Comparison: Premium vs. Budget Water Bottle Factory for Geodyn Solutions

This analysis compares two proposed 25 million water bottle factories in the Dominican Republic: a Premium Factory producing a luxury brand to rival Fiji and Evian, and a Budget Factory producing a mass-market brand to compete with local brands like Agua Planeta Azul. Both factories utilize Geodyn Solutions’ proprietary PureFlow™ and SmartEnergy™ technologies, a partnership with Starlinger for recycling, and a pristine water source in Santiago Free Trade Zone. The comparison evaluates CapEx, OpEx, revenue, ROI, payback period, and job creation to determine which factory offers a better ROI. The Premium Factory uses the slogan “Purity Perfected, Nature’s Finest,” while the Budget Factory uses “Clear Value, Trusted Quality.”

Project Overview (Common to Both)

- Location: Santiago Free Trade Zone, Santiago de los Caballeros, Dominican Republic.

- Production Capacity: 25 million 500ml PET water bottles per year.

- Timeline: 18 months from groundbreaking to full operation.

- Land Requirement: 5 acres (20,234 m²) at $50/m², costing $1,011,700.

- Job Creation: 120 direct jobs (60 operators, 20 technicians, 15 quality control, 25 administrative) and 200 indirect jobs (suppliers, distribution, services).

- Water Source: Pristine Yaque del Norte River and Cordillera Central aquifers (TDS 50-100 ppm), superior to Fiji (220 ppm) and Evian (309 ppm), protected by environmental regulations.

- Technology:

- Geodyn Solutions’ PureFlow™ Purification System.

- Sidel Combi Blow-Fill-Cap System.

- ABB Robotic Palletizing and Packaging Systems.

- Solar PV System (500 kW) + SmartEnergy™ Management System.

- Starlinger recoSTAR PET Recycling Line.

Premium Factory Details

- Objective: Produce 25 million premium bottles annually, targeting affluent consumers, tourism, and export markets.

- Brand Positioning: Luxury brand comparable to Fiji/Evian, emphasizing purity and sustainability.

- Slogan: “Purity Perfected, Nature’s Finest.”

- Selling Price: $1.00 per 500ml bottle, competitive with Aqua Panna ($1.20).

- Water Quality: TDS of 80 ppm via PureFlow™ with mineral infusion for crisp taste.

