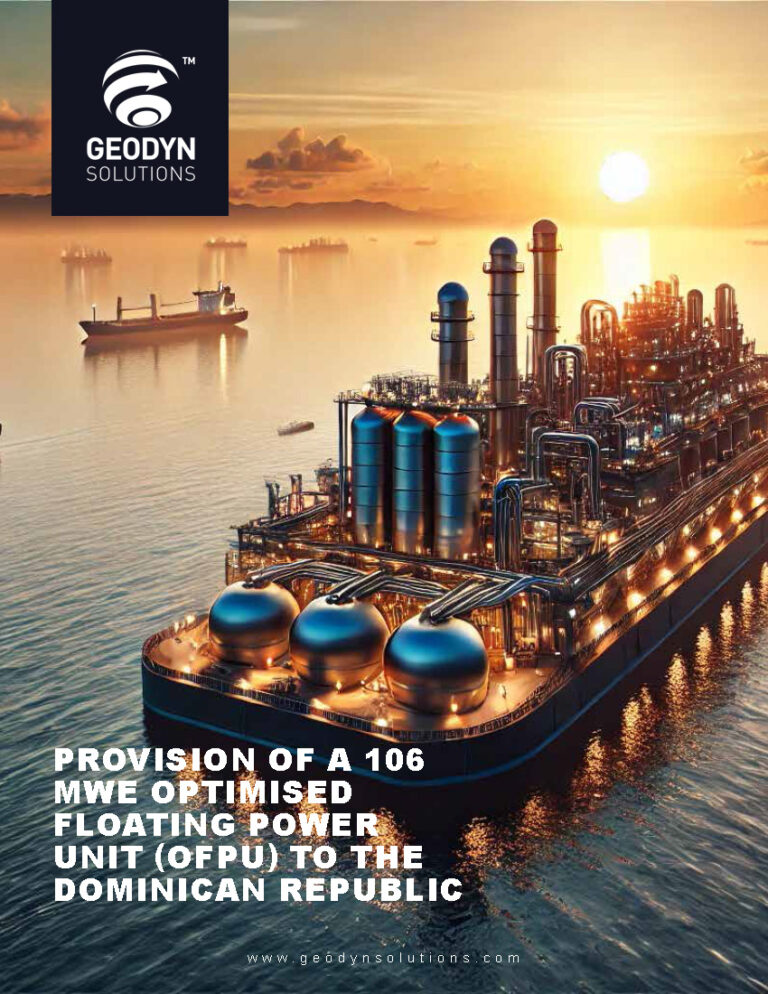

Geodyn Solutions Proposal: 200 MW LNG Power Plant or Power Barge for the Dominican Republic

Geodyn Solutions, in collaboration with its strategic technology partner, proposes two advanced 200 MW LNG-based power generation solutions for the Dominican Republic: (1) a land-based combined cycle gas turbine (CCGT) power plant, and (2) an LNG power barge, both powered by proprietary technologies co-developed to maximize efficiency and reliability. Deployed at a coastal site (e.g., Santo Domingo or Puerto Plata), either option will deliver 200 MW to the grid at $0.14/kWh, supporting energy security and sustainability. The proposal compares costs, ROI, job creation, and environmental impacts, leveraging the Dominican Republic’s LNG infrastructure (e.g., AES Andrés terminal).

Technology Overview

Option 1: Land-Based LNG Combined Cycle Power Plant

- Type: Combined Cycle Gas Turbine (CCGT) power plant, using the proprietary GeoCycle-200 system, co-developed by Geodyn Solutions and its partner.

- Capacity: 200 MW electric (MWe), achieved with one GeoCycle-200 gas turbine (150 MW) and a steam turbine (50 MW).

- Efficiency: 64% net efficiency (LHV), among the highest for CCGT, reducing fuel consumption.

- Key Technologies:

- Gas Turbine: GeoCycle-200 turbine, co-developed with advanced low-NOx combustion (GeoFlame technology, <12 ppm NOx) and hydrogen co-firing capability (up to 25% by volume).

- Heat Recovery Steam Generator (HRSG): Proprietary triple-pressure HRSG with integrated selective catalytic reduction (GeoSCR), achieving 92% NOx removal.

