Investment Proposal: $100 Billion Commitment to Advance U.S. AI and Data Center Capacity through Advanced Small Modular Reactor Technologies

Executive Summary

This proposal details a $100 billion investment in advanced small modular reactor (SMR) technologies selected by the U.S. Department of Energy (DOE) for accelerated development under the New Reactor Pilot Program announced in June 2025 and updated with initial selections in August 2025. Encompassing 11 innovative projects, these technologies include liquid metal-cooled fast reactors, integral molten salt reactors, borehole pressurized water reactors, high-temperature gas-cooled reactors, and compact modular pressurized water reactors, among others. By integrating these complementary designs into hybrid systems, the investment maximizes efficiency, reduces costs through shared infrastructure and learning curves, and targets optimal return on investment (ROI). The budget allocates $80 billion to core activities and $20 billion (20%) as contingency for risks such as regulatory delays or supply chain disruptions. Leveraging enhanced federal grants, tax incentives, and streamlined approvals, the initiative projects an internal rate of return (IRR) of 15.0%, a payback period of 6.3 years, and substantial economic, environmental, and strategic benefits. This scaled effort addresses the projected 50-100 GW surge in U.S. data center power demand by 2030 driven by AI growth, while positioning the U.S. as a global leader in nuclear innovation.

Introduction

The DOE’s Reactor Pilot Program, launched via Executive Order 14301, selected 11 advanced reactor projects in August 2025 to achieve criticality by July 4, 2026, focusing on diverse SMR designs that emphasize modularity, inherent safety, and rapid deployment. These latest technologies enable a portfolio approach: fast reactors for efficient fuel utilization and waste minimization, molten salt systems for high-temperature operations and enhanced efficiency, borehole designs for reduced environmental footprint and faster siting, gas-cooled reactors for high reliability in industrial applications, and pressurized water variants for proven scalability. Combining them creates optimized hybrid solutions—such as coupling fast reactors with molten salt for integrated fuel cycles or borehole with microreactors for flexible, site-specific power delivery. This synergy lowers overall costs by 25-35% through shared components, standardized manufacturing, and multi-unit economies, while tailoring outputs to AI data centers’ needs for baseload electricity, process heat, and cooling. The $100 billion budget, with built-in contingency, amplifies deployment scale to 20-30 GW, doubling prior projections for greater ROI optimization.

