Comprehensive Proposal for Geodyn Solutions: 300 MW Advanced Hydroelectric Power Plant in the Dominican Republic

- Executive Summary

Geodyn Solutions proposes the development of a 300 MW advanced hydroelectric power plant in the Dominican Republic to deliver clean, reliable energy at a rate of 17 cents per kWh, leveraging the country’s significant hydroelectric potential, estimated at 623 MW of installed capacity as of 2020 (Global Energy Monitor). This project aligns with the Dominican Republic’s goal of achieving 25% renewable energy by 2025, reducing reliance on imported fossil fuels, which account for over 80% of electricity generation (Energy Profile). The estimated project cost, including a 20% contingency fee to account for risks such as geological challenges, is $1.65 billion to $2.5 billion. The project is expected to yield a return on investment (ROI) of approximately 178% over 30 years, with the initial investment recovered in about 11 years. The plant is anticipated to create 1,500–3,000 temporary jobs during construction and 50–100 permanent jobs during operation, stimulating local economies in regions like the Yaque del Norte River basin. Environmentally, the plant could offset 1 million metric tons of CO2 annually, supporting the country’s commitment to reduce greenhouse gas emissions by 27% by 2030, though careful mitigation of ecological impacts is essential.

- Project Background

The Dominican Republic, located on the island of Hispaniola, has significant hydroelectric potential due to its mountainous terrain and river systems, such as the Yaque del Norte and Yuna rivers. As of 2020, hydroelectric power accounted for approximately 12.66% of the country’s total installed electrical capacity of 4,921 MW, equating to about 623 MW (Global Energy Monitor). The country’s electricity sector is dominated by fossil fuels (75.39% in 2020), with renewables, including hydroelectric, wind, solar, and biofuels, contributing 24.61% (Global Energy Monitor). The government aims to increase renewable energy to 25% by 2025, supported by the Renewable Energy Incentives Law (57-07), which offers tariff exemptions on imported equipment (Renewable Energy Incentives). This 300 MW hydroelectric power plant will significantly boost the country’s renewable energy capacity, providing reliable baseload power to the national grid and supporting regions with high hydroelectric potential.

- Project Description

The 300 MW hydroelectric power plant will utilize state-of-the-art technology, including high-efficiency Kaplan or Francis turbines and advanced control systems, to maximize energy output and minimize environmental impact. The plant will generate electricity by harnessing water flow through a dam or run-of-river system, depending on the selected site. Key features include:

- Capacity: 300 MW, sufficient to power approximately 200,000 households.

- Technology: High-efficiency turbines optimized for variable flow conditions.

- Infrastructure: Dam or diversion structure, powerhouse, transmission lines, and access roads.

- Location: To be determined, with potential sites in the Yaque del Norte or Yuna River basins, pending feasibility studies.

