Comprehensive $250 Million Budget Proposal Geodyn Solutions: Sugarcane & Sorghum Biofuel-to-Power with Co-Product Value Chains – Dominican Republic

Executive Summary

Geodyn Solutions, in partnership with Dominican stakeholders, proposes a $250 million biofuel-to-power investment utilizing sugarcane and sorghum as the most efficient feedstocks for both electricity generation and ROI.

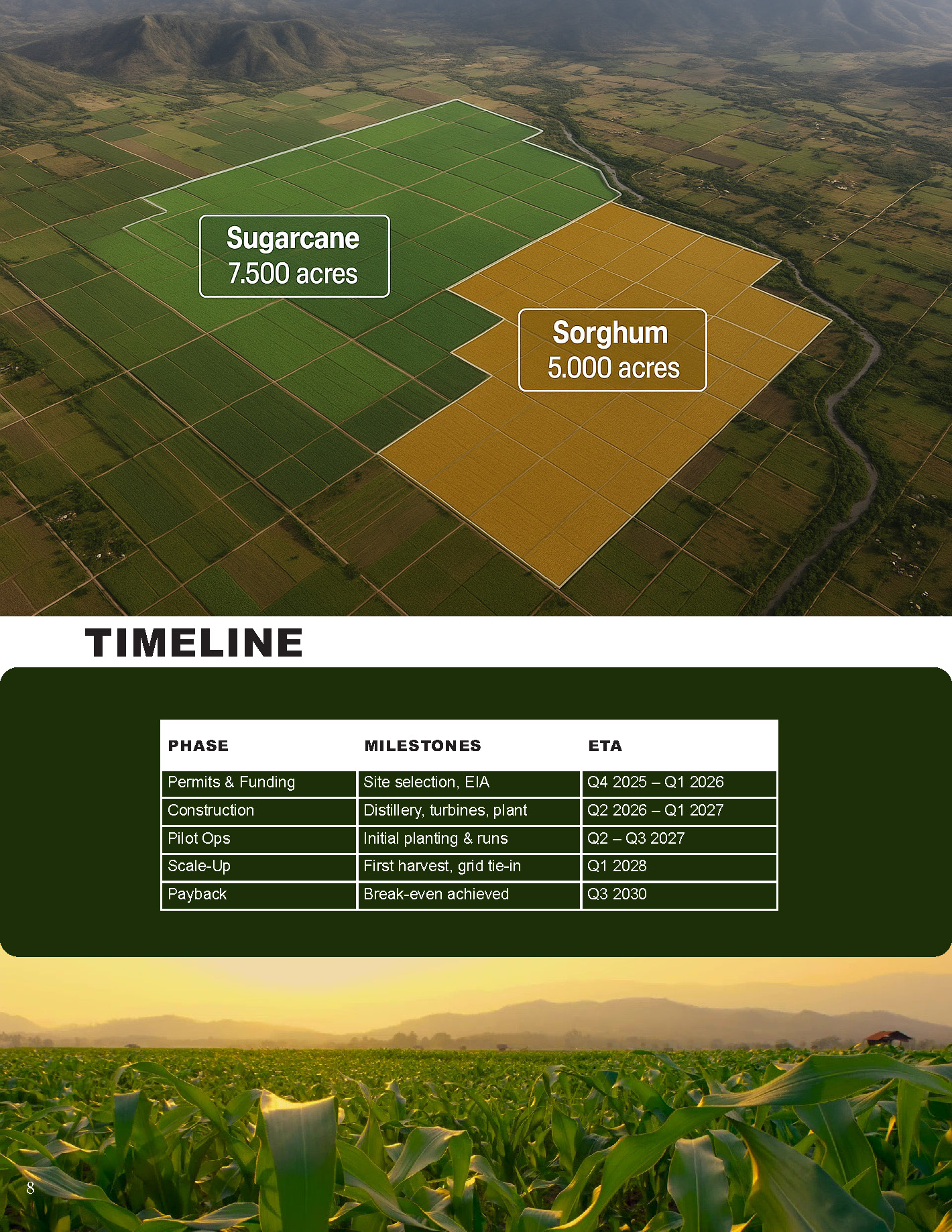

This project covers 12,500 acres in provinces like Azua and Barahona, with dual cultivation cycles of sugarcane (7,500 acres) and sweet sorghum (5,000 acres). The integrated system will produce:

- 50M+ liters of ethanol annually

- 100,000+ tons of bagasse pellets

- 50,000 tons of molasses

- High-value nutraceutical extracts

- 30 MW of baseload renewable power (240 GWh/year)via six 5 MW biomass turbines

Key Highlights

- Total Investment:$250M

- ROI:30–40% average over 15 years

- Payback Period:5 years

- Jobs:650 direct, 950 indirect (1,600 total)

- Environmental Benefits:150,000–200,000 tons CO₂ offset annually

- Incentives:Up to $80M from Law 57-07, CIF, World Bank, IDB

- Timeline:Groundbreaking Q2 2026 → Full Scale Q1 2028

Project Overview

Cultivation

- Sugarcane:60–100 t/ha, ethanol yield 500–700 L/ton

- Sweet Sorghum:40–60 t/ha, ethanol yield 400–600 L/ton

- Year-round feedstock ensures consistent power & ethanol production.

Processing

- Ethanol distillery:50M liters/year

- Pelletizing plant:100,000 tons/year bagasse pellets

- Molasses & nutraceuticals linefor high-value by-products

Power Generation

- Six 5 MW biomass turbines

- Long-term PPAs at $0.17/kWhwith CDEEE

- 30 MW (240 GWh/year)contribution to DR’s renewable targets

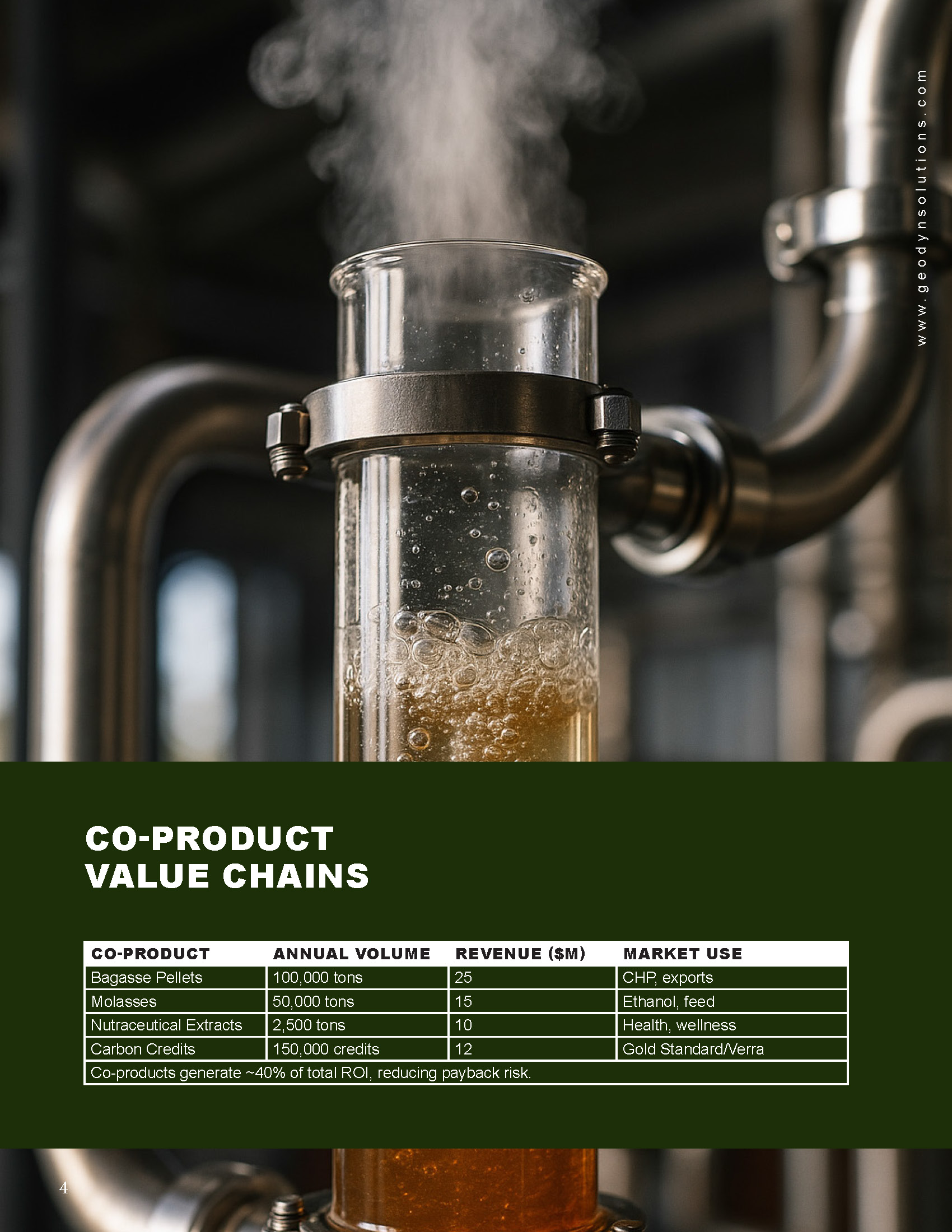

Co-Product Value Chains

Co-Product | Annual Volume | Revenue ($M) | Market Use |

Bagasse Pellets | 100,000 tons | 25 | CHP, exports |

Molasses | 50,000 tons | 15 | Ethanol, feed |

Nutraceutical Extracts | 2,500 tons | 10 | Health, wellness |

Carbon Credits | 150,000 credits | 12 | Gold Standard/Verra |

Co-products generate ~40% of total ROI, reducing payback risk.