- Steam Turbine: Co-developed high-efficiency steam cycle with proprietary blade cooling (GeoCool), enhancing thermal performance.

- Digital Controls: GeoSmart-AI, a joint AI-based control system, optimizes fuel efficiency and predicts maintenance, reducing downtime by 35%.

- Carbon Capture Readiness: Modular GeoCapture design allows retrofit of post-combustion capture, capturing up to 90% CO2.

- Fuel: LNG (99% methane), sourced via AES Andrés terminal, with backup diesel capability.

- Adaptations:

- Climate Resilience: Co-developed corrosion-resistant alloys for tropical conditions (27°C, high humidity).

- Grid Integration: 60 Hz grid-compatible, with fast-start capability (25 minutes to full load) for renewable integration.

Option 2: LNG Power Barge

- Type: Floating Power Plant (FPP), non-self-propelled barge, using the proprietary GeoCycle-200B system, co-developed by Geodyn Solutions and its partner.

- Capacity: 200 MW electric (MWe), achieved with four 50 MW GeoCycle-200B aeroderivative turbines in simple cycle configuration.

- Efficiency: 43% net efficiency (LHV), optimized for rapid deployment and flexibility.

- Key Technologies:

- Gas Turbines: GeoCycle-200B turbines with co-developed dry low-emission (GeoDLE) combustors, achieving <20 ppm NOx and 12-minute startup.

- Power Generation System: Compact, modular generators with proprietary air-cooling (GeoAir), eliminating marine water use.

- Hull Design: Co-developed double-hulled barge (150 m long, 40 m wide, 10 m high; 20,000 tonnes) withstands Category 5 hurricanes.

- Digital Controls: GeoSmart-B AI system, a joint innovation, enables real-time optimization and remote monitoring.

- LNG Storage: Onboard 10,000 m³ LNG tanks, with weekly refueling via shuttle tankers.

- Fuel: LNG, sourced via coastal transfer from AES Andrés, with diesel backup.

- Adaptations:

- Climate Resilience: Co-developed anti-corrosion coatings and air-cooled systems for marine conditions.

- Grid Integration: Submarine cables for 60 Hz grid, with load-following for renewable support.

- Mooring: 1-2 km offshore, minimizing coastal disruption.

Economic Analysis

Option 1: Land-Based LNG Power Plant

Capital Expenditure (CapEx)

- Base Cost: $250 million ($1,250/kW, reflecting proprietary technology development).

- Infrastructure: $60 million (LNG pipeline, grid connection, cooling towers, site preparation).

- Licensing and Permitting: $10 million (environmental assessments, local approvals).

- Total CapEx: $320 million.

- 20% Contingency: $64 million.

- Total CapEx with Contingency: $384 million.

Operating Costs

- Annual Operating Cost: $34 million/year, including:

- Fuel: $21 million (LNG at $8/MMBtu, 7.4 MMBtu/MWh at 64% efficiency).

- Maintenance: $8 million (turbine and HRSG upkeep).

- Staffing (50 personnel): $3 million.

- Environmental Compliance: $2 million (emissions monitoring, GeoSCR maintenance).

- Levelized Cost of Electricity (LCOE): $47/MWh, cheaper than solar with storage ($60-100/MWh).

Return on Investment (ROI)

- Revenue Assumptions:

- Tariff: $0.14/kWh.

- Annual output: 200 MW × 8,000 hours (91% capacity factor) = 1,600 GWh.

- Annual revenue: 1,600,000 MWh × $0.14/kWh = $224 million.

- Payback Period:

- Net annual profit: $224 million – $34 million = $190 million.

- Payback: $384 million ÷ $190 million ≈ 2.0 years.

- ROI over 20 Years:

- Total revenue: $224 million × 20 = $4.48 billion.

- Total costs: $384 million (CapEx) + ($34 million × 20) = $1.064 billion.

- Net profit: $4.48 billion – $1.064 billion = $3.416 billion.

- ROI: ($3.416 billion ÷ $384 million) × 100 ≈ 889%.

Option 2: LNG Power Barge

Capital Expenditure (CapEx)

- Base Cost: $290 million ($1,450/kW, reflecting proprietary barge and turbine costs).

- Infrastructure: $80 million (submarine cables, mooring systems, port upgrades).