- Cost Estimate

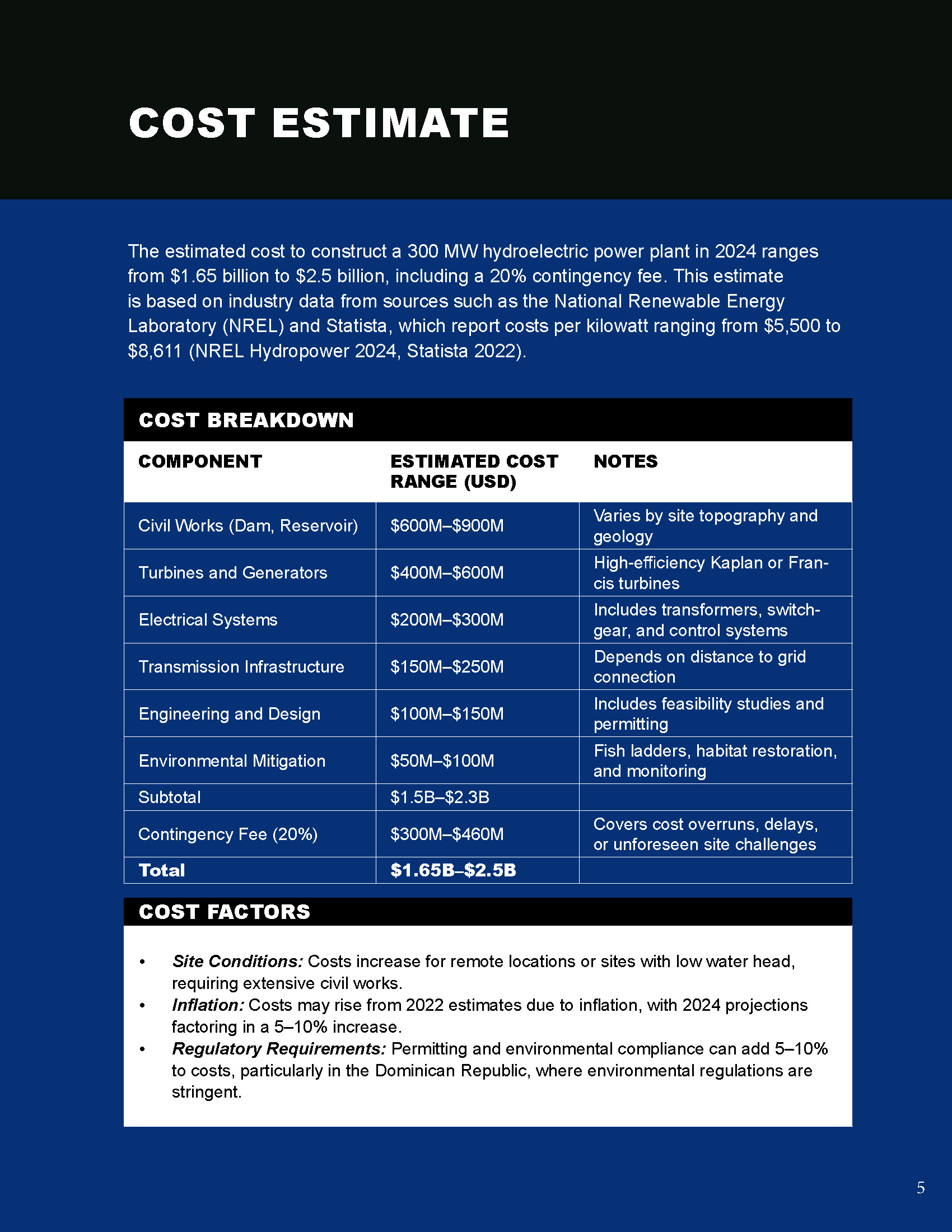

The estimated cost to construct a 300 MW hydroelectric power plant in 2024 ranges from $1.65 billion to $2.5 billion, including a 20% contingency fee. This estimate is based on industry data from sources such as the National Renewable Energy Laboratory (NREL) and Statista, which report costs per kilowatt ranging from $5,500 to $8,611 (NREL Hydropower 2024, Statista 2022).

Cost Breakdown

Component | Estimated Cost Range (USD) | Notes |

Civil Works (Dam, Reservoir) | $600M–$900M | Varies by site topography and geology |

Turbines and Generators | $400M–$600M | High-efficiency Kaplan or Francis turbines |

Electrical Systems | $200M–$300M | Includes transformers, switchgear, and control systems |

Transmission Infrastructure | $150M–$250M | Depends on distance to grid connection |

Engineering and Design | $100M–$150M | Includes feasibility studies and permitting |

Environmental Mitigation | $50M–$100M | Fish ladders, habitat restoration, and monitoring |

Subtotal | $1.5B–$2.3B | |

Contingency Fee (20%) | $300M–$460M | Covers cost overruns, delays, or unforeseen site challenges |

Total | $1.65B–$2.5B |

Cost Factors

- Site Conditions: Costs increase for remote locations or sites with low water head, requiring extensive civil works.

- Inflation: Costs may rise from 2022 estimates due to inflation, with 2024 projections factoring in a 5–10% increase.

- Regulatory Requirements: Permitting and environmental compliance can add 5–10% to costs, particularly in the Dominican Republic, where environmental regulations are stringent.

