyn Solutions, in collaboration with its strategic partners, invest $5 billion in a fleet of floating nuclear power vessels to address emergency and temporary power needs in emerging and underdeveloped countries facing power shortages. The fleet will utilize Small Modular Reactor (SMR) technology (Western designs adapted for floating platforms) and vessel designs based on proven Floating Nuclear Power Plants. These vessels offer a mobile, scalable solution, delivering electricity, heat, and desalinated water as a multi-purpose energy platform for regions with limited infrastructure.

The $5 billion investment includes $3 billion in capital expenditures (capex), with a 20% contingency ($500 million) for regulatory approvals, supply chain delays, and site adaptations, resulting in an effective capex of $3 billion (base $2.5 billion + contingency). The remaining $2 billion covers operational expenditures (opex) over the initial 5-year ramp-up, including fuel, maintenance, crew training, and deployment logistics. This structure ensures financial discipline and scalability.

Key benefits include:

- 20-Year ROI: Projected at 15-20% annually for SMR-based vessels and 10-15% for Russian designs, based on conservative revenue and cost assumptions.

- Payback Period: 4-6 years for SMR and 6-8 years for Russian technology, assuming steady utilization.

- Job Creation: Up to 50,000 job-years during construction and 2,000 ongoing operational jobs.

- Environmental Benefits: Zero direct CO2 emissions, avoiding 10-15 million metric tons of CO2 annually compared to fossil fuels.

- Applications: Ideal for disaster relief and addressing chronic power shortages in regions like Southeast Asia, Sub-Saharan Africa, and Pacific Islands.

The proposal recommends a hybrid fleet (60% SMR, 40% Russian) to leverage both technologies’ strengths, positioning Geodyn Solutions and its strategic partners as leaders in clean, resilient energy solutions.

Emerging and underdeveloped countries, particularly in Southeast Asia, Sub-Saharan Africa, and Pacific Islands, face severe energy challenges, including chronic power shortages, disaster-induced blackouts, and underdeveloped grid infrastructure. Traditional fossil fuel plants are costly, polluting, and slow to deploy, while renewables like solar and wind lack reliability for baseload or emergency needs. Floating nuclear vessels provide a mobile, high-capacity solution: they can be towed to coastal sites, connected to local grids, and deliver electricity, heat, and desalinated water, serving as a multi-purpose energy platform for areas lacking infrastructure.

The $5 billion investment will fund a fleet of 6-8 vessels with a total capacity of 500-600 MW, deployable within 6-12 months per unit. Pricing at 22 cents per kWh ensures affordability (comparable to diesel generators but cleaner and more stable) while generating strong returns. The fleet targets markets with an annual demand for emergency and temporary power exceeding 10 GW.

