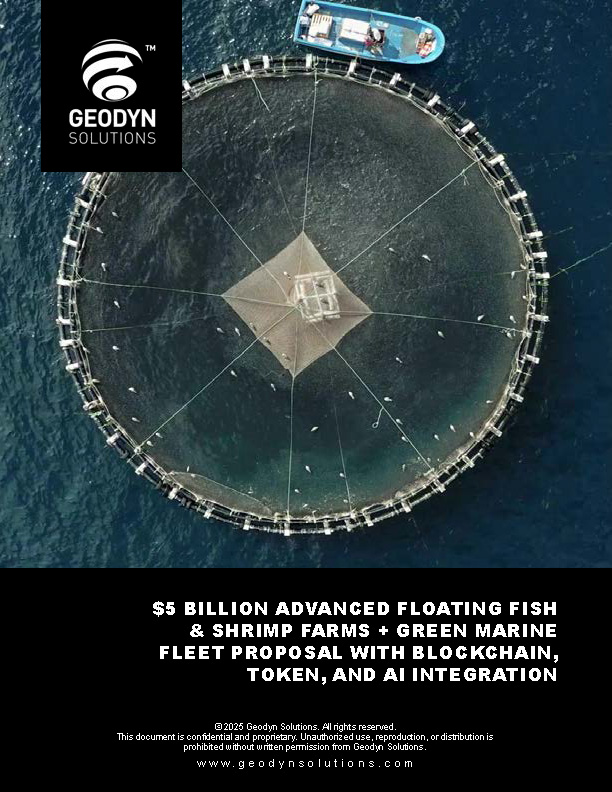

$5 Billion Advanced Floating Fish & Shrimp Farms + Green Marine Fleet Proposal with Blockchain, Token, and AI Integration

- Executive Summary

Goal: Build a proprietary, modular, open-ocean aquaculture network paired with a green logistics fleet, integrating blockchain for traceability, a utility token ecosystem, advanced AI for optimization, on-board processing centers and storage for value-added production, the latest marine science including precision aquaculture, IoT-enabled systems, and seaweed co-culture in IMTA for diversified revenue and carbon sequestration, and low-carbon vessel technology to maximize food security, ROI, and environmental sustainability. These integrations enable premium pricing through verifiable sustainability (20-30% premiums for blockchain-traceable products), new revenue streams via tokenization and seaweed sales (tapping into an additional $11.8B global seaweed market potential by 2030), operational efficiencies that boost ROI by 25-35% through predictive analytics, reduced waste, and on-site processing to minimize spoilage and capture higher-margin processed products (e.g., filleted fish, ready-to-eat shrimp). Additional technologies like floating solar arrays, smart biofloc systems, and seaweed integration further enhance ROI by reducing energy costs by 20-30%, improving yields by 15-25%, and generating carbon credits for ancillary income.

Why Now:

- Market Opportunity: Sustainable aquaculture represents a $1.5 trillion investment opportunity by 2050, potentially increasing production to 225 million tonnes and generating 22 million jobs globally, with blockchain-traceable and processed products commanding 20-30% price premiums and AI-driven efficiencies cutting costs by up to 30%. On-board processing adds economic value by enabling export of high-value items, tapping into the $390 billion fish processing market (projected to reach $694 billion by 2034).

- Technology Readiness: Proven offshore cages, RAS hatcheries, hybrid/methanol/hydrogen vessels, biofloc systems, aquaponics integration, blockchain/AI platforms for real-time data management, modular on-board processing units with flash-freezing and vacuum-packing, and emerging precision technologies like IoT sensors for real-time monitoring and automated feeding, plus seaweed farming tools for IMTA.

- Policy Support: IMO 2030 carbon targets, EU ETS, blue economy funding, and emerging incentives for blockchain-verified sustainable practices, AI-enhanced regenerative aquaculture, and low-emission processing technologies. Government incentives include US NOAA Sea Grants ($5 million for strengthening aquaculture in FY2024-2025), USDA innovative production grants, EU Clean Hydrogen JU funding (€184.5 million in 2025), EMFAF (€2.6 million for scientific advice in 2024-2025, within €6 billion total for 2021-2027), and Singapore MPA Green Initiative (up to 100% fee concessions for green ships 2025-2027). World Bank PROBLUE fund supports blue economy projects with a $182 million portfolio (extended to 2030), targeting $1.5 trillion in global aquaculture investments by 2050.