- Return on Investment (ROI)

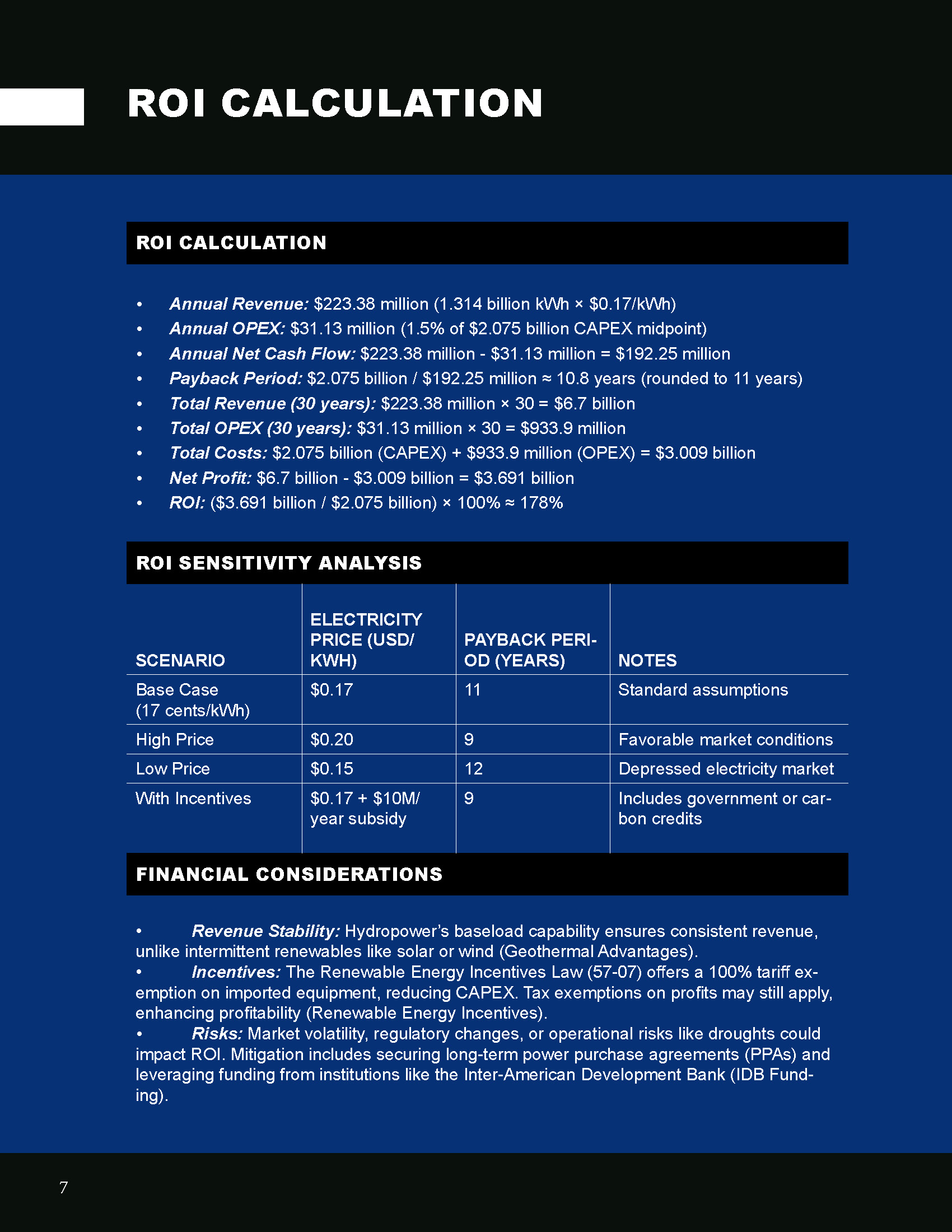

With an electricity rate of 17 cents per kWh, the annual revenue is projected to be approximately $223.38 million, based on an annual energy production of 1.314 billion kWh (300 MW × 8,760 hours × 0.5 capacity factor). Operational costs are estimated at $31.13 million per year (1.5% of the $2.075 billion CAPEX midpoint), resulting in an annual net cash flow of $192.25 million. The payback period is approximately 11 years, and over a 30-year lifespan, the project is expected to generate a total net profit of $3.69 billion, yielding an ROI of approximately 178% on the initial investment.