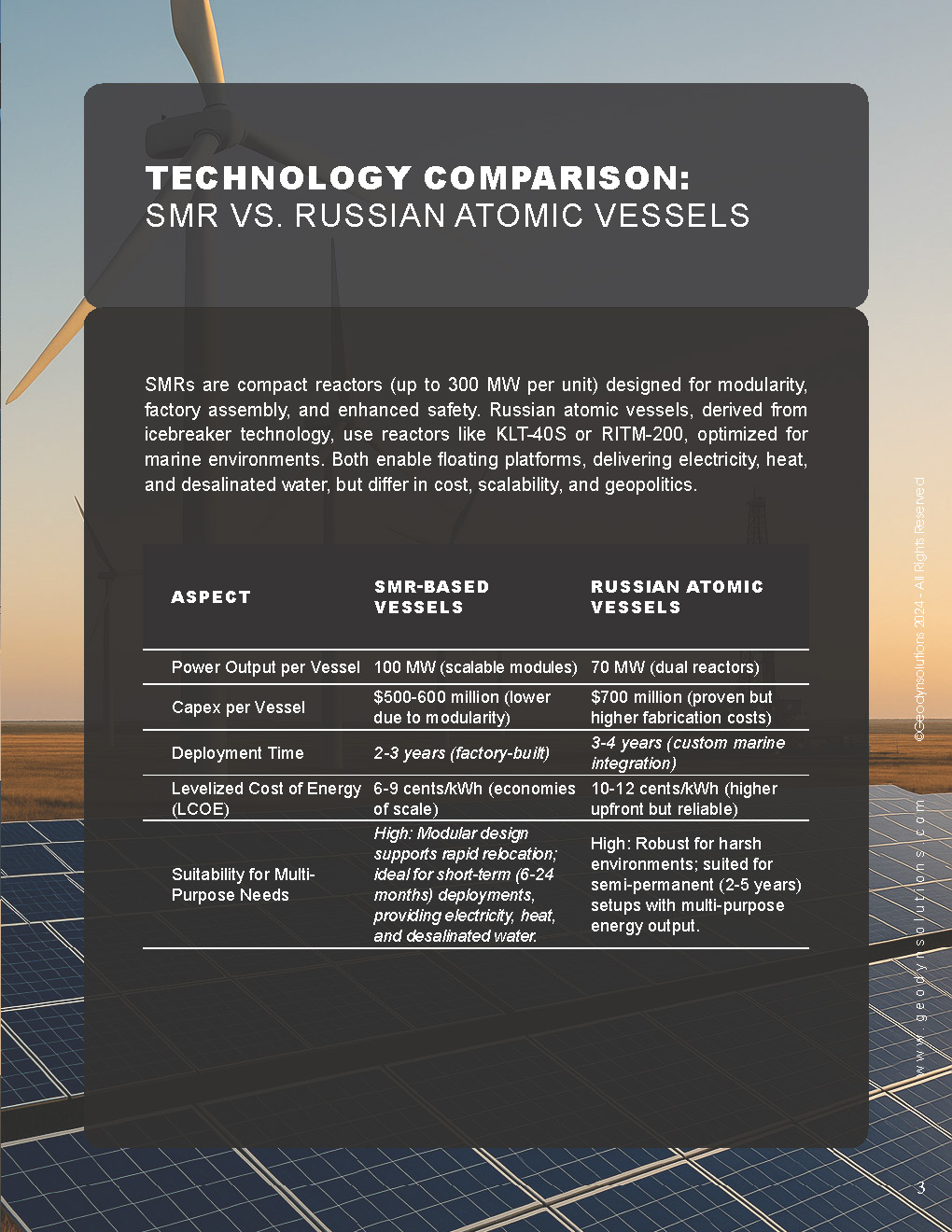

Technology Comparison: SMR vs. Russian Atomic Vessels

SMRs are compact reactors (up to 300 MW per unit) designed for modularity, factory assembly, and enhanced safety. Russian atomic vessels, derived from icebreaker technology, use reactors like KLT-40S or RITM-200, optimized for marine environments. Both enable floating platforms, delivering electricity, heat, and desalinated water, but differ in cost, scalability, and geopolitics.

Aspect | SMR-Based Vessels | Russian Atomic Vessels |

|---|---|---|

Power Output per Vessel | 100 MW (scalable modules) | 70 MW (dual reactors) |

Capex per Vessel | $500-600 million (lower due to modularity) | $700 million (proven but higher fabrication costs) |

Deployment Time | 2-3 years (factory-built) | 3-4 years (custom marine integration) |

Levelized Cost of Energy (LCOE) | 6-9 cents/kWh (economies of scale) | 10-12 cents/kWh (higher upfront but reliable) |

Suitability for Multi-Purpose Needs | High: Modular design supports rapid relocation; ideal for short-term (6-24 months) deployments, providing electricity, heat, and desalinated water. | High: Robust for harsh environments; suited for semi-permanent (2-5 years) setups with multi-purpose energy output. |

