3 Billion Investment in Hemp-Based Biofuel Production-Power Generation- Diversified Hemp Processing in Vietnam

Executive Summary

Geodyn Solutions is positioned to lead Vietnam’s green technology sector with a $3 billion USD investment in a vertically integrated hemp ecosystem, enhanced by blockchain technology and a native utility token. This proposal outlines a strategy to cultivate industrial hemp on a large scale for biofuel production, construct biomass power plants to generate electricity from hemp-derived fuels, establish textile and paper manufacturing facilities, and implement a blockchain platform for supply chain transparency and tokenized incentives. Utilizing every part of the hemp plant—seeds for biofuel and oils, fibers for textiles and paper, hurds for paper and construction materials, and residual biomass for energy—creates multiple high-value revenue streams, amplified by blockchain traceability and the Geodyn Token (GEO).

Targeted regions include the Mekong Delta, Central Highlands, Red River Delta, and Central Coast, selected for their favorable climate, fertile soils, regulatory progress, and agricultural infrastructure. The $3 billion USD budget supports 150,000 acres of hemp cultivation, eight 50 MW power plants, four textile plants, four paper mills, a blockchain infrastructure, and research and development (R&D) for efficiency and innovation. Labor costs are adjusted to Vietnam’s 2025 average wage of approximately $300 USD/month ($3,600/year) for agricultural and manufacturing workers, reducing operational expenses by 30-50% compared to Western markets.

Financial projections estimate an average ROI of 24-34% over 10 years, with a payback period—the time to recover the $3 billion USD investment through net profits—of approximately 4.9 years, accelerated by low labor costs and incentives. Operational break-even is expected in year three. Blockchain and GEO token integration adds 5-8% to ROI through tokenized carbon credits and ecosystem rewards. The project will create over 10,000 direct jobs and 15,000 indirect jobs, reflecting Vietnam’s labor-intensive economy, and contribute $4-6 billion USD annually to Vietnam’s GDP by year five through multipliers in agriculture, manufacturing, energy, and blockchain sectors.

Environmentally, hemp sequesters 10-15 tons of CO2 per acre, regenerates soil, and reduces emissions by 85-97% compared to fossil fuels. Blockchain enables verifiable carbon tracking for global markets. Funding will leverage Vietnam’s green incentives, World Bank loans, and Asian Development Bank (ADB) support, offsetting 20-30% of costs. This initiative positions Geodyn as a leader in Vietnam’s bioeconomy, aligning with the country’s 2050 net-zero goals.

Introduction

Vietnam’s rapid economic growth, with a GDP of $470 billion USD in 2025, and commitment to net-zero emissions by 2050 under the National Green Growth Strategy, create a prime opportunity for green investments. Industrial hemp, regulated under Decree 100/2021/ND-CP, is emerging as a viable crop, with the market projected to grow from $200 million USD in 2025 to $1 billion by 2034 at a 25% CAGR. Hemp’s 90-120 day growth cycle, low resource needs, and high biomass yield (up to 10 tons per acre) make it ideal for biofuels, textiles, paper, and energy, avoiding food-fuel competition and offering significant carbon sequestration.

This $3 billion USD investment adapts our model to Vietnam, scaling to 150,000 acres and multiple facilities to meet demand for sustainable products. We target the Mekong Delta, Central Highlands, Red River Delta, and Central Coast, leveraging their agricultural strengths and low labor costs ($300 USD/month or $3,600/year for agricultural/manufacturing workers, compared to $10,000-$15,000 in Western markets). Biomass allocation—35% to textiles, 25% to paper, 25% to biofuel, 15% to energy—optimizes ROI. A blockchain platform with the GEO token ensures transparency, compliance with Vietnam’s Ministry of Industry and Trade (MoIT), and incentivizes stakeholders. Aligned with Vietnam’s renewable energy incentives and international funding from the World Bank and ADB, the project secures subsidies. Diversifying into textiles and paper (global markets at $10-50 billion by 2030) and blockchain enhances profitability and sustainability.

Market Analysis and Opportunity

Vietnam’s biofuel market, supported by the Biofuel Development Scheme to 2030, produced 500 million liters in 2025, with hemp as a promising feedstock due to its high yield and sustainability. Demand for sustainable aviation fuel (SAF) is expected to triple by 2030. The hemp fiber market, valued at $150 million USD in 2024, is projected to reach $800 million by 2033, driven by textiles and packaging. Hemp paper targets the $80 billion global paper industry, offering faster cycles than trees.