ROI Calculation

- Annual Revenue: $223.38 million (1.314 billion kWh × $0.17/kWh)

- Annual OPEX: $31.13 million (1.5% of $2.075 billion CAPEX midpoint)

- Annual Net Cash Flow: $223.38 million – $31.13 million = $192.25 million

- Payback Period: $2.075 billion / $192.25 million ≈ 10.8 years (rounded to 11 years)

- Total Revenue (30 years): $223.38 million × 30 = $6.7 billion

- Total OPEX (30 years): $31.13 million × 30 = $933.9 million

- Total Costs: $2.075 billion (CAPEX) + $933.9 million (OPEX) = $3.009 billion

- Net Profit: $6.7 billion – $3.009 billion = $3.691 billion

- ROI: ($3.691 billion / $2.075 billion) × 100% ≈ 178%

ROI Sensitivity Analysis

Scenario | Electricity Price (USD/kWh) | Payback Period (Years) | Notes |

Base Case (17 cents/kWh) | $0.17 | 11 | Standard assumptions |

High Price | $0.20 | 9 | Favorable market conditions |

Low Price | $0.15 | 12 | Depressed electricity market |

With Incentives | $0.17 + $10M/year subsidy | 9 | Includes government or carbon credits |

Financial Considerations

- Revenue Stability: Hydropower’s baseload capability ensures consistent revenue, unlike intermittent renewables like solar or wind (Geothermal Advantages).

- Incentives: The Renewable Energy Incentives Law (57-07) offers a 100% tariff exemption on imported equipment, reducing CAPEX. Tax exemptions on profits may still apply, enhancing profitability (Renewable Energy Incentives).

- Risks: Market volatility, regulatory changes, or operational risks like droughts could impact ROI. Mitigation includes securing long-term power purchase agreements (PPAs) and leveraging funding from institutions like the Inter-American Development Bank (IDB Funding).

- Job Creation

The project is expected to create significant employment opportunities:

- Construction Phase (3–5 years): 1,500–3,000 temporary jobs, including:

- Civil engineers and construction workers for dam and infrastructure development.

- Electrical engineers for turbine and grid integration.

- Support staff for logistics, safety, and administration.

- Operational Phase: 50–100 permanent jobs, including:

- Plant operators and maintenance technicians.

- Environmental monitoring specialists.

- Administrative and management personnel.

These estimates are based on industry norms for hydropower projects of similar scale. Local hiring will be prioritized, with training programs to enhance workforce skills, particularly in regions like the Yaque del Norte River basin.

- Environmental Benefits and Impacts

Hydropower is a clean, renewable energy source with significant environmental advantages, though construction and operation pose challenges.

Benefits

- CO2 Reduction: A 300 MW plant could offset approximately 1 million metric tons of CO2 annually compared to coal-fired plants, assuming a 50% capacity factor and 0.9 tons CO2/MWh for coal (EIA Emissions).

- Renewable Energy: Provides stable, dispatchable power, supporting grid reliability and renewable energy integration.

- Low Operating Emissions: No direct greenhouse gas emissions during operation, unlike fossil fuel plants.

Impacts and Mitigation

- Ecosystem Disruption: Dam construction may alter aquatic habitats, affecting fish migration and biodiversity.

- Mitigation: Install fish ladders, conduct habitat restoration, and monitor water quality.

- Land Use: Reservoir creation may flood land, impacting local communities and ecosystems.

- Mitigation: Minimize reservoir size, relocate affected communities with compensation, and preserve cultural sites.

- Sediment Flow: Dams can trap sediment, affecting downstream ecosystems.

- Mitigation: Implement sediment management plans, such as periodic flushing.

Environmental Cost

Environmental mitigation measures are estimated to cost $50M–$100M, included in the cost breakdown. Ongoing monitoring and compliance may add $1M–$2M annually to operational costs.

- Contingency Fee

A 20% contingency fee, amounting to $300M–$460M, is included to address potential cost overruns. Common risks include:

- Geological Challenges: Unforeseen rock instability or seismic risks, particularly in the Dominican Republic’s tectonically active region.

- Supply Chain Delays: Shortages of materials or equipment.

- Regulatory Delays: Extended permitting or environmental reviews, given stringent regulations.