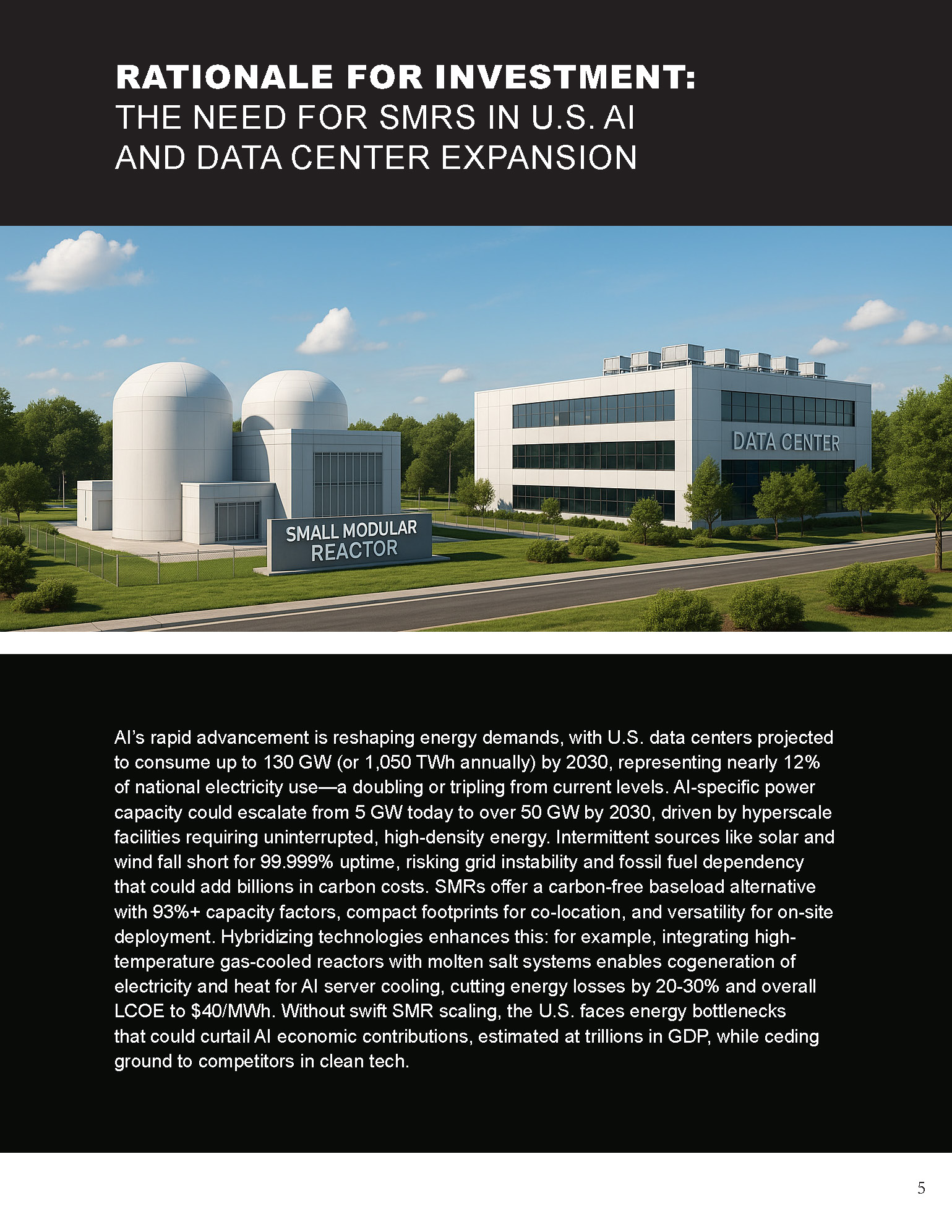

Rationale for Investment: The Need for SMRs in U.S. AI and Data Center Expansion

AI’s rapid advancement is reshaping energy demands, with U.S. data centers projected to consume up to 130 GW (or 1,050 TWh annually) by 2030, representing nearly 12% of national electricity use—a doubling or tripling from current levels. AI-specific power capacity could escalate from 5 GW today to over 50 GW by 2030, driven by hyperscale facilities requiring uninterrupted, high-density energy. Intermittent sources like solar and wind fall short for 99.999% uptime, risking grid instability and fossil fuel dependency that could add billions in carbon costs. SMRs offer a carbon-free baseload alternative with 93%+ capacity factors, compact footprints for co-location, and versatility for on-site deployment. Hybridizing technologies enhances this: for example, integrating high-temperature gas-cooled reactors with molten salt systems enables cogeneration of electricity and heat for AI server cooling, cutting energy losses by 20-30% and overall LCOE to $40/MWh. Without swift SMR scaling, the U.S. faces energy bottlenecks that could curtail AI economic contributions, estimated at trillions in GDP, while ceding ground to competitors in clean tech.

Investment Details and Optimization with Government Support

The $100 billion budget allocates $80 billion to core investments—60% for CapEx (reactor fabrication, hybrid integration facilities), 25% for site development, licensing, and multi-technology piloting, and 15% for OpEx startup—plus $20 billion contingency to buffer against inflation, supply issues, or extended timelines. Portfolio integration optimizes ROI by leveraging complementarities: shared HALEU fuel supply for fast and gas-cooled designs, modular borehole siting for rapid multi-unit rollout, and AI-tailored configurations for premium PPAs. Federal support offsets 40-50% of costs:

- Grants and Funding: Tap into the DOE’s Reactor Pilot Program and ARDP, securing $10-20 billion in awards for the 11 projects’ test reactors and scale-up.