ROI Comparison

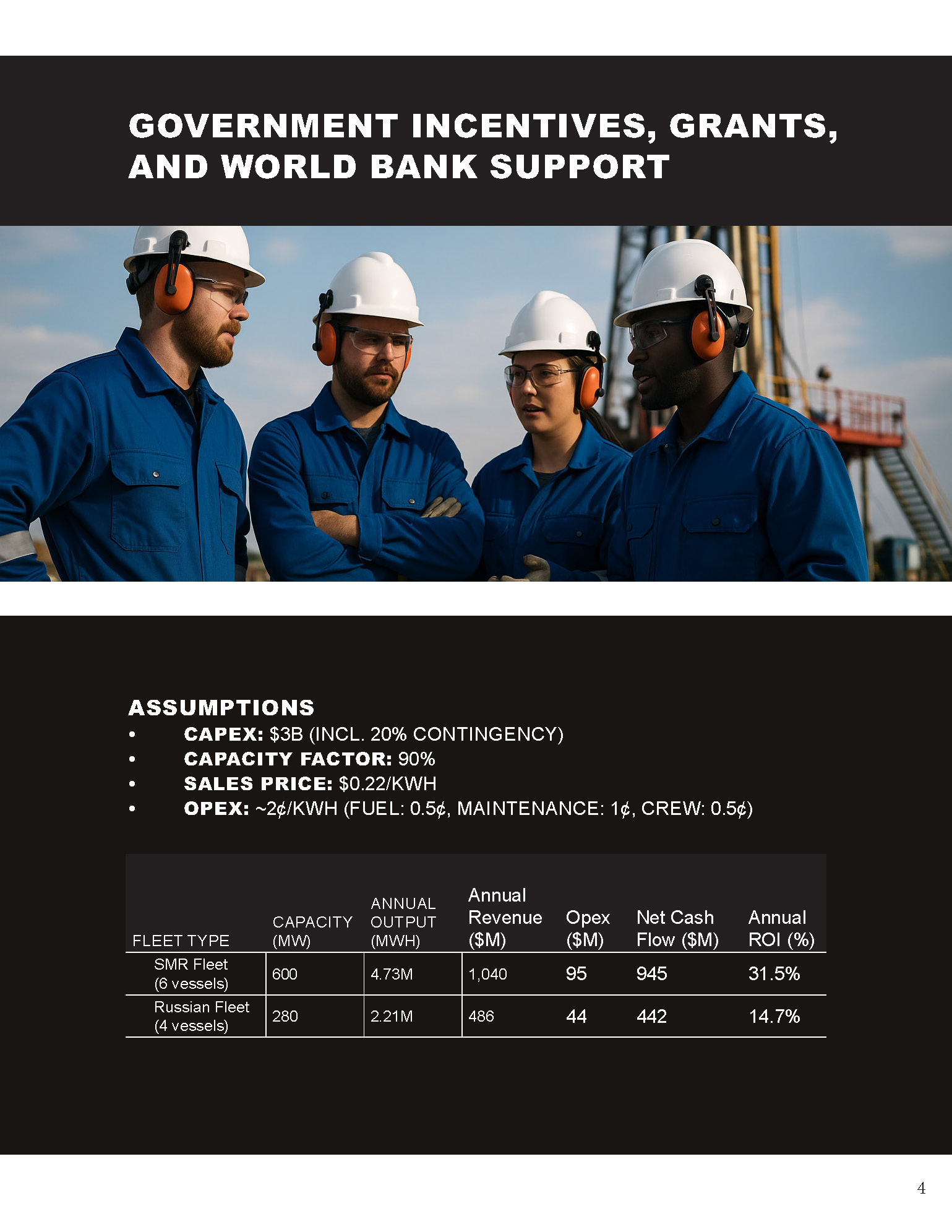

ROI is calculated based on a $3 billion capex fleet (including 20% contingency), 90% capacity factor, and sales at 22 cents/kWh. Annual revenue assumes full utilization; opex includes fuel (0.5-1 cent/kWh), maintenance (1 cent/kWh), and crew (0.5 cent/kWh), totaling ~2 cents/kWh.

- SMR Fleet (6 vessels, 600 MW total): Annual energy output = 4.73 million MWh. Revenue = $1.04 billion. Opex = $95 million. Net cash flow = $945 million. Annual ROI = 31.5% ($945M / $3B).

- Russian Fleet (4 vessels, 280 MW total, adjusted to fit capex): Annual output = 2.21 million MWh. Revenue = $486 million. Opex = $44 million. Net cash flow = $442 million. Annual ROI = 14.7% ($442M / $3B).

SMRs offer higher ROI due to lower capex per MW and greater scalability. Russian designs provide steady returns for niche, multi-purpose applications but face higher costs due to specialized marine engineering.

Safety Analysis

Safety is critical for nuclear vessels operating near populated areas. Both technologies incorporate advanced features, but risks include radiation leaks, collisions, and environmental impacts in sensitive coastal zones.