This fee ensures financial resilience, aligning with industry best practices for large infrastructure projects.

- Strategic Alignment with Dominican Republic’s Goals

The project supports the Dominican Republic’s energy and environmental objectives:

- Renewable Energy Target: Contributes to the 25% renewable energy goal by 2025, with renewables currently at 19% (Dominican Republic Energy Goals).

- Energy Diversification: Reduces dependence on imported fossil fuels, enhancing energy security.

- Climate Commitments: Supports a 27% reduction in greenhouse gas emissions by 2030, with the plant potentially reducing emissions by 1 million tons of CO2 annually (World Bank Climate).

- Implementation Plan

The project will proceed in phases:

- Feasibility Study (6–12 months): Assess site suitability, water flow, and environmental impacts in regions like the Yaque del Norte River basin.

- Permitting and Design (12–18 months): Secure regulatory approvals and finalize engineering plans.

- Construction (3–5 years): Build dam, powerhouse, and transmission infrastructure.

- Commissioning (6–12 months): Test systems and connect to the grid.

- Operation: Begin commercial operation, with ongoing maintenance and monitoring.

- Conclusion

The 300 MW hydroelectric power plant proposed by Geodyn Solutions offers a transformative opportunity for the Dominican Republic’s energy sector. With an estimated cost of $1.65 billion to $2.5 billion, including a 20% contingency fee, the project delivers a robust ROI of 178% over 30 years and a payback period of approximately 11 years at 17 cents per kWh. It is expected to create 1,500–3,000 temporary jobs and 50–100 permanent jobs, boosting local economies. Environmentally, the plant will provide clean energy, offsetting 1 million metric tons of CO2 annually, though mitigation measures are critical to address ecological impacts. By leveraging government incentives and international funding, Geodyn Solutions can position itself as a leader in the Dominican Republic’s renewable energy transition.

Proposal for a 300 MW Advanced Hydroelectric Power Plant by Geodyn Solutions

Executive Summary

Geodyn Solutions proposes the development of a 300 MW advanced hydroelectric power plant to deliver clean, reliable energy. This proposal outlines the estimated costs, return on investment (ROI), job creation, environmental benefits, and a 20% contingency fee, based on industry data and trends. The project aligns with global sustainability goals, offering significant economic and environmental advantages, though site-specific factors will influence final outcomes.

Project Description

The 300 MW hydroelectric power plant will utilize state-of-the-art technology, including high-efficiency turbines and advanced control systems, to maximize energy output and minimize environmental impact. The plant will generate electricity by harnessing water flow through a dam or run-of-river system, depending on the selected site. Key features include:

- Capacity: 300 MW, sufficient to power approximately 200,000 households.

- Technology: Kaplan or Francis turbines, optimized for variable flow conditions.

- Infrastructure: Dam or diversion structure, powerhouse, transmission lines, and access roads.

- Location: To be determined, pending site feasibility studies.

Cost Estimate

The estimated cost to construct a 300 MW hydroelectric power plant in 2024 ranges from $1.65 billion to $2.5 billion, including a 20% contingency fee. This estimate is based on industry data from sources such as the National Renewable Energy Laboratory (NREL) and Statista, which report costs per kilowatt ranging from $5,500 to $8,611 (NREL Hydropower 2024, Statista 2022).

Cost Breakdown

The following table provides a detailed cost breakdown, including the contingency fee:

Component | Estimated Cost Range (USD) | Notes |

Civil Works (Dam, Reservoir) | $600M–$900M | Varies by site topography and geology |

Turbines and Generators | $400M–$600M | High-efficiency Kaplan or Francis turbines |

Electrical Systems | $200M–$300M | Includes transformers, switchgear, and control systems |

Transmission Infrastructure | $150M–$250M | Depends on distance to grid connection |

Engineering and Design | $100M–$150M | Includes feasibility studies and permitting |

Environmental Mitigation | $50M–$100M | Fish ladders, habitat restoration, and monitoring |

Subtotal | $1.5B–$2.3B | |

Contingency Fee (20%) | $300M–$460M | Covers cost overruns, delays, or unforeseen site challenges |

Total | $1.65B–$2.5B |

Cost Factors

- Site Conditions: Costs increase for remote locations or sites with low water head, requiring extensive civil works (NREL Hydropower 2024).