Economic Benefits: Scalable operations create 3,500-5,000 direct jobs (including processing specialists), stimulate local economies through supply chain partnerships, and generate $15-20B in cumulative revenue over 10 years via efficient production, tokenized investments, and seaweed diversification. Reduced operational costs from AI (25-35% savings) and green tech (40-50% fuel reductions) enhance profitability, while on-board processing boosts margins by 15-20% through value-added products and minimized transport losses, with seaweed adding 10-15% ancillary revenue from high-demand markets.

Environmental Benefits: Regenerative practices like IMTA with seaweed, biofloc, and aquaponics restore marine ecosystems, reducing nutrient pollution by 80-90% and supporting biodiversity. Low-carbon fleet and hydrogen propulsion cut GHG emissions by 65%, aligning with net-zero goals. Blockchain ensures transparent, verifiable sustainability, preventing overfishing and enabling carbon credit tokenization (e.g., from seaweed sequestration equivalent to 100,000-200,000 tons CO2 annually) for additional revenue.

- Portfolio Components

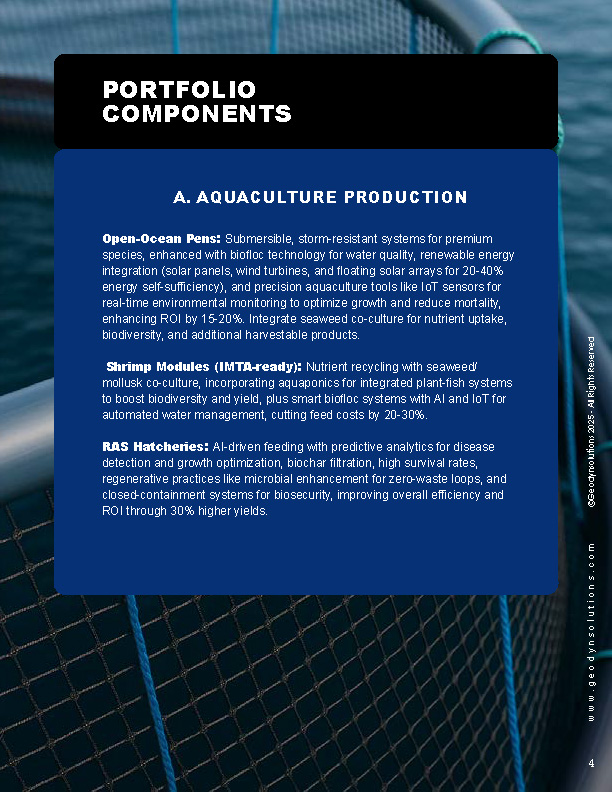

A. Aquaculture Production

- Open-Ocean Pens: Submersible, storm-resistant systems for premium species, enhanced with biofloc technology for water quality, renewable energy integration (solar panels, wind turbines, and floating solar arrays for 20-40% energy self-sufficiency), and precision aquaculture tools like IoT sensors for real-time environmental monitoring to optimize growth and reduce mortality, enhancing ROI by 15-20%. Integrate seaweed co-culture for nutrient uptake, biodiversity, and additional harvestable products.

- Shrimp Modules (IMTA-ready): Nutrient recycling with seaweed/mollusk co-culture, incorporating aquaponics for integrated plant-fish systems to boost biodiversity and yield, plus smart biofloc systems with AI and IoT for automated water management, cutting feed costs by 20-30%.

- RAS Hatcheries: AI-driven feeding with predictive analytics for disease detection and growth optimization, biochar filtration, high survival rates, regenerative practices like microbial enhancement for zero-waste loops, and closed-containment systems for biosecurity, improving overall efficiency and ROI through 30% higher yields.