Biomass energy qualifies for Vietnam’s feed-in tariffs (FiTs) for biomass at $0.085/kWh. The hemp industry could contribute $2 billion to Vietnam’s economy by 2030. Blockchain in agriculture, valued at $100 million in Vietnam, is expected to grow to $500 million by 2028, with GEO enabling carbon credit trading and certifications. Low labor costs ($300 USD/month) reduce operational expenses by 30-50% compared to Western markets, boosting competitiveness. Risks like price volatility ($0.45-0.55 USD/lb for biomass) and regulatory hurdles are mitigated through diversification and blockchain transparency. Geodyn’s model, with GEO token utilities, projects $800 million-$1.5 billion USD in annual revenues by year five.

Technology Overview: Hemp Cultivation, Processing, Production, and Blockchain Integration

Hemp cultivation uses high-biomass varieties optimized for fiber or seed, with AI-monitored systems yielding 500-1,000 liters of biofuel per acre. Processes include:

- Biofuel Production: Seeds pressed for oil (biodiesel); stalks fermented for ethanol (75% efficiency).

- Textile Manufacturing: Fibers decorticated, spun, and woven using enzymatic retting.

- Paper Manufacturing: Hurds and fibers pulped, yielding 4-5 times more than trees per acre.

- Power Generation: Residual biomass pelletized for boilers, with 30-35% efficiency.

A blockchain platform (e.g., Ethereum or layer-2) ensures traceability from seed to product. Smart contracts automate payments, verify certifications, and tokenize carbon data. The GEO token facilitates:

- Staking for governance.

- Rewards for sustainable farming (e.g., GEO for CO2 sequestration).

- Payments within the Geodyn network.

- Trading tokenized assets (carbon credits, certifications).

Vertical integration recycles byproducts, with blockchain logging transactions for audits, achieving zero-waste.

Location Comparison

The Mekong Delta, Central Highlands, Red River Delta, and Central Coast are selected for their climate, soil, and infrastructure. The Mekong Delta leads in yields, Central Highlands in land availability, Red River Delta in market access, and Central Coast in regulatory support. Labor costs are standardized at $300 USD/month ($3,600/year) across regions, based on Vietnam’s 2025 average for agricultural and manufacturing workers.

Region | ROI (10-Year Estimate) | Capital Cost (Total, incl. 20% Contingency, USD) | Operational Cost (Annual, Per Facility Type, USD) | Job Creation (Direct/Indirect) | Government Incentives |

Mekong Delta | 26-36% | $900M (farms: $300M, textiles: $90M, paper: $120M, biofuel: $150M, power: $200M, blockchain: $40M) | Textiles: $3-5M, Paper: $4-7M, Biofuel: $6-10M, Power: $10-12M, Blockchain: $1-2M | 3,000 / 4,500 | MoIT biomass grants $30M; ADB loans $50M; Green Growth Fund. |

Central Highlands | 23-31% | $950M (higher transport; blockchain: $40M) | Similar to Mekong, +5% logistics | 2,500 / 3,800 | MoNRE grants $20M; FiTs $0.085/kWh; World Bank $40M. |

Red River Delta | 24-34% | $850M (lower irrigation; blockchain: $40M) | Textiles/Paper 10% lower | 2,800 / 4,200 | MoIT grants $25M; VEPF $15M; ADB support. |

Central Coast | 21-29% | $1B (higher land costs; blockchain: $40M) | Power/Biofuel 5-10% higher | 2,200 / 3,000 | MoNRE grants $20M; SDTC $10M; Green Climate Fund. |

Capital costs: textiles $15-40M/plant, paper $25-50M, biofuel $30-60M, power $150-300M ($3,000-6,000 USD/kW), blockchain $160M total, with 20% contingency. Operational costs: labor $0.5-1.5M (reflecting $300 USD/month wages), materials $2-8M, maintenance $0.8-2M, energy $0.8-1.5M, blockchain $1-2M. Mekong Delta is recommended for initial rollout due to high yields and incentives.