- Inflation: Costs may rise from 2022 estimates due to inflation, with 2024 projections factoring in a 5–10% increase (Statista 2022).

- Regulatory Requirements: Permitting and environmental compliance can add 5–10% to costs, depending on jurisdiction.

Return on Investment (ROI)

The ROI for the 300 MW hydroelectric plant depends on electricity sales, operational costs, and potential incentives. Key assumptions and projections include:

- Electricity Price: $0.05 per kWh, based on global averages for wholesale electricity.

- Capacity Factor: 50%, typical for hydropower plants, yielding 1.314 billion kWh annually (300 MW × 8,760 hours × 0.5).

- Annual Revenue: Approximately $65.7 million ($0.05/kWh × 1.314 billion kWh).

- Operational Costs: 1–2% of capital expenditure annually, or $16.5M–$50M, covering maintenance, staffing, and administration.

- Payback Period: 10–20 years, assuming stable electricity prices and no major disruptions.

- Incentives: Government subsidies, tax credits, or carbon offset programs could reduce payback time by 2–5 years.

ROI Sensitivity Analysis

The following table illustrates ROI under different scenarios:

Scenario | Electricity Price (USD/kWh) | Payback Period (Years) | Notes |

Base Case | $0.05 | 15–18 | Standard assumptions |

High Price | $0.07 | 10–12 | Favorable market conditions |

Low Price | $0.03 | 20–25 | Depressed electricity market |

With Incentives | $0.05 + $10M/year subsidy | 12–15 | Includes government or carbon credits |

Risks to ROI

- Market Volatility: Fluctuations in electricity prices could extend payback periods.

- Regulatory Changes: Shifts in energy policy or environmental regulations may impact profitability.

- Operational Risks: Droughts or equipment failures could reduce output, affecting revenue.

Job Creation

The project is expected to create significant employment opportunities during construction and operation:

- Construction Phase: 1,500–3,000 temporary jobs over 3–5 years, including:

- Civil engineers and construction workers for dam and infrastructure development.

- Electrical engineers for turbine and grid integration.

- Support staff for logistics, safety, and administration.

- Operational Phase: 50–100 permanent jobs, including:

- Plant operators and maintenance technicians.

- Environmental monitoring specialists.

- Administrative and management personnel.

These estimates are based on industry norms for hydropower projects of similar scale. Local hiring will be prioritized to maximize community benefits, with training programs to enhance workforce skills.

Environmental Benefits and Impacts

Hydropower is a clean, renewable energy source with significant environmental advantages, though construction and operation pose challenges.

Benefits

- CO2 Reduction: A 300 MW plant could offset approximately 1 million metric tons of CO2 annually compared to coal-fired plants, assuming a 50% capacity factor and 0.9 tons CO2/MWh for coal.

- Renewable Energy: Provides stable, dispatchable power, supporting grid reliability and renewable energy integration.

- Low Operating Emissions: No direct greenhouse gas emissions during operation, unlike fossil fuel plants.

Impacts and Mitigation

- Ecosystem Disruption: Dam construction may alter aquatic habitats, affecting fish migration and biodiversity.

- Mitigation: Install fish ladders, conduct habitat restoration, and monitor water quality.

- Land Use: Reservoir creation may flood land, impacting local communities and ecosystems.

- Mitigation: Minimize reservoir size, relocate affected communities with compensation, and preserve cultural sites.

- Sediment Flow: Dams can trap sediment, affecting downstream ecosystems.

- Mitigation: Implement sediment management plans, such as periodic flushing.

Environmental Cost

Environmental mitigation measures are estimated to cost $50M–$100M, included in the cost breakdown. Ongoing monitoring and compliance may add $1M–$2M annually to operational costs.

Contingency Fee

A 20% contingency fee, amounting to $300M–$460M, is included to address potential cost overruns. Common risks include:

- Geological Challenges: Unforeseen rock instability or seismic risks.

- Supply Chain Delays: Shortages of materials or equipment.

- Regulatory Delays: Extended permitting or environmental reviews.

This fee ensures financial resilience, aligning with industry best practices for large infrastructure projects.