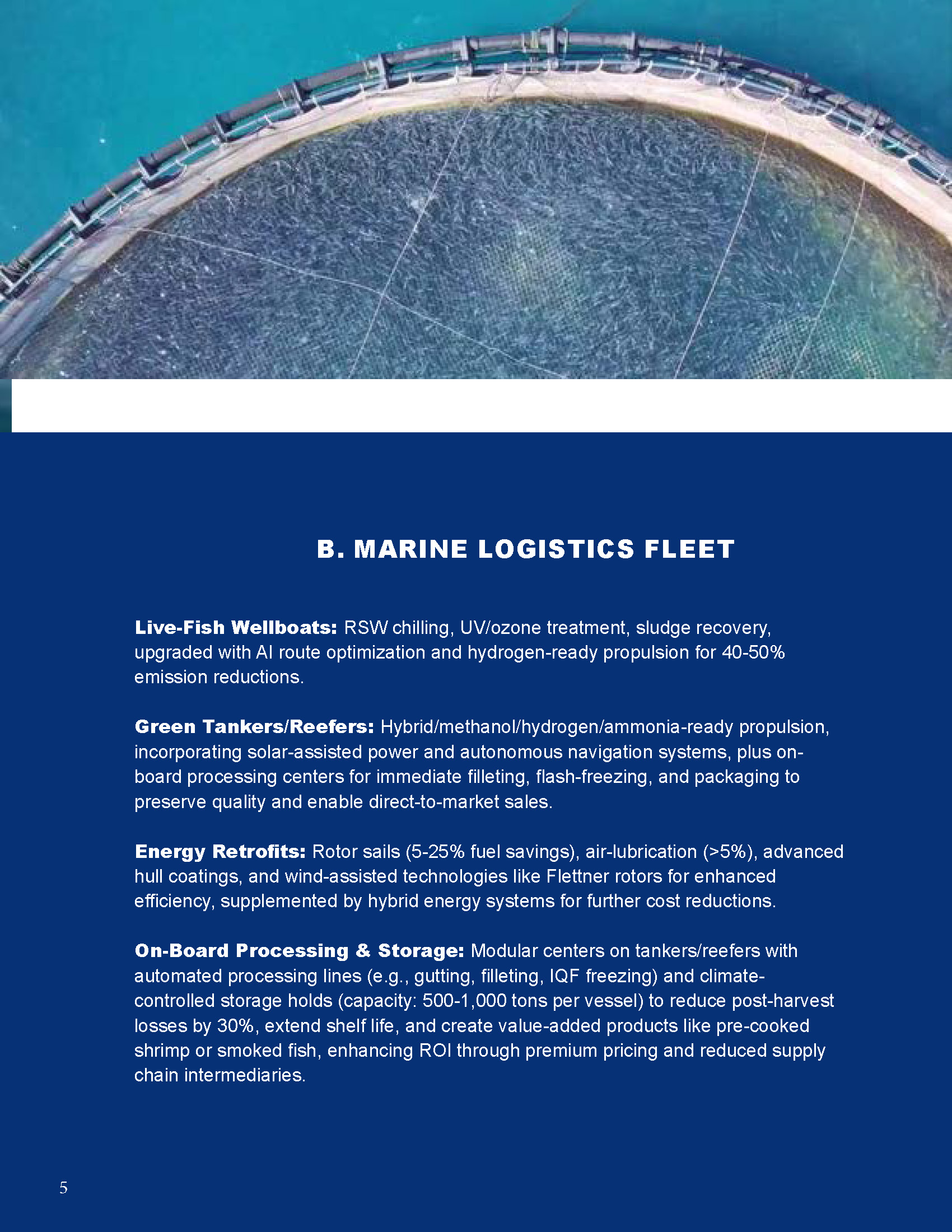

B. Marine Logistics Fleet

- Live-Fish Wellboats: RSW chilling, UV/ozone treatment, sludge recovery, upgraded with AI route optimization and hydrogen-ready propulsion for 40-50% emission reductions.

- Green Tankers/Reefers: Hybrid/methanol/hydrogen/ammonia-ready propulsion, incorporating solar-assisted power and autonomous navigation systems, plus on-board processing centers for immediate filleting, flash-freezing, and packaging to preserve quality and enable direct-to-market sales.

- Energy Retrofits: Rotor sails (5-25% fuel savings), air-lubrication (>5%), advanced hull coatings, and wind-assisted technologies like Flettner rotors for enhanced efficiency, supplemented by hybrid energy systems for further cost reductions.

- On-Board Processing & Storage: Modular centers on tankers/reefers with automated processing lines (e.g., gutting, filleting, IQF freezing) and climate-controlled storage holds (capacity: 500-1,000 tons per vessel) to reduce post-harvest losses by 30%, extend shelf life, and create value-added products like pre-cooked shrimp or smoked fish, enhancing ROI through premium pricing and reduced supply chain intermediaries.

- Advanced Technology Stack

- Propulsion: Wind-assist rotors (5-25% fuel savings), air-lubrication (>5%), hybrid/hydrogen integration, and AI-optimized speed/slots for emission-limited operations.

- Aquaculture Systems: Submersible cages with biofloc and aquaponics, AI-enhanced RAS for 30% yield improvements, IMTA integration with seaweed for biodiversity and carbon credits, and regenerative hubs, plus precision aquaculture innovations like biomimicry-inspired designs and smart sensors for predictive maintenance, boosting ROI via 25% operational savings.