- Licensing and Permitting: $12 million (marine environmental assessments, approvals).

- Total CapEx: $382 million.

- 20% Contingency: $76.4 million.

- Total CapEx with Contingency: $458.4 million.

Operating Costs

- Annual Operating Cost: $41 million/year, including:

- Fuel: $27 million (LNG at $8/MMBtu, 8.4 MMBtu/MWh at 43% efficiency).

- Maintenance: $9 million (turbine and barge upkeep).

- Staffing (60 personnel): $3.5 million.

- Environmental Compliance: $1.5 million (emissions monitoring, marine compliance).

- Levelized Cost of Electricity (LCOE): $55/MWh, competitive with natural gas ($40-80/MWh).

Return on Investment (ROI)

- Revenue Assumptions:

- Tariff: $0.14/kWh.

- Annual output: 1,600 GWh (as above).

- Annual revenue: $224 million.

- Payback Period:

- Net annual profit: $224 million – $41 million = $183 million.

- Payback: $458.4 million ÷ $183 million ≈ 2.5 years.

- ROI over 20 Years:

- Total revenue: $4.48 billion.

- Total costs: $458.4 million (CapEx) + ($41 million × 20) = $1.278 billion.

- Net profit: $4.48 billion – $1.278 billion = $3.202 billion.

- ROI: ($3.202 billion ÷ $458.4 million) × 100 ≈ 699%.