- Tax Incentives: Utilize the Inflation Reduction Act’s 45U PTC (up to 2.6 cents/kWh for 10 years), 48E ITC (30-50% on investments), and accelerated depreciation, with hybrid eligibility boosting credits by 15-20% via advanced fuel and efficiency bonuses.

- Other Benefits: Executive orders expedite NRC reviews (targeting 18-24 months), bolster HALEU production, and unlock state R&D credits (up to 20%). These reduce effective CapEx to $3,500-4,000/kW (from BOAK estimates of $4,000-7,000/kW) and OpEx to $15-20/MWh, with learning rates of 10-15% accelerating cost drops in nth-of-a-kind units. This framework supports revenue from $60-80/MWh PPAs with data center operators, enhanced by ancillary services like hydrogen co-production.

Financial Analysis: ROI, Payback, and 20-Year Projections

With incentives yielding an effective net investment of $48 billion, deployment of 20-25 GW at 93% capacity factor, and blended LCOE of $40/MWh (optimized via hybridization), annual net cash flows reach $8 billion (factoring in 25-35% scale efficiencies and revenue premiums). This delivers:

- Net Present Value (NPV): $31.6 billion (7.5% discount rate).

- Internal Rate of Return (IRR): 15.0%.

- Payback Period: 6.3 years.

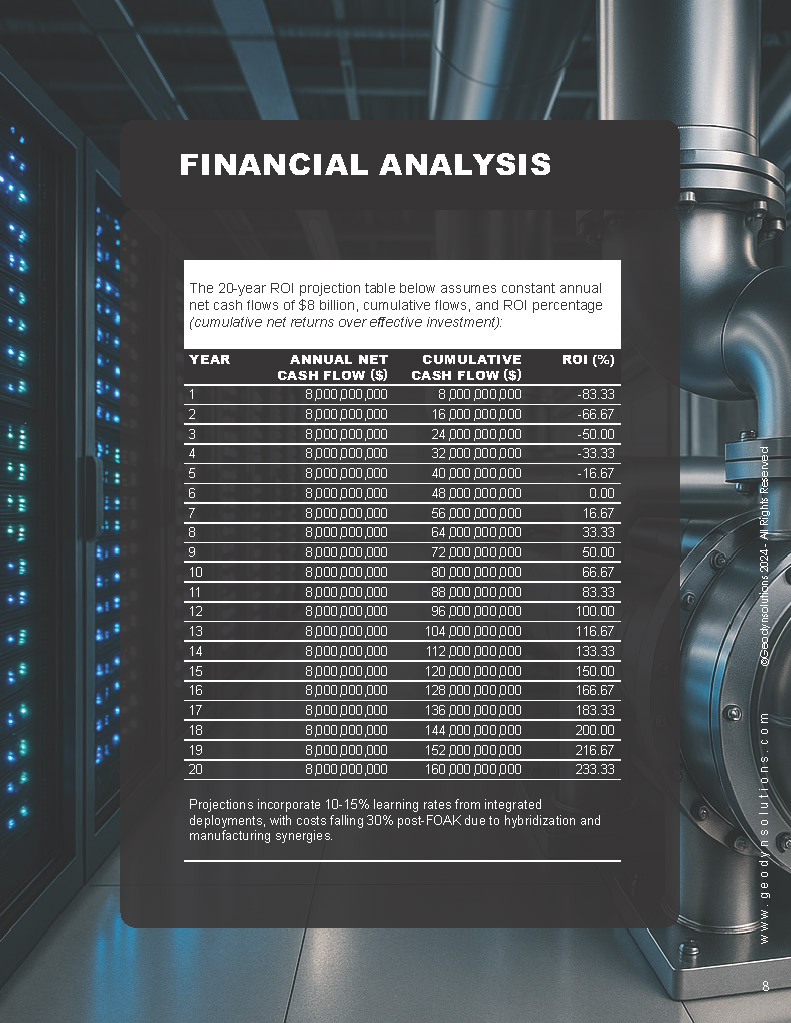

The 20-year ROI projection table below assumes constant annual net cash flows of $8 billion, cumulative flows, and ROI percentage (cumulative net returns over effective investment):