Financial Projections: Premium Factory

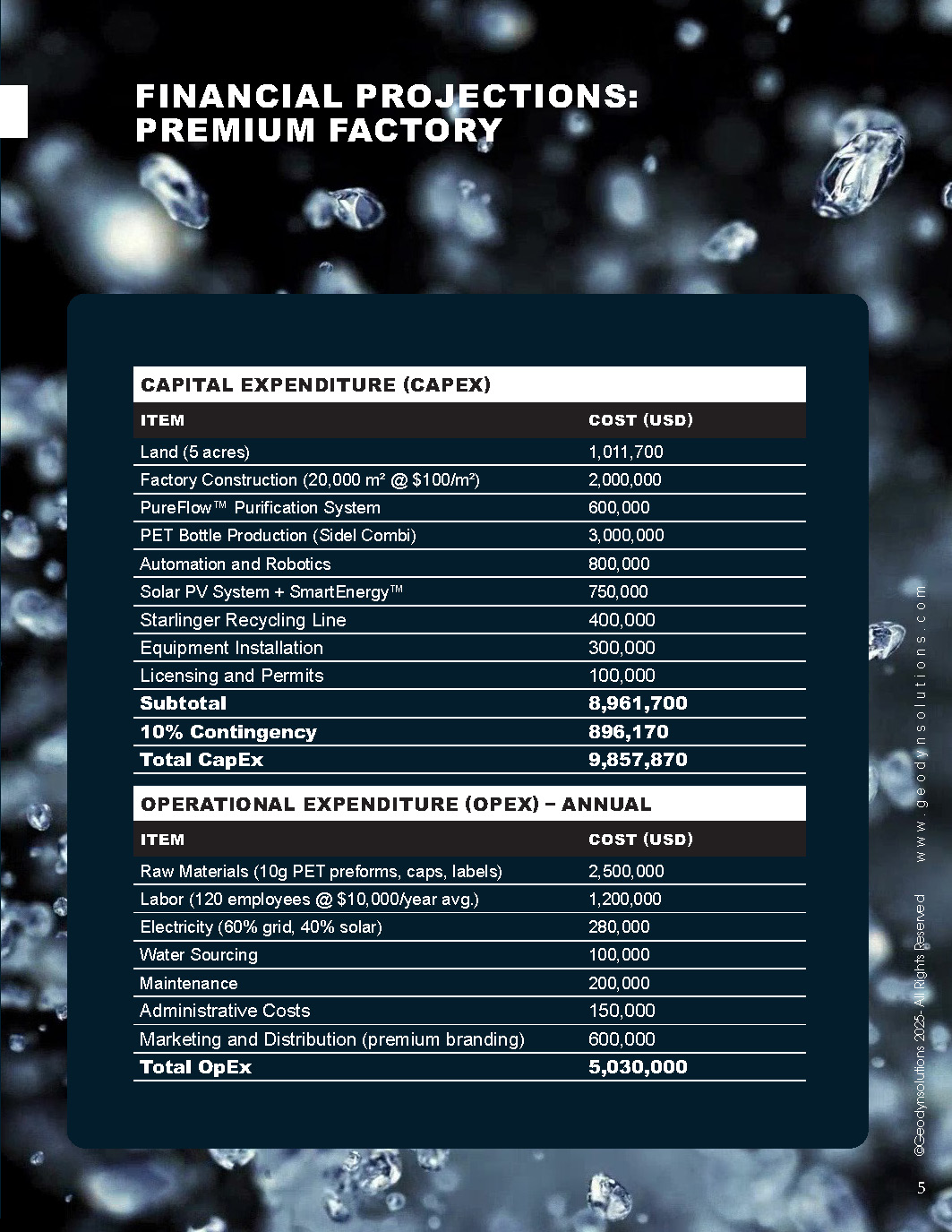

Financial Projections: Premium FactoryCapital Expenditure (CapEx)