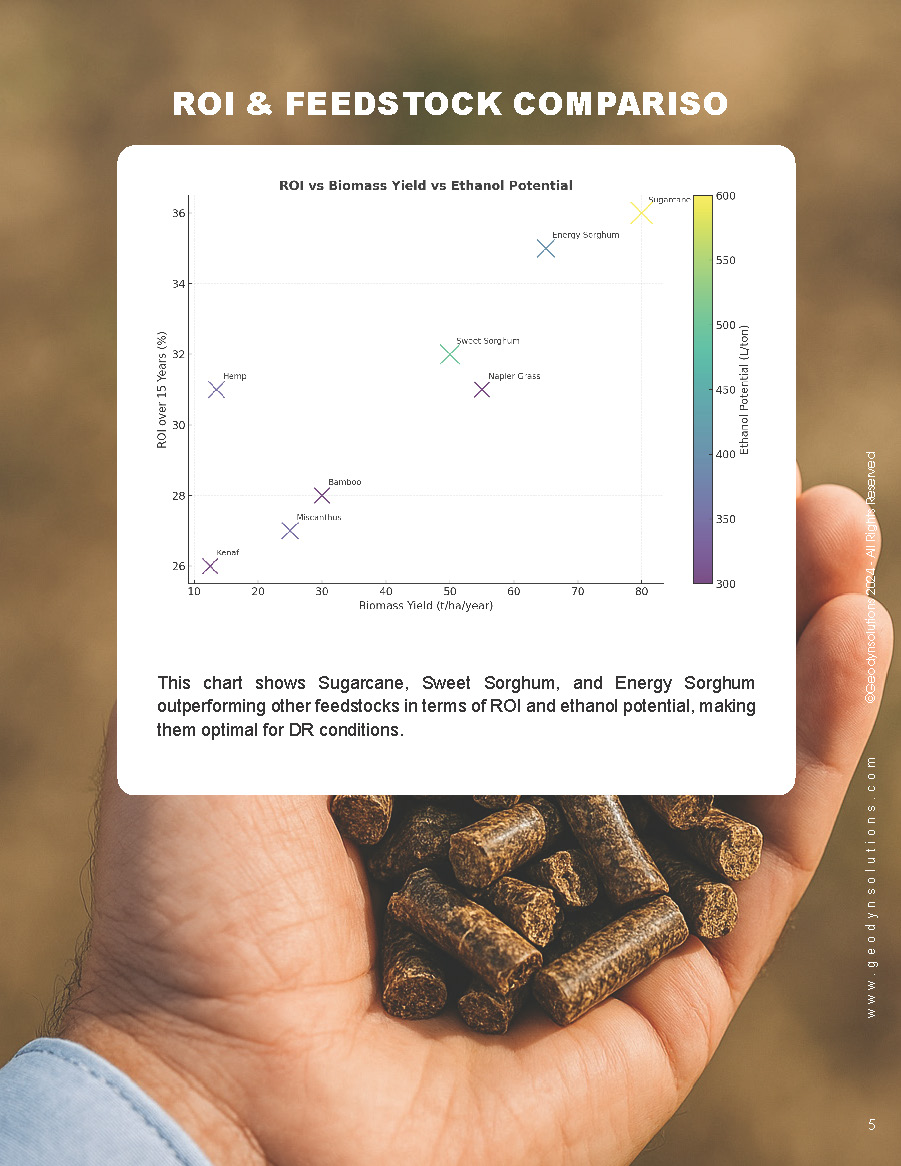

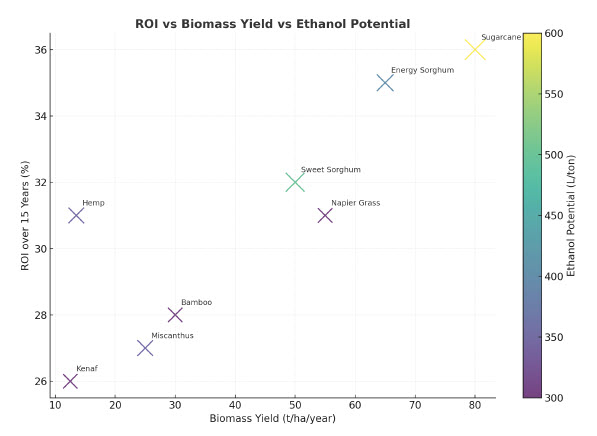

ROI & Feedstock Comparison

Chart 1 – ROI vs Biomass Yield vs Ethanol Potential

(Comparison of Sugarcane, Sweet Sorghum, Energy Sorghum, Hemp, Kenaf, Bamboo, Napier, Miscanthus)

This chart shows Sugarcane, Sweet Sorghum, and Energy Sorghum outperforming other feedstocks in terms of ROI and ethanol potential, making them optimal for DR conditions.