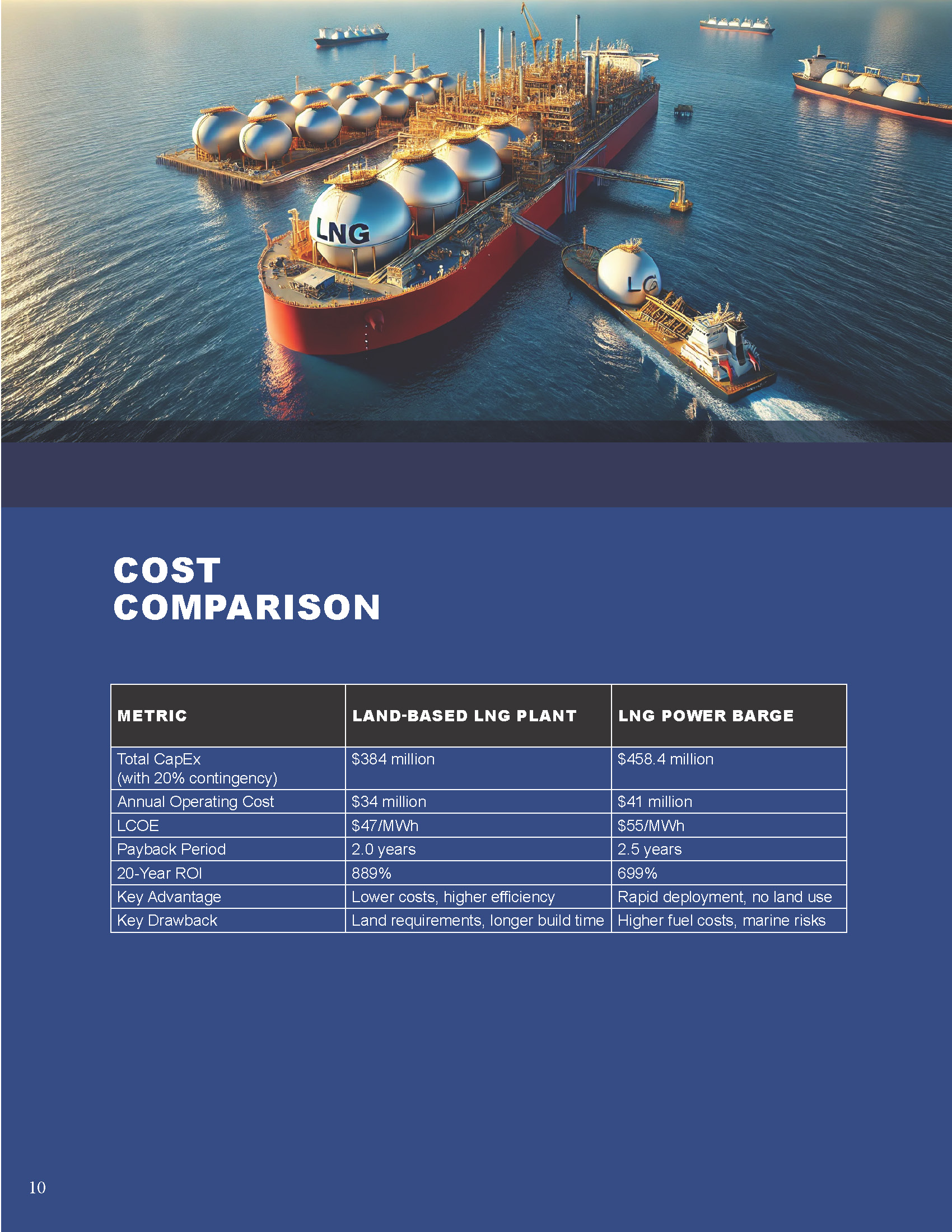

Cost Comparison

Metric | Land-Based LNG Plant | LNG Power Barge |

Total CapEx (with 20% contingency) | $384 million | $458.4 million |

Annual Operating Cost | $34 million | $41 million |

LCOE | $47/MWh | $55/MWh |

Payback Period | 2.0 years | 2.5 years |

20-Year ROI | 889% | 699% |

Key Advantage | Lower costs, higher efficiency | Rapid deployment, no land use |

Key Drawback | Land requirements, longer build time | Higher fuel costs, marine risks |

Job Creation

Land-Based LNG Plant

- Construction Phase (2 years):

- 800 temporary jobs, including 600 local hires for civil works, piping, and logistics.

- 200 skilled jobs (engineers, technicians), with 50% trained locally via Geodyn-partner programs.

- Operational Phase (20 years):

- 50 permanent jobs (operators, maintenance, management).

- 70 indirect jobs (LNG supply chain, local services).

- Training: Partnership with Universidad Autónoma de Santo Domingo for gas turbine and GeoSmart-AI training, leveraging partner expertise.

LNG Power Barge

- Construction Phase (1.5 years):

- 1,000 temporary jobs, including 700 local hires for port upgrades and cable installation.

- 300 skilled jobs, with 50% trained locally through Geodyn-partner programs.

- Operational Phase (20 years):

- 60 permanent jobs (operators, marine crew, maintenance).

- 80 indirect jobs (port services, LNG transport).

- Training: Collaboration with INTEC for marine and turbine engineering, supported by partner knowledge.

Environmental Impact

Land-Based LNG Plant

- Greenhouse Gas Emissions: ~395 g CO2e/kWh (64% efficiency), 60% lower than coal (1,001 g CO2e/kWh). GeoCapture retrofit could reduce emissions by 90%.

- Land Use: 10 hectares, potentially impacting local ecosystems.

- Water Consumption: Closed-loop cooling towers use 0.5 m³/MWh, minimizing water impact.

- Air Emissions: <12 ppm NOx, <10 ppm CO, compliant with EPA standards via GeoSCR and GeoFlame.

- Mitigation: Site selection avoids protected areas (e.g., Los Haitises). Reforestation offsets land use.

LNG Power Barge

- Greenhouse Gas Emissions: ~445 g CO2e/kWh (43% efficiency), slightly higher due to lower efficiency.

- Land Use: Zero land footprint; offshore mooring preserves ecosystems.

- Water Consumption: GeoAir cooling eliminates marine water use.

- Air Emissions: <20 ppm NOx, compliant with IMO and EPA standards via GeoDLE.

- Marine Impact: Mooring and cables avoid coral reefs. Co-developed spill prevention systems minimize LNG risks.

- Mitigation: Marine environmental monitoring ensures IUCN compliance.