Item | Cost (USD) |

|---|---|

Land (5 acres) | 1,011,700 |

Factory Construction (20,000 m² @ $100/m²) | 2,000,000 |

PureFlow™ Purification System | 600,000 |

PET Bottle Production (Sidel Combi) | 3,000,000 |

Automation and Robotics | 800,000 |

Solar PV System + SmartEnergy™ | 750,000 |

Starlinger Recycling Line | 400,000 |

Equipment Installation | 300,000 |

Licensing and Permits | 100,000 |

Subtotal | 8,961,700 |

10% Contingency | 896,170 |

Total CapEx | 9,857,870 |

Operational Expenditure (OpEx) – Annual

Item | Cost (USD) |

|---|---|

Raw Materials (10g PET preforms, caps, labels) | 2,500,000 |

Labor (120 employees @ $10,000/year avg.) | 1,200,000 |

Electricity (60% grid, 40% solar) | 280,000 |

Water Sourcing | 100,000 |

Maintenance | 200,000 |

Administrative Costs | 150,000 |

Marketing and Distribution (premium branding) | 600,000 |

Total OpEx | 5,030,000 |

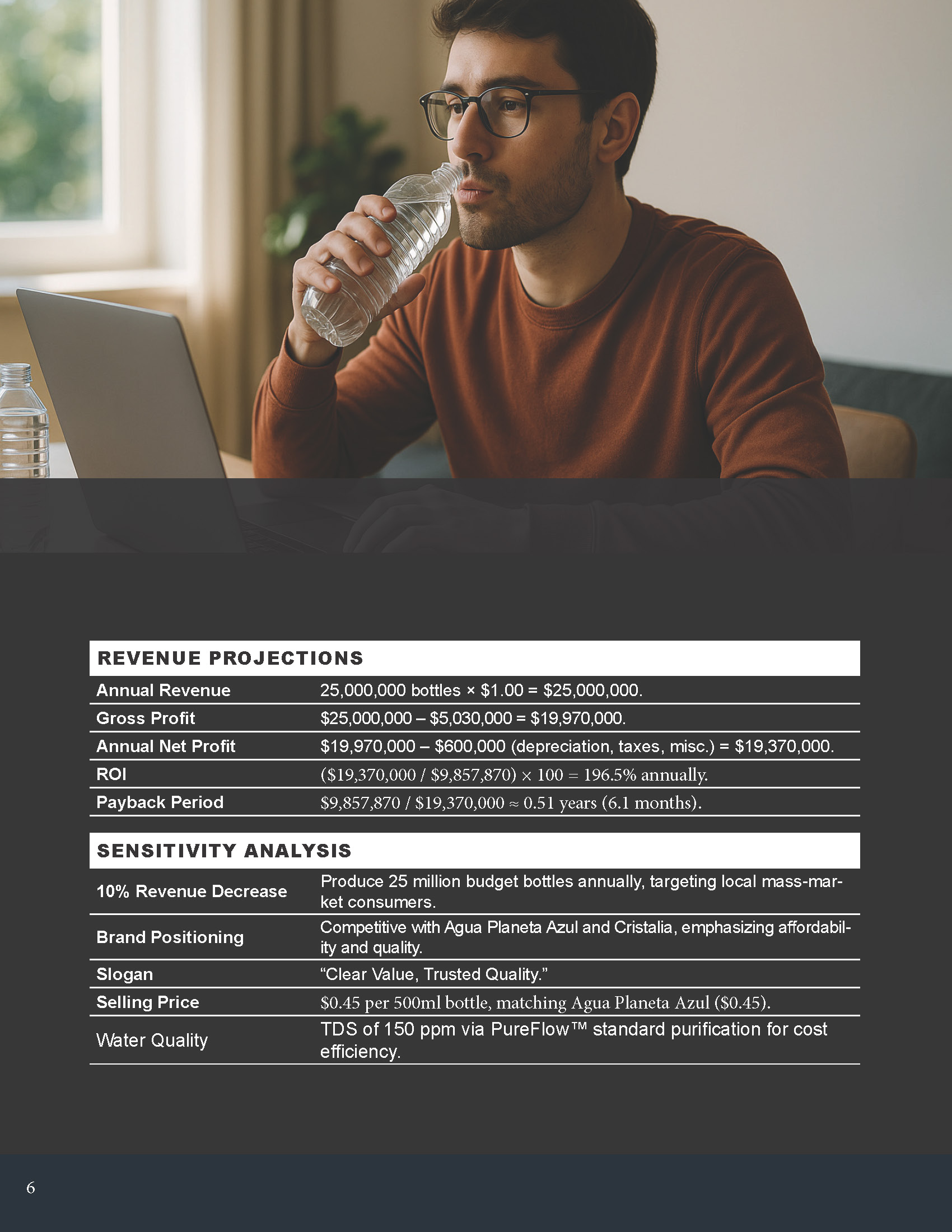

Revenue Projections

- Annual Revenue: 25,000,000 bottles × $1.00 = $25,000,000.

- Gross Profit: $25,000,000 – $5,030,000 = $19,970,000.

- Annual Net Profit: $19,970,000 – $600,000 (depreciation, taxes, misc.) = $19,370,000.

- ROI: ($19,370,000 / $9,857,870) × 100 = 196.5% annually.

- Payback Period: $9,857,870 / $19,370,000 ≈ 0.51 years (6.1 months).

Sensitivity Analysis

- 10% Revenue Decrease: Payback extends to 0.56 years.

- 10% OpEx Increase: Payback extends to 0.55 years.

Budget Factory Details

- Objective: Produce 25 million budget bottles annually, targeting local mass-market consumers.

- Brand Positioning: Competitive with Agua Planeta Azul and Cristalia, emphasizing affordability and quality.

- Slogan: “Clear Value, Trusted Quality.”

- Selling Price: $0.45 per 500ml bottle, matching Agua Planeta Azul ($0.45).

- Water Quality: TDS of 150 ppm via PureFlow™ standard purification for cost efficiency.