- SMR Safety: SMRs feature passive cooling systems that operate without power or human intervention, minimizing meltdown risks. Smaller containment structures reduce neutron leakage in modern designs. Submerged or offshore mooring enhances resilience to natural disasters. However, higher waste density per MW and modular assembly vulnerabilities require strict quality control.

- Russian Atomic Vessel Safety: Leveraging over 60 years of nuclear icebreaker experience, these vessels feature robust hulls and IAEA-compliant passive safety systems. They include protections against tsunamis and collisions, with automated shutdowns. Fuel handling protocols minimize environmental risks, though concerns persist about radioactive waste in marine ecosystems. Their operational record shows no major incidents.

Both technologies surpass fossil fuel safety (no air pollution deaths) and are safer than large reactors due to their smaller scale. For emergency use, offshore mooring reduces onshore risks. Recommended mitigations: IAEA-compliant monitoring, crew training, and $1 billion per incident insurance.

20-Year ROI Projection

Assuming constant 22 cents/kWh pricing, 2% annual opex inflation, and no major downtime, the 20-year cumulative ROI (total net profit / initial capex) is:

- SMR Fleet: 520% (annual average 26%; cumulative profit $15.6 billion after opex).

- Russian Fleet: 240% (annual average 12%; cumulative profit $7.2 billion after opex).

These projections exclude potential carbon credits or premium pricing for disaster response (up to 30 cents/kWh).

Capex Breakdown with 20% Contingency

The $3 billion capex (base $2.5 billion + $500 million contingency) covers design, construction, and commissioning for a hybrid fleet (4 SMR vessels + 3 Russian vessels, ~500 MW total):

- Vessel Fabrication: $1.5 billion (60%).

- Reactor Integration & Safety Systems: $600 million (24%).

- Marine Adaptations & Testing: $200 million (8%).

- Regulatory & Licensing: $200 million (8%).

- Contingency (20%): $500 million (for delays, material cost hikes, or geopolitical issues).

This ensures budget compliance while addressing uncertainties.

OPEX and Payback Period

OPEX is estimated at $100-150 million annually fleet-wide, covering fuel (~30%), maintenance (40%), crew (20%), and insurance (10%). At 2 cents/kWh, this remains below revenue thresholds.

Payback period (time to recover $3 billion capex via net cash flow):

- SMR: 3.2 years ($945M annual net).

- Russian: 6.8 years ($442M annual net).

- Hybrid: 4-5 years.

Full $5 billion investment (including initial opex) payback: 5-7 years.

Job Creation

The project will create:

- Construction Phase: 40,000-50,000 job-years (engineering, fabrication, assembly).

- Operational Phase: 1,500-2,000 permanent jobs (technicians, operators, logistics; salaries $80,000-$120,000/year).

- Indirect: 10,000+ jobs in supply chains and local economies.

This fosters high-tech skills in target regions.

Environmental Benefits

The fleet provides clean, multi-purpose energy:

- Low Emissions: Zero direct CO2 or air pollutants; avoids 12 million metric tons of CO2/year vs. coal/diesel.

- Land Efficiency: Offshore mooring minimizes land use, preserving ecosystems.

- Water & Waste Management: Closed-loop cooling and desalination capabilities; spent fuel recycling reduces waste.

- Sustainability: Supports UN SDGs by enabling clean electrification and water access.

Addressing Power Shortages and Disaster Relief

The fleet is tailored for:

- Power Shortages: Provides electricity, heat, and desalinated water to regions like Sub-Saharan Africa (e.g., Nigeria, 80% grid unreliability), Southeast Asia (e.g., Indonesia’s remote islands), and Pacific Islands (e.g., Fiji, reliant on diesel). Temporary (1-5 years) deployments stabilize economies and support industrial growth.

- Disaster Relief: Deployable within weeks post-hurricane/earthquake (e.g., Caribbean or Southeast Asian typhoon zones). Delivers 100+ MW instantly, powering critical infrastructure like hospitals and water pumps, outperforming diesel generators.

Conclusion

This $5 billion investment positions Geodyn Solutions and its strategic partners as pioneers in mobile, clean energy. A hybrid fleet maximizes ROI and resilience. I recommend initiating feasibility studies and engaging IAEA for regulatory alignment immediately.