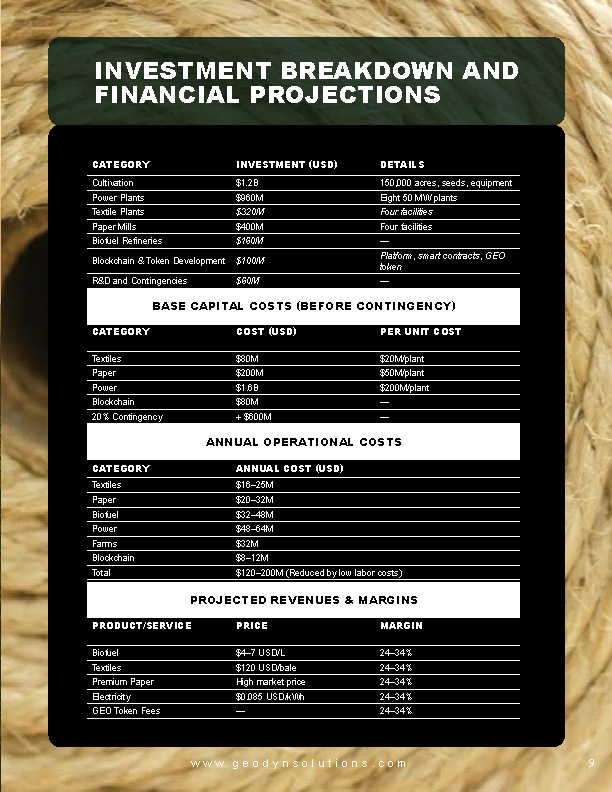

Investment Breakdown and Financial Projections

Category | Investment (USD) | Details |

Cultivation | $1.2B | 150,000 acres, seeds, equipment |

Power Plants | $960M | Eight 50 MW plants |

Textile Plants | $320M | Four facilities |

Paper Mills | $400M | Four facilities |

Biofuel Refineries | $160M | — |

Blockchain & Token Development | $100M | Platform, smart contracts, GEO token |

R&D and Contingencies | $60M | — |

Base Capital Costs (Before Contingency)

Category | Cost (USD) | Per Unit Cost |

Textiles | $80M | $20M/plant |

Paper | $200M | $50M/plant |

Power | $1.6B | $200M/plant |

Blockchain | $80M | — |

20% Contingency | + $600M | — |

Annual Operational Costs

Category | Annual Cost (USD) |

Textiles | $16–25M |

Paper | $20–32M |

Biofuel | $32–48M |

Power | $48–64M |

Farms | $32M |

Blockchain | $8–12M |

Total | $120–200M (Reduced by low labor costs) |

Projected Revenues & Margins

Product/Service | Price | Margin |

Biofuel | $4–7 USD/L | 24–34% |

Textiles | $120 USD/bale | 24–34% |

Premium Paper | High market price | 24–34% |

Electricity | $0.085 USD/kWh | 24–34% |

GEO Token Fees | — | 24–34% |

10-Year Return Chart

Year | Revenue ($B USD) | Op Costs ($B USD) | Net Profit ($B USD) | Cumulative Return ($B USD) | ROI (%) |

1 | 0.5 | 0.3 | 0.2 | 0.2 | 6.7 |

2 | 0.9 | 0.4 | 0.5 | 0.7 | 23.3 |

3 | 1.3 | 0.5 | 0.8 | 1.5 | 50.0 |

4 | 1.7 | 0.6 | 1.1 | 2.6 | 86.7 |

5 | 2.1 | 0.7 | 1.4 | 4.0 | 133.3 |

6 | 2.5 | 0.8 | 1.7 | 5.7 | 190.0 |

7 | 2.9 | 0.9 | 2.0 | 7.7 | 256.7 |

8 | 3.3 | 1.0 | 2.3 | 10.0 | 333.3 |

9 | 3.7 | 1.1 | 2.6 | 12.6 | 420.0 |

10 | 4.1 | 1.2 | 2.9 | 15.5 | 516.7 |

Payback Period – Time to Recover Investment

Metric | Value | Notes |

Total Investment | $3 billion USD | — |

Estimated Payback Period | 4.3 years | Rounded from 4.29 years |

Cumulative Profit by Year 4 | $2.6 billion USD | Leaves $0.4B to recover |

Net Profit in Year 5 | $1.4 billion USD | Remaining $0.4B recovered in ~0.29 years |

Operational Break-even | Year 3 | Early positive cash flow |

Benchmarks | 5–10 years | Biofuel/biomass industry standard |

Accelerators | Low labor costs ($300 USD/month) | Vietnam advantage |

Incentives | 20–30% cost offset | Government programs |

Additional Revenue Drivers | GEO token activities (carbon credit trading) | Blockchain liquidity |