Implementation Plan

The project will proceed in phases:

- Feasibility Study (6–12 months): Assess site suitability, water flow, and environmental impacts.

- Permitting and Design (12–18 months): Secure regulatory approvals and finalize engineering plans.

- Construction (3–5 years): Build dam, powerhouse, and transmission infrastructure.

- Commissioning (6–12 months): Test systems and connect to the grid.

- Operation: Begin commercial operation, with ongoing maintenance and monitoring.

Conclusion

The proposed 300 MW hydroelectric power plant by Geodyn Solutions offers a compelling opportunity to deliver clean energy, create jobs, and achieve long-term financial returns. With estimated costs of $1.65B–$2.5B, including a 20% contingency fee, the project is financially viable, with a payback period of 10–20 years. Environmental benefits are significant, though mitigation measures are critical to address ecological impacts. Geodyn Solutions is committed to rigorous planning and stakeholder engagement to ensure project success.

Proposal for a 300 MW Advanced Hydroelectric Power Plant by Geodyn Solutions

Executive Summary

Geodyn Solutions proposes the development of a 300 MW advanced hydroelectric power plant to deliver clean, reliable energy. This proposal outlines the estimated costs, return on investment (ROI), job creation, environmental benefits, and a 20% contingency fee, based on industry data and trends. The project aligns with global sustainability goals, offering significant economic and environmental advantages, though site-specific factors will influence final outcomes.

Project Description

The 300 MW hydroelectric power plant will utilize state-of-the-art technology, including high-efficiency turbines and advanced control systems, to maximize energy output and minimize environmental impact. The plant will generate electricity by harnessing water flow through a dam or run-of-river system, depending on the selected site. Key features include:

- Capacity: 300 MW, sufficient to power approximately 200,000 households.

- Technology: Kaplan or Francis turbines, optimized for variable flow conditions.

- Infrastructure: Dam or diversion structure, powerhouse, transmission lines, and access roads.

- Location: To be determined, pending site feasibility studies.

Cost Estimate

The estimated cost to construct a 300 MW hydroelectric power plant in 2024 ranges from $1.65 billion to $2.5 billion, including a 20% contingency fee. This estimate is based on industry data from sources such as the National Renewable Energy Laboratory (NREL) and Statista, which report costs per kilowatt ranging from $5,500 to $8,611 (NREL Hydropower 2024, Statista 2022).

Cost Breakdown

The following table provides a detailed cost breakdown, including the contingency fee:

Component | Estimated Cost Range (USD) | Notes |

Civil Works (Dam, Reservoir) | $600M–$900M | Varies by site topography and geology |

Turbines and Generators | $400M–$600M | High-efficiency Kaplan or Francis turbines |

Electrical Systems | $200M–$300M | Includes transformers, switchgear, and control systems |

Transmission Infrastructure | $150M–$250M | Depends on distance to grid connection |

Engineering and Design | $100M–$150M | Includes feasibility studies and permitting |

Environmental Mitigation | $50M–$100M | Fish ladders, habitat restoration, and monitoring |

Subtotal | $1.5B–$2.3B | |

Contingency Fee (20%) | $300M–$460M | Covers cost overruns, delays, or unforeseen site challenges |

Total | $1.65B–$2.5B |

Cost Factors

- Site Conditions: Costs increase for remote locations or sites with low water head, requiring extensive civil works (NREL Hydropower 2024).

- Inflation: Costs may rise from 2022 estimates due to inflation, with 2024 projections factoring in a 5–10% increase (Statista 2022).

- Regulatory Requirements: Permitting and environmental compliance can add 5–10% to costs, depending on jurisdiction.

Return on Investment (ROI)

The ROI for the 300 MW hydroelectric plant depends on electricity sales, operational costs, and potential incentives. Key assumptions and projections include:

- Electricity Price: $0.05 per kWh, based on global averages for wholesale electricity.

- Capacity Factor: 50%, typical for hydropower plants, yielding 1.314 billion kWh annually (300 MW × 8,760 hours × 0.5).

- Annual Revenue: Approximately $65.7 million ($0.05/kWh × 1.314 billion kWh).

- Operational Costs: 1–2% of capital expenditure annually, or $16.5M–$50M, covering maintenance, staffing, and administration.