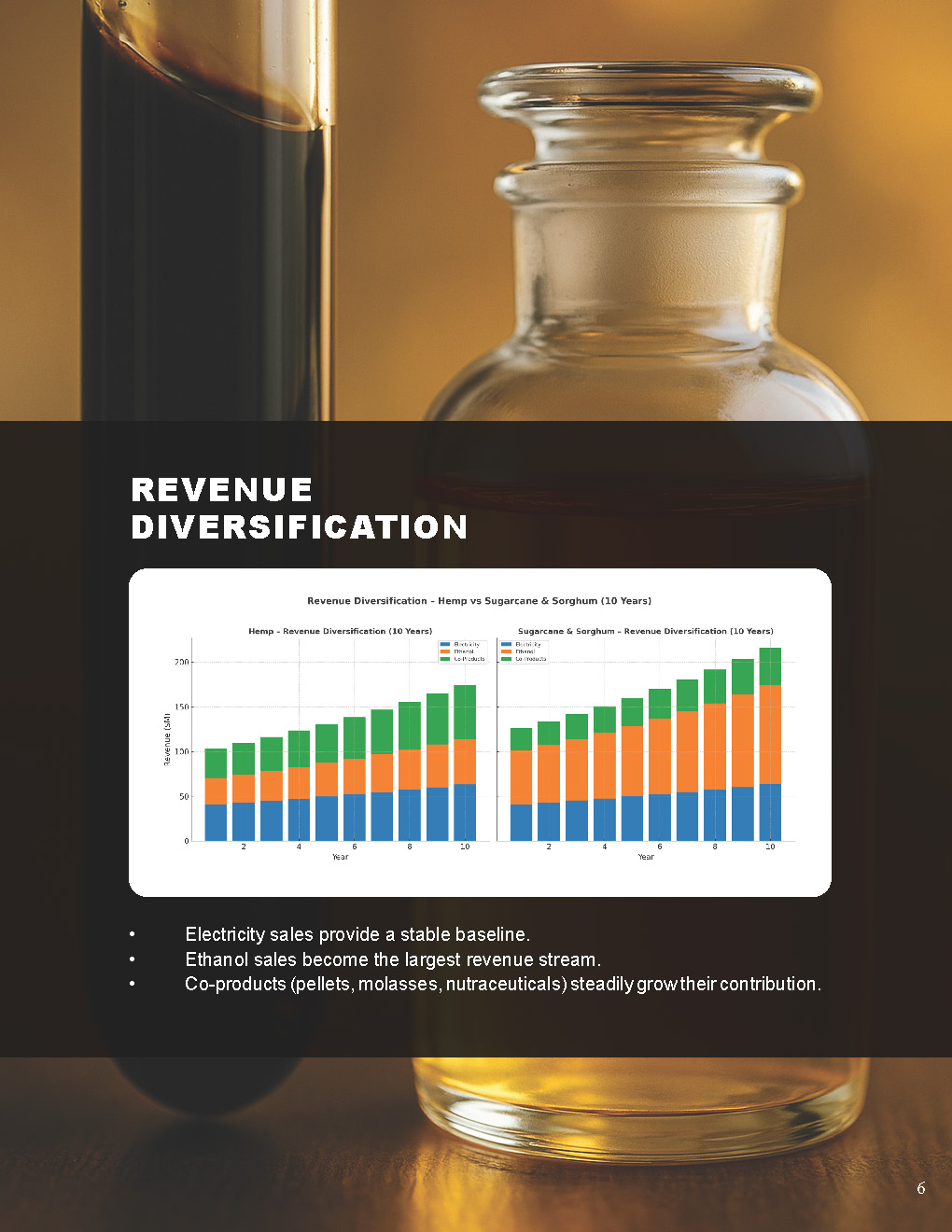

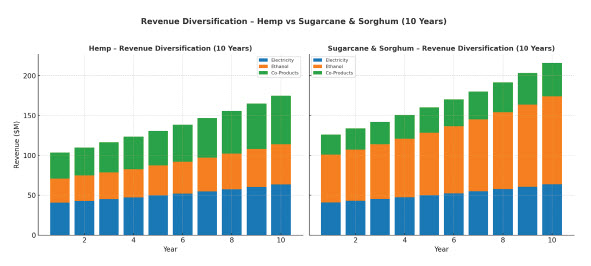

Revenue Diversification

Chart 2 – Stacked Revenue Streams (10 Years)

- Electricity salesprovide a stable baseline.

- Ethanol salesbecome the largest revenue stream.

- Co-products(pellets, molasses, nutraceuticals) steadily grow their contribution.

Financial Overview

Capex ($250M)

- Land: $15M

- Cultivation Setup: $35M

- Processing Facility: $55M

- Power Infrastructure: $75M

- R&D/Co-Products: $25M

- Contingency: $45M

Opex (~$65M/year)

- Cultivation: $15M

- Processing: $25M

- Power O&M: $12M

- Logistics/Admin: $13M

Revenue (Year 1 = $136M; Year 10 = $300M+)

- Electricity: $41M

- Ethanol: $60M

- Co-Products: $25M

- Carbon Credits: $10M

NPV: $520M @ 8%

IRR: 36%

Payback: 4.5 years

Timeline

Phase | Milestones | ETA |

Permits & Funding | Site selection, EIA | Q4 2025 – Q1 2026 |

Construction | Distillery, turbines, plant | Q2 2026 – Q1 2027 |

Pilot Ops | Initial planting & runs | Q2 – Q3 2027 |

Scale-Up | First harvest, grid tie-in | Q1 2028 |

Payback | Break-even achieved | Q3 2030 |