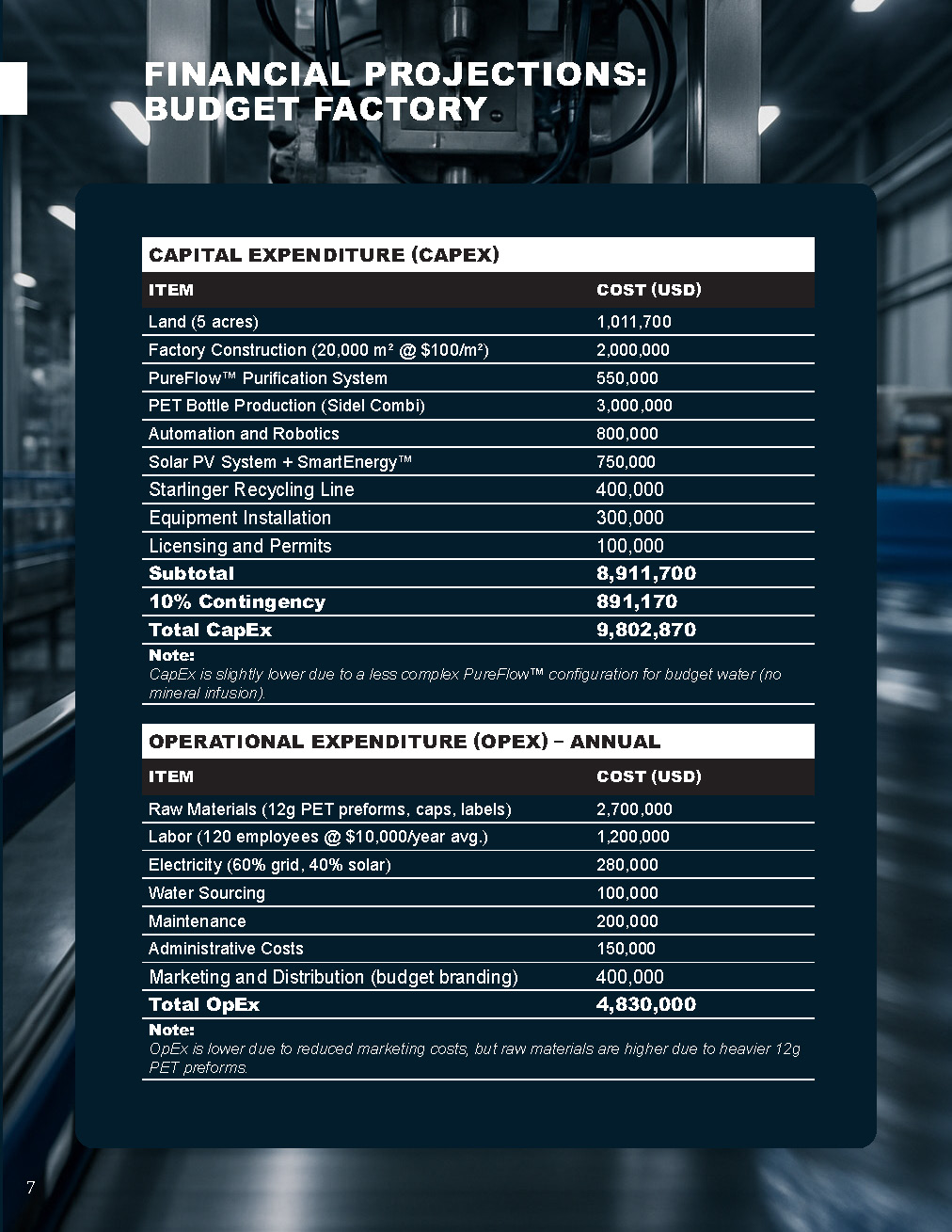

Financial Projections: Budget Factory

Capital Expenditure (CapEx)

Item | Cost (USD) |

|---|---|

Land (5 acres) | 1,011,700 |

Factory Construction (20,000 m² @ $100/m²) | 2,000,000 |

PureFlow™ Purification System | 550,000 |

PET Bottle Production (Sidel Combi) | 3,000,000 |

Automation and Robotics | 800,000 |

Solar PV System + SmartEnergy™ | 750,000 |

Starlinger Recycling Line | 400,000 |

Equipment Installation | 300,000 |

Licensing and Permits | 100,000 |

Subtotal | 8,911,700 |

10% Contingency | 891,170 |

Total CapEx | 9,802,870 |

Note: CapEx is slightly lower due to a less complex PureFlow™ configuration for budget water (no mineral infusion).