- Payback Period: 10–20 years, assuming stable electricity prices and no major disruptions.

- Incentives: Government subsidies, tax credits, or carbon offset programs could reduce payback time by 2–5 years.

ROI Sensitivity Analysis

The following table illustrates ROI under different scenarios:

Scenario | Electricity Price (USD/kWh) | Payback Period (Years) | Notes |

Base Case | $0.05 | 15–18 | Standard assumptions |

High Price | $0.07 | 10–12 | Favorable market conditions |

Low Price | $0.03 | 20–25 | Depressed electricity market |

With Incentives | $0.05 + $10M/year subsidy | 12–15 | Includes government or carbon credits |

Risks to ROI

- Market Volatility: Fluctuations in electricity prices could extend payback periods.

- Regulatory Changes: Shifts in energy policy or environmental regulations may impact profitability.

- Operational Risks: Droughts or equipment failures could reduce output, affecting revenue.

Job Creation

The project is expected to create significant employment opportunities during construction and operation:

- Construction Phase: 1,500–3,000 temporary jobs over 3–5 years, including:

- Civil engineers and construction workers for dam and infrastructure development.

- Electrical engineers for turbine and grid integration.

- Support staff for logistics, safety, and administration.

- Operational Phase: 50–100 permanent jobs, including:

- Plant operators and maintenance technicians.

- Environmental monitoring specialists.

- Administrative and management personnel.

These estimates are based on industry norms for hydropower projects of similar scale. Local hiring will be prioritized to maximize community benefits, with training programs to enhance workforce skills.

Environmental Benefits and Impacts

Hydropower is a clean, renewable energy source with significant environmental advantages, though construction and operation pose challenges.

Benefits

- CO2 Reduction: A 300 MW plant could offset approximately 1 million metric tons of CO2 annually compared to coal-fired plants, assuming a 50% capacity factor and 0.9 tons CO2/MWh for coal.

- Renewable Energy: Provides stable, dispatchable power, supporting grid reliability and renewable energy integration.

- Low Operating Emissions: No direct greenhouse gas emissions during operation, unlike fossil fuel plants.

Impacts and Mitigation

- Ecosystem Disruption: Dam construction may alter aquatic habitats, affecting fish migration and biodiversity.

- Mitigation: Install fish ladders, conduct habitat restoration, and monitor water quality.

- Land Use: Reservoir creation may flood land, impacting local communities and ecosystems.

- Mitigation: Minimize reservoir size, relocate affected communities with compensation, and preserve cultural sites.

- Sediment Flow: Dams can trap sediment, affecting downstream ecosystems.

- Mitigation: Implement sediment management plans, such as periodic flushing.

Environmental Cost

Environmental mitigation measures are estimated to cost $50M–$100M, included in the cost breakdown. Ongoing monitoring and compliance may add $1M–$2M annually to operational costs.

Contingency Fee

A 20% contingency fee, amounting to $300M–$460M, is included to address potential cost overruns. Common risks include:

- Geological Challenges: Unforeseen rock instability or seismic risks.

- Supply Chain Delays: Shortages of materials or equipment.

- Regulatory Delays: Extended permitting or environmental reviews.

This fee ensures financial resilience, aligning with industry best practices for large infrastructure projects.

Implementation Plan

The project will proceed in phases:

- Feasibility Study (6–12 months): Assess site suitability, water flow, and environmental impacts.

- Permitting and Design (12–18 months): Secure regulatory approvals and finalize engineering plans.

- Construction (3–5 years): Build dam, powerhouse, and transmission infrastructure.

- Commissioning (6–12 months): Test systems and connect to the grid.

- Operation: Begin commercial operation, with ongoing maintenance and monitoring.

Conclusion

The proposed 300 MW hydroelectric power plant by Geodyn Solutions offers a compelling opportunity to deliver clean energy, create jobs, and achieve long-term financial returns. With estimated costs of $1.65B–$2.5B, including a 20% contingency fee, the project is financially viable, with a payback period of 10–20 years. Environmental benefits are significant, though mitigation measures are critical to address ecological impacts. Geodyn Solutions is committed to rigorous planning and stakeholder engagement to ensure project success.