Growth Factors | Hemp’s rapid growth cycles | Multiple annual harvests |

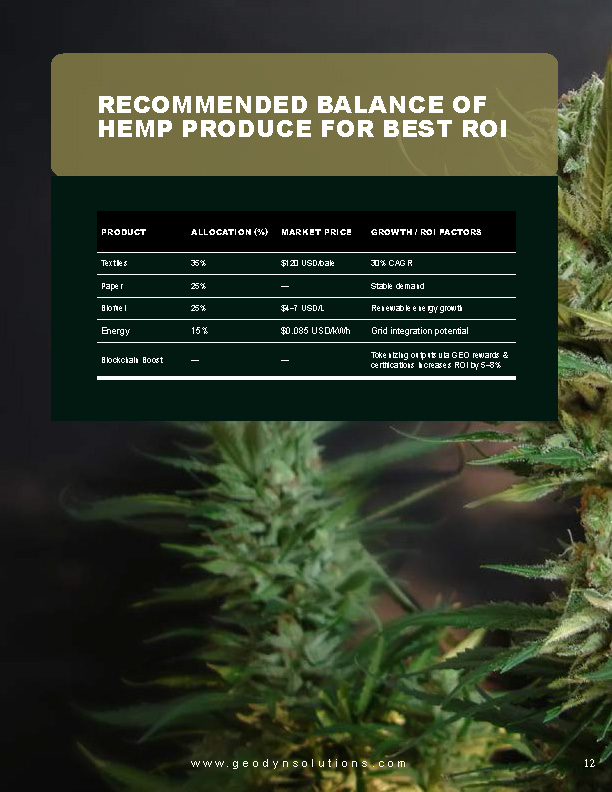

Recommended Balance of Hemp Produce for Best ROI

Product | Allocation (%) | Market Price | Growth / ROI Factors |

Textiles | 35% | $120 USD/bale | 30% CAGR |

Paper | 25% | — | Stable demand |

Biofuel | 25% | $4–7 USD/L | Renewable energy growth |

Energy | 15% | $0.085 USD/kWh | Grid integration potential |

Blockchain Boost | — | — | Tokenizing outputs via GEO rewards & certifications increases ROI by 5–8% |

Economic Value to Vietnam

The project expands Vietnam’s hemp industry, contributing $8 billion in investments, 80,000 jobs, and $40 billion in output by 2030.

- Job Creation: 10,000 direct (farming, manufacturing, operations, blockchain developers), 15,000 indirect (supply chain, logistics, token economy), leveraging Vietnam’s labor-intensive workforce.

- GDP Contribution: $4-6 billion USD/year by year five, plus $800M-$1.5B in taxes, driven by agricultural (1.5x), manufacturing (2.5x), and blockchain (3x) multipliers.

- Broader Impacts: Reduces textile/paper imports ($80B global market), enhances energy security, grows bioeconomy, and adds blockchain sector growth (0.1-0.2% GDP boost).

Additional Uses of Hemp to Minimize Waste and Enhance ROI

Hurds for hempcrete, leaves for CBD (per MoIT regulations), oils for food/cosmetics, adding $40-80 USD/acre. Blockchain tokenizes byproducts (e.g., NFT certifications for CBD), increasing ROI by 8-12%.

Environmental Benefits

Hemp sequesters 10-15 tons CO2/acre, regenerates soil, cuts emissions 85-97%. Blockchain tracks sequestration for GEO-backed credits. Offsets 1.5 million tons CO2/year, conserves water, enhances biodiversity.

Funding Sources and Incentives

Secure $400M+ USD: MoIT biomass grants ($30M), MoNRE ($20M), ADB loans ($50M), World Bank ($40M), Green Climate Fund, Digital Technology Supercluster ($10M). Offsets 20-30% of costs.

Risk Assessment and Mitigation

Risks: regulatory shifts (MoIT compliance, blockchain audits), market volatility (diversification, GEO liquidity), climate (multi-region). Mitigate with insurance, contracts, contingencies.

Conclusion

This $3 billion USD investment, with a 4.9-year payback and 24-34% ROI, positions Geodyn as a bioeconomy leader in Vietnam. Launch in the Mekong Delta, leveraging yields, low labor costs, and incentives, with blockchain and GEO token driving innovation.