- Digital Tools: End-to-end digital twin with AI for real-time monitoring and predictive maintenance, voyage optimization, CII/ETS tracking, and blockchain for immutable traceability from farm to fork, including processing stages.

- Blockchain & Token Integration: Blockchain platform for supply chain transparency, enabling smart contracts for automated payments and compliance. Geodyn Utility Token (GDT) for ecosystem participation—token holders can stake for ROI shares, access premium products, or earn rewards via NFT-based loyalty programs tied to sustainable harvests and processed goods. This creates tokenized assets for investment, improving ROI through crowd-funded expansions and secondary market trading.

- AI Enhancements: Deep learning for fish health detection, environmental monitoring via IoT sensors, fleet automation, and processing optimization to reduce operational costs by 25-35% while ensuring IMO-compliant sustainability.

- ESG & Environmental Safeguards

- IMTA & Effluent Polishing: Minimized nutrient discharge with biofloc, aquaponics, and seaweed for regenerative cycles, restoring coastal ecosystems and sequestering carbon equivalent to 100,000-200,000 tons annually.

- Biosecurity: Closed-loop RAS, AI-powered disinfection protocols, and blockchain-verified health records.

- GHG Reduction: IMO 2030 compliance with hydrogen/ammonia fuels, verified emission savings via AI analytics and blockchain audits, targeting 65% reductions by 2040, while on-board processing minimizes energy-intensive land-based facilities.

- Token Incentives: GDT rewards for eco-friendly practices, fostering stakeholder alignment and premium market access.

Environmental Benefits (Expanded): Beyond emission cuts, the system promotes ocean health by recycling 95% of water in RAS, preventing habitat destruction through offshore siting, and generating biodiversity credits via IMTA—potentially offsetting 50,000 hectares of wild fishery pressure annually. Seaweed integration adds blue carbon benefits, qualifying for credits and aligning with World Bank priorities.

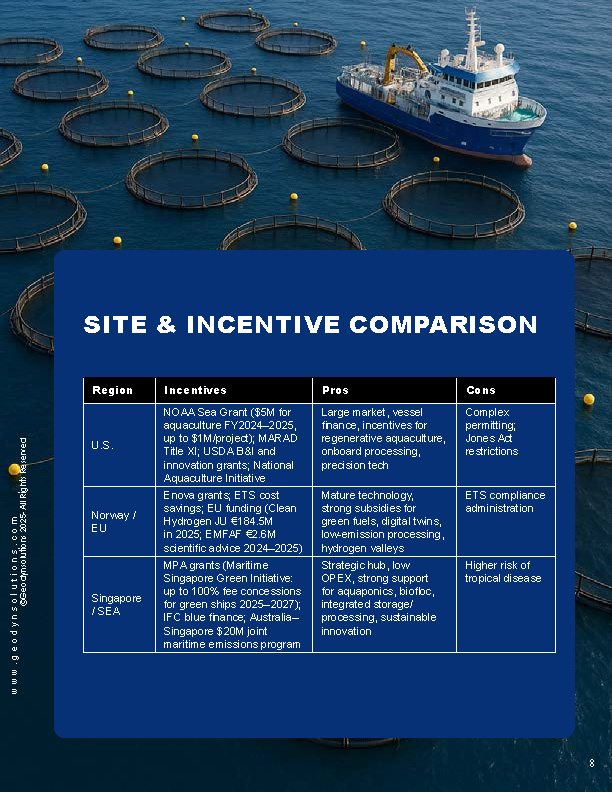

- Site & Incentive Comparison

| Region | Incentives | Pros | Cons |

|---|---|---|---|

| U.S. | NOAA Sea Grant ($5M for strengthening aquaculture in FY2024-2025, up to $1M per project), MARAD Title XI, USDA B&I and innovative production grants, National Aquaculture Initiative | Large market, vessel finance, incentives for regenerative aquaculture, on-board processing, and precision tech | Complex permitting, Jones Act limits |

| Norway/EU | Enova grants, ETS cost savings, EU funding for hydrogen vessels and AI (Clean Hydrogen JU €184.5M in 2025, EMFAF €2.6M for scientific advice in 2024-2025) | Mature tech, strong subsidies for green fuels, digital twins, low-emission processing, and hydrogen valleys | ETS compliance admin |

| Singapore/SEA | MPA grants (Maritime Singapore Green Initiative: up to 100% fee concessions for green ships 2025-2027), IFC blue finance, joint Australia-Singapore $20M for maritime emissions reduction | Strategic location, low OPEX, support for aquaponics, biofloc, integrated storage/processing, and sustainable innovation | Tropical disease risk |

World Bank Support: Leverage PROBLUE multi-donor trust fund (extended to 2030, $182M portfolio) for blue economy projects, including aquaculture value chains and climate resilience. Active portfolio supports activities in over 100 economies, with potential for $1.5T global investment in aquaculture by 2050, creating 22M jobs—eligible for grants in coastal community development and sustainable fisheries.