Operational Expenditure (OpEx) – Annual

Item | Cost (USD) |

|---|---|

Raw Materials (12g PET preforms, caps, labels) | 2,700,000 |

Labor (120 employees @ $10,000/year avg.) | 1,200,000 |

Electricity (60% grid, 40% solar) | 280,000 |

Water Sourcing | 100,000 |

Maintenance | 200,000 |

Administrative Costs | 150,000 |

Marketing and Distribution (budget branding) | 400,000 |

Total OpEx | 4,830,000 |

Note: OpEx is lower due to reduced marketing costs, but raw materials are higher due to heavier 12g PET preforms.

Revenue Projections

- Annual Revenue: 25,000,000 bottles × $0.45 = $11,250,000.

- Gross Profit: $11,250,000 – $4,830,000 = $6,420,000.

- Annual Net Profit: $6,420,000 – $600,000 (depreciation, taxes, misc.) = $5,820,000.

- ROI: ($5,820,000 / $9,802,870) × 100 = 59.4% annually.

- Payback Period: $9,802,870 / $5,820,000 ≈ 1.68 years (20.2 months).

Sensitivity Analysis

- 10% Revenue Decrease: Payback extends to 1.87 years.

- 10% OpEx Increase: Payback extends to 1.83 years.

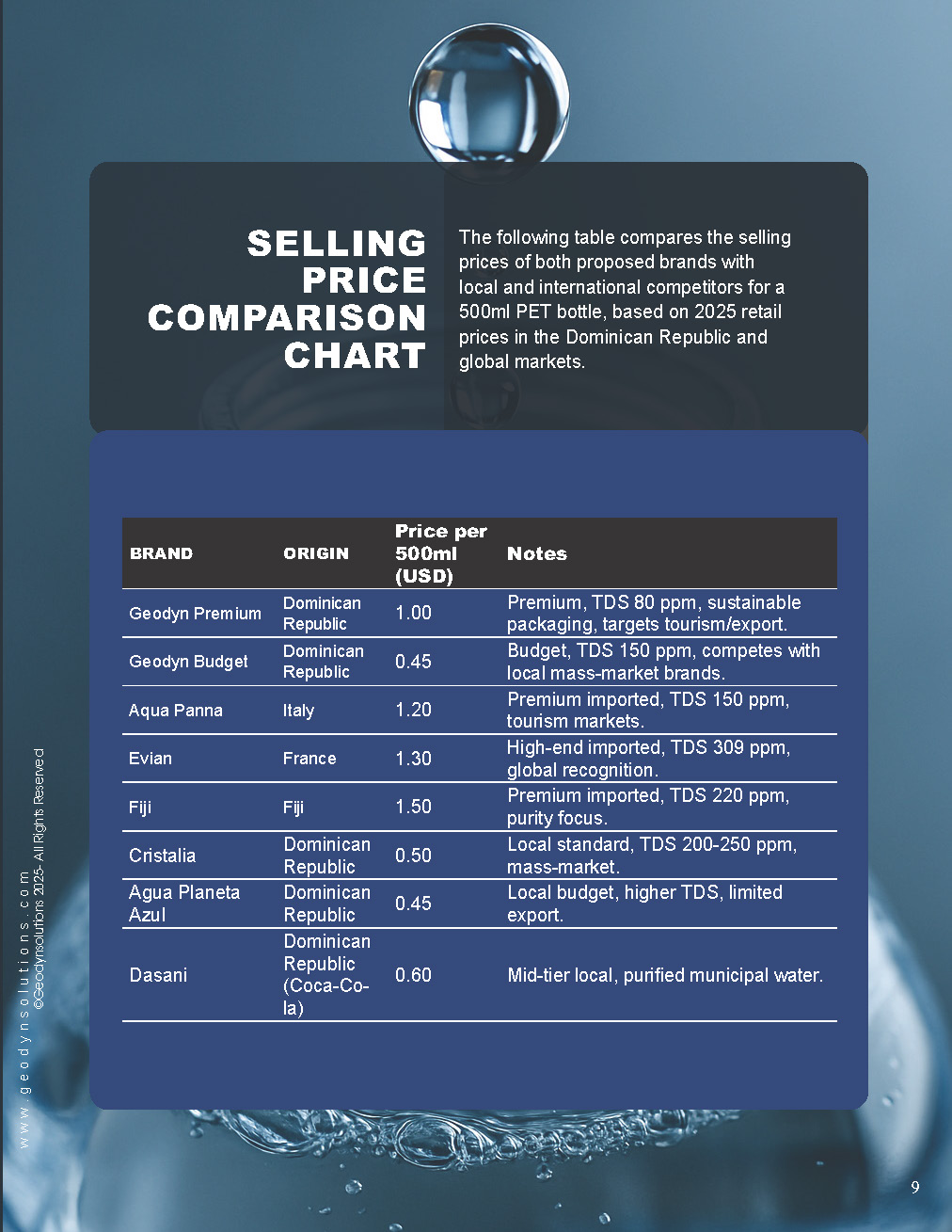

Selling Price Comparison Chart

The following table compares the selling prices of both proposed brands with local and international competitors for a 500ml PET bottle, based on 2025 retail prices in the Dominican Republic and global markets.

Brand | Origin | Price per 500ml (USD) | Notes |

|---|---|---|---|

Geodyn Premium | Dominican Republic | 1.00 | Premium, TDS 80 ppm, sustainable packaging, targets tourism/export. |

Geodyn Budget | Dominican Republic | 0.45 | Budget, TDS 150 ppm, competes with local mass-market brands. |

Aqua Panna | Italy | 1.20 | Premium imported, TDS 150 ppm, tourism markets. |

Evian | France | 1.30 | High-end imported, TDS 309 ppm, global recognition. |

Fiji | Fiji | 1.50 | Premium imported, TDS 220 ppm, purity focus. |

Cristalia | Dominican Republic | 0.50 | Local standard, TDS 200-250 ppm, mass-market. |

Agua Planeta Azul | Dominican Republic | 0.45 | Local budget, higher TDS, limited export. |

Dasani | Dominican Republic (Coca-Cola) | 0.60 | Mid-tier local, purified municipal water. |