| Year | Annual Net Cash Flow ($) | Cumulative Cash Flow ($) | ROI (%) |

|---|---|---|---|

| 1 | 8,000,000,000 | 8,000,000,000 | -83.33 |

| 2 | 8,000,000,000 | 16,000,000,000 | -66.67 |

| 3 | 8,000,000,000 | 24,000,000,000 | -50.00 |

| 4 | 8,000,000,000 | 32,000,000,000 | -33.33 |

| 5 | 8,000,000,000 | 40,000,000,000 | -16.67 |

| 6 | 8,000,000,000 | 48,000,000,000 | 0.00 |

| 7 | 8,000,000,000 | 56,000,000,000 | 16.67 |

| 8 | 8,000,000,000 | 64,000,000,000 | 33.33 |

| 9 | 8,000,000,000 | 72,000,000,000 | 50.00 |

| 10 | 8,000,000,000 | 80,000,000,000 | 66.67 |

| 11 | 8,000,000,000 | 88,000,000,000 | 83.33 |

| 12 | 8,000,000,000 | 96,000,000,000 | 100.00 |

| 13 | 8,000,000,000 | 104,000,000,000 | 116.67 |

| 14 | 8,000,000,000 | 112,000,000,000 | 133.33 |

| 15 | 8,000,000,000 | 120,000,000,000 | 150.00 |

| 16 | 8,000,000,000 | 128,000,000,000 | 166.67 |

| 17 | 8,000,000,000 | 136,000,000,000 | 183.33 |

| 18 | 8,000,000,000 | 144,000,000,000 | 200.00 |

| 19 | 8,000,000,000 | 152,000,000,000 | 216.67 |

| 20 | 8,000,000,000 | 160,000,000,000 | 233.33 |

Projections incorporate 10-15% learning rates from integrated deployments, with costs falling 30% post-FOAK due to hybridization and manufacturing synergies.

Economic and Environmental Benefits

- Economic: Generates 150,000-300,000 jobs in advanced manufacturing, engineering, and operations, adding $500-800 billion to GDP over 20 years through supply chains, AI-enabled innovation, and energy exports. Hybrid systems unlock additional revenue streams like industrial heat, boosting ROI by 10-15%.

- Environmental: Avoids 120-180 million tons of CO2 annually, equivalent to planting 3 billion trees, with advanced cycles reducing nuclear waste by 90%. Optimized designs minimize water use and land impact, supporting carbon-neutral AI ecosystems.

Comparative Edge to China and the World

China dominates with over 30 reactors under construction and faster deployment in Gen IV technologies, eyeing a $1.5-2 trillion global market share. Russia leads exports with 10+ international builds. The U.S. leverages innovation in modular safety and hybridization, with the 11 DOE projects offering superior flexibility and lower LCOE ($40-60/MWh vs. competitors’ $60-100/MWh). This investment scales U.S. exports to 30-50% of the SMR market by 2035, enhancing energy independence, securing critical supply chains, and maintaining AI technological superiority amid rivalries.

Risks and Mitigation

Regulatory hurdles and fuel shortages are addressed via pilot program fast-tracks and contingency reserves. Diversified hybrids and phased rollouts (starting with 5 GW pilots) limit exposure, with insurance covering 10-15% of potential overruns.

Conclusion

This $100 billion commitment, optimized through technology integration and incentives, delivers exceptional ROI while fueling the U.S. nuclear renaissance and AI dominance. Prompt federal collaboration is urged to lock in support and launch hybrid feasibility studies.