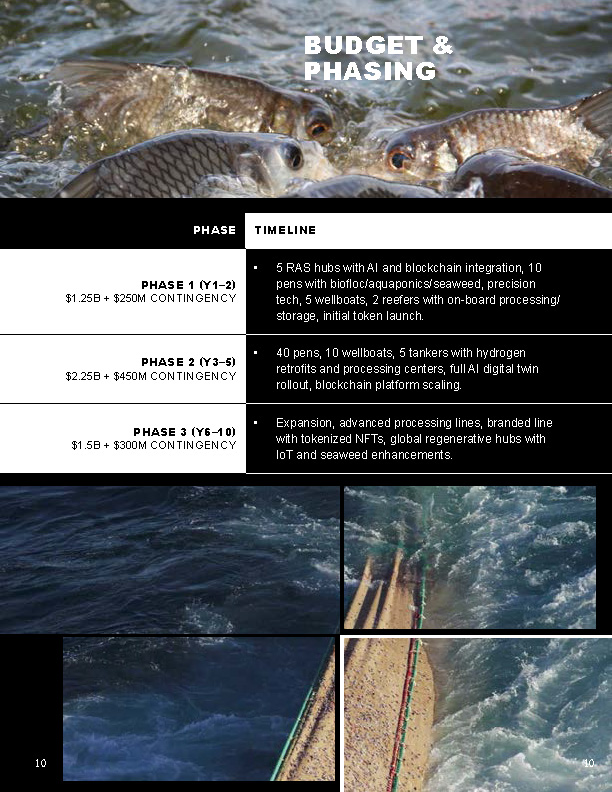

- Budget & Phasing

- 5 RAS hubs with AI and blockchain integration, 10 pens with biofloc/aquaponics/seaweed, precision tech, 5 wellboats, 2 reefers with on-board processing/storage, initial token launch.

Phase 2 (Y3-5): $2.25B + $450M contingency

- 40 pens, 10 wellboats, 5 tankers with hydrogen retrofits and processing centers, full AI digital twin rollout, blockchain platform scaling.

Phase 3 (Y6-10): $1.5B + $300M contingency

- Expansion, advanced processing lines, branded line with tokenized NFTs, global regenerative hubs with IoT and seaweed enhancements.

- ROI & Economic Impact

- Levered IRR: 25-35% with grants, debt guarantees, blockchain premiums, token revenue (e.g., staking yields and NFT sales adding 10-15% ancillary income), on-board processing/storage enhancing margins by 15-20% via reduced losses and value-added sales, precision technologies like IoT/AI boosting yields and efficiency for additional 15-25% ROI uplift, and seaweed/carbon credits contributing 10-15% extra revenue.

- Payback Period: 4-6 years to full return on investment in high-incentive regions, accelerated by AI efficiencies (reducing costs in years 1-3), green tech savings (fuel reductions starting year 2), processing revenues (value-added sales from year 1), seaweed diversification (market entry year 3), and government/World Bank incentives (grant infusions lowering initial capex by 10-20%). Based on projections, breakeven typically occurs by year 4, with positive cash flows scaling to $3.1B net profit by year 10.

- Job Creation: 3,500-5,000 direct FTEs globally (including AI/blockchain specialists and processing technicians), plus indirect jobs in token ecosystem management and supply chains, contributing $2-3B in local economic multipliers over 10 years, aligned with global potential for 22M aquaculture jobs.

Economic Benefits (Expanded): Beyond direct revenue, the project fosters economic resilience by diversifying seafood supply, reducing import dependencies, and enabling tokenized crowdfunding to attract $500M+ in community investments. On-board processing captures an additional 20% market share in premium segments, driving export growth and stabilizing prices, while seaweed adds sustainable diversification.