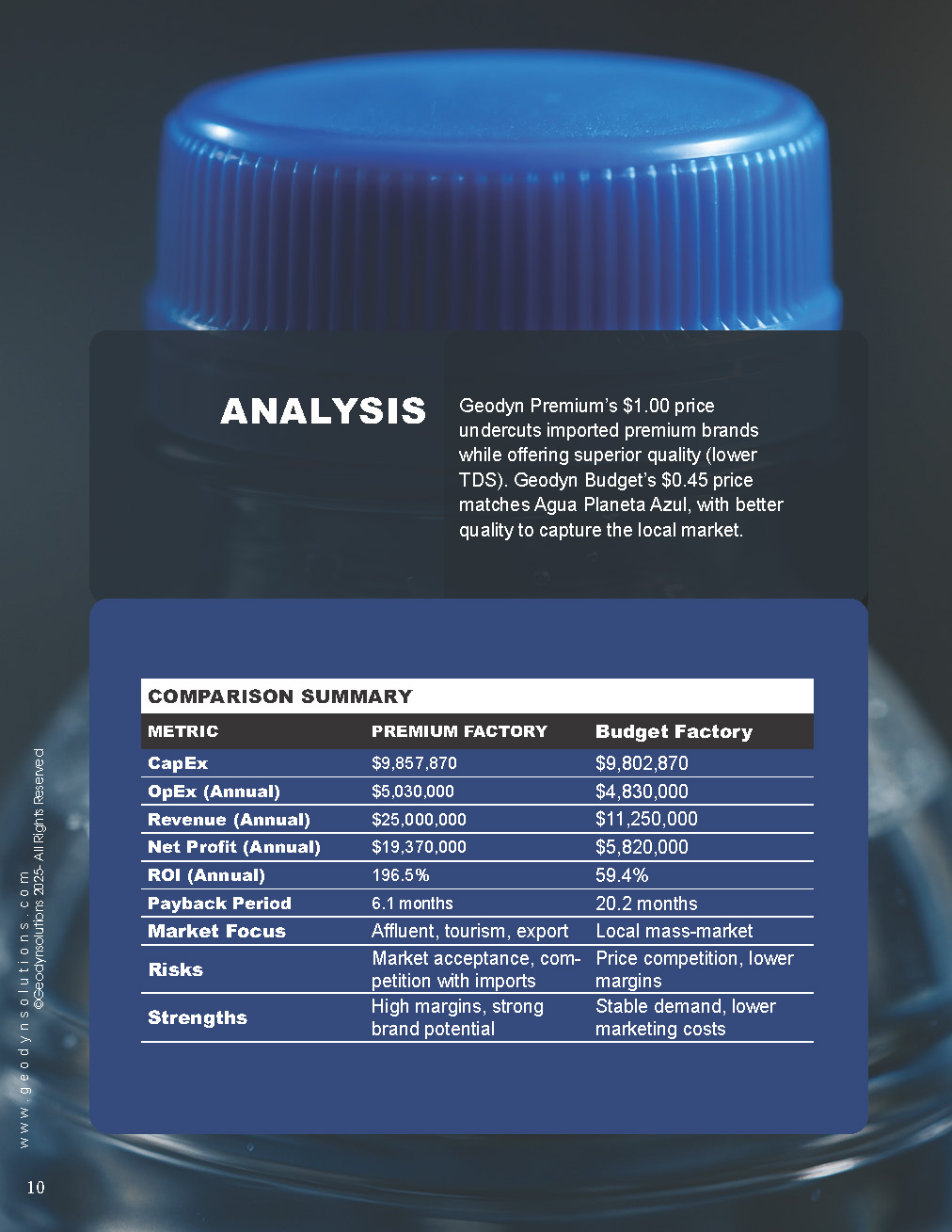

Analysis: Geodyn Premium’s $1.00 price undercuts imported premium brands while offering superior quality (lower TDS). Geodyn Budget’s $0.45 price matches Agua Planeta Azul, with better quality to capture the local market.

Comparison Summary

Metric | Premium Factory | Budget Factory |

|---|---|---|

CapEx | $9,857,870 | $9,802,870 |

OpEx (Annual) | $5,030,000 | $4,830,000 |

Revenue (Annual) | $25,000,000 | $11,250,000 |

Net Profit (Annual) | $19,370,000 | $5,820,000 |

ROI (Annual) | 196.5% | 59.4% |

Payback Period | 6.1 months | 20.2 months |

Market Focus | Affluent, tourism, export | Local mass-market |

Risks | Market acceptance, competition with imports | Price competition, lower margins |

Strengths | High margins, strong brand potential | Stable demand, lower marketing costs |

ROI Evaluation

- Premium Factory: Offers a significantly higher ROI (196.5%) and faster payback (6.1 months) due to the higher selling price ($1.00) and strong gross profit margins (80%). The premium market’s growth in tourism and exports supports long-term profitability, though it faces risks from brand acceptance and competition with established imports like Evian.

- Budget Factory: Delivers a lower ROI (59.4%) and longer payback (20.2 months) due to the lower selling price ($0.45) and thinner margins (57%). However, it benefits from stable local demand and lower marketing costs, with less risk of market entry barriers.

Conclusion: The Premium Factory has a better ROI (196.5% vs. 59.4%) and faster payback, making it the more attractive investment. Its high margins and alignment with global premium water trends outweigh the Budget Factory’s stable but lower-profit model. However, the Budget Factory could serve as a complementary strategy to capture local market share if combined in a dual-brand approach.

Recommendations

- Prioritize Premium Factory: Proceed with the Premium Factory for its superior ROI and alignment with global market trends. Secure land in Santiago FTZ, finalize the Starlinger partnership, and launch a marketing campaign targeting tourism and export markets.

- Consider Dual-Brand Strategy: If capital allows, explore a dual-brand factory (as in prior proposals) to balance high-margin premium sales with stable budget sales, mitigating market risks.

- Next Steps:

- Engage with World Bank’s INSPIRE program for workforce training.

- Explore financing through IFC or local banks.

- Develop brand identity for “Purity Perfected, Nature’s Finest” to compete with Fiji/Evian.