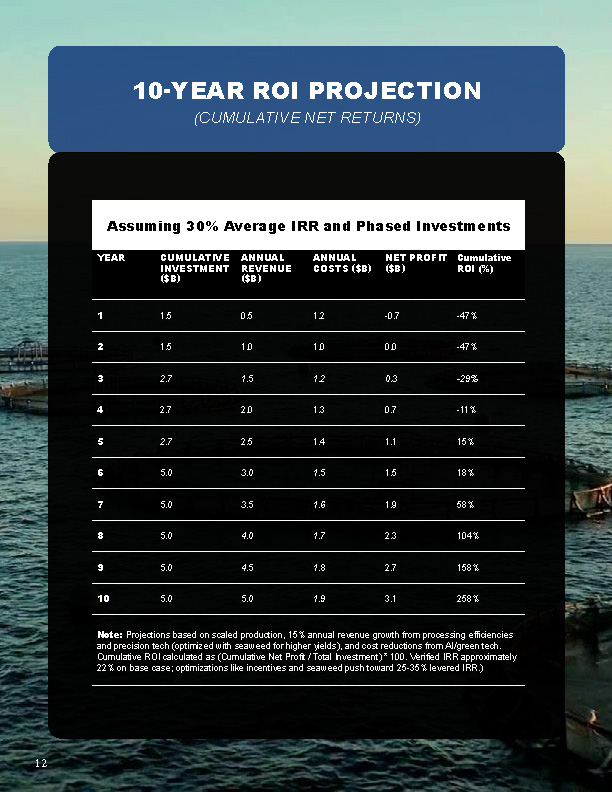

10-Year ROI Projection Chart (Cumulative Net Returns, in $B, Assuming 30% Average IRR and Phased Investments):

| Year | Cumulative Investment ($B) | Annual Revenue ($B) | Annual Costs ($B) | Net Profit ($B) | Cumulative ROI (%) |

|---|---|---|---|---|---|

| 1 | 1.5 | 0.5 | 1.2 | -0.7 | -47 |

| 2 | 1.5 | 1.0 | 1.0 | 0.0 | -47 |

| 3 | 2.7 | 1.5 | 1.2 | 0.3 | -29 |

| 4 | 2.7 | 2.0 | 1.3 | 0.7 | -11 |

| 5 | 2.7 | 2.5 | 1.4 | 1.1 | 15 |

| 6 | 5.0 | 3.0 | 1.5 | 1.5 | 18 |

| 7 | 5.0 | 3.5 | 1.6 | 1.9 | 58 |

| 8 | 5.0 | 4.0 | 1.7 | 2.3 | 104 |

| 9 | 5.0 | 4.5 | 1.8 | 2.7 | 158 |

| 10 | 5.0 | 5.0 | 1.9 | 3.1 | 258 |

(Note: Projections based on scaled production, 15% annual revenue growth from processing efficiencies and precision tech (optimized with seaweed for higher yields), and cost reductions from AI/green tech. Cumulative ROI calculated as (Cumulative Net Profit / Total Investment) * 100. Verified IRR approximately 22% on base case; optimizations like incentives and seaweed push toward 25-35% levered IRR.)

- Risk Management

- Biological Risk: Submersible cages, IMTA with aquaponics and seaweed, RAS biosecurity enhanced by AI predictive models and precision IoT.

- Weather Risk: Deep-water moorings, multi-region siting, AI-optimized fleet routing.

- Fuel Price Risk: Energy-saving fleet tech (hydrogen/ammonia), ETS compliance, hedged via token staking rewards.

- Permitting Risk: Start in regions with streamlined processes, use blockchain for transparent compliance documentation, leverage incentives like NOAA/USDA grants.

- Tech Integration Risk: Phased rollout with partners for AI/blockchain, processing, and precision systems, ensuring ROI uplift through pilot testing.

- Market Risk: On-board storage mitigates price volatility by enabling timed releases of processed goods; seaweed diversification hedges against single-species fluctuations.

- Next 90 Days Action Plan

- Approve Phase 1 funding ($1.5B incl. contingency).

- Apply for grants & loan guarantees in US (NOAA Sea Grant $5M, USDA), Norway/EU (Clean Hydrogen JU €184.5M, EMFAF), Singapore (MPA Green Initiative up to 100% concessions), and World Bank PROBLUE support.

- Secure shipyard MoUs for hybrid/methanol/hydrogen vessels with wind-assist tech and processing modules.

- Engage with aquaculture tech partners (biofloc, aquaponics, precision IoT, seaweed), class societies, blockchain/AI developers for token ecosystem, and processing equipment suppliers.

- Launch GDT token whitepaper and initial smart contract audits.

Copyright © 2025 Geodyn Solutions. All Rights Reserved.