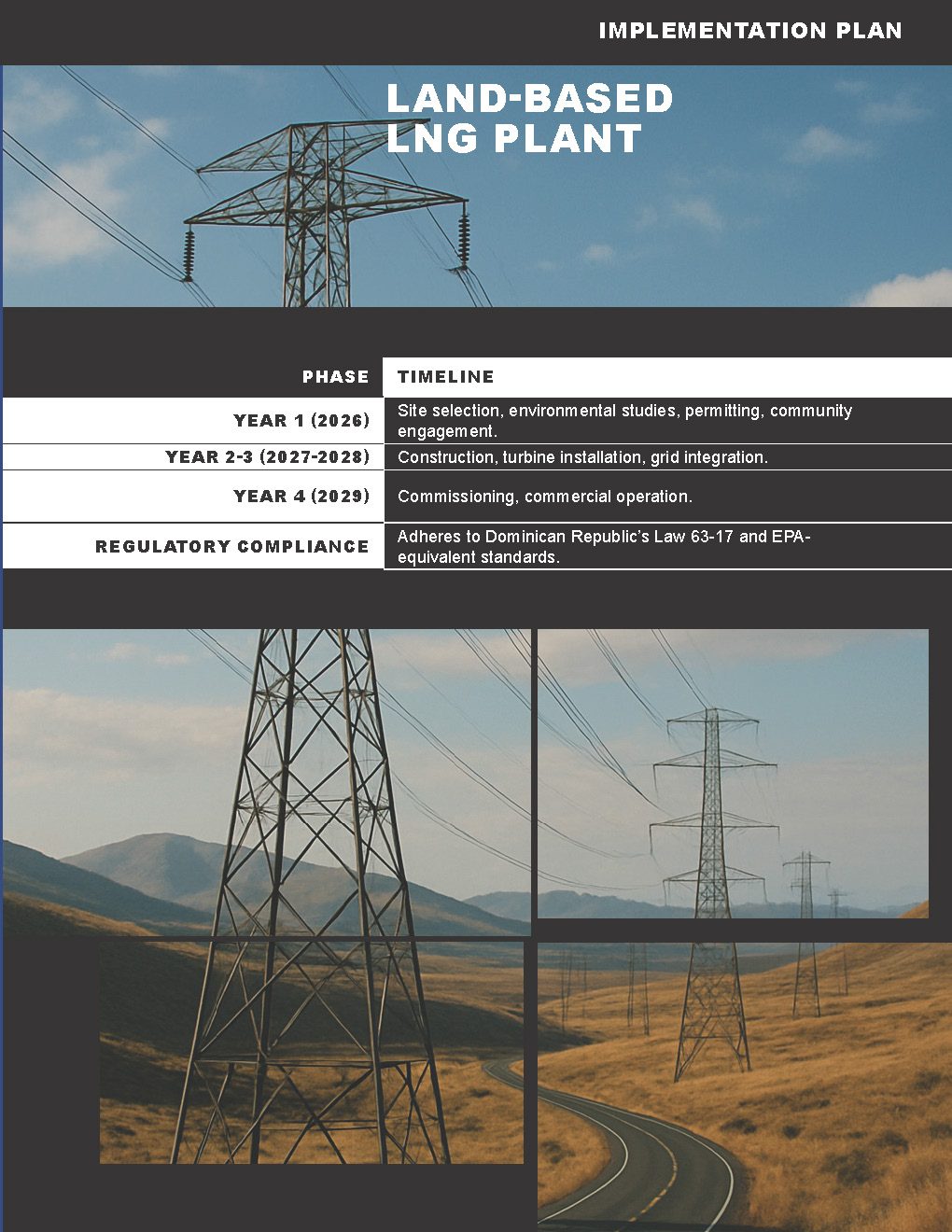

Implementation Plan

Land-Based LNG Plant

- Year 1 (2026): Site selection, environmental studies, permitting, community engagement.

- Year 2-3 (2027-2028): Construction, turbine installation, grid integration.

- Year 4 (2029): Commissioning, commercial operation.

- Regulatory Compliance: Adheres to Dominican Republic’s Law 63-17 and EPA-equivalent standards.

LNG Power Barge

- Year 1 (2026): Mooring site selection, marine studies, permitting, community engagement.

- Year 2 (2027): Barge construction, cable installation, grid integration.

- Year 3 (2028): Delivery, mooring, commissioning, operation.

- Regulatory Compliance: Adheres to Law 63-17, IMO, and EPA-equivalent standards.

Risk Mitigation

- Technical Risks: Co-developed GeoCycle systems undergo joint testing for reliability. GeoSmart-AI/B reduces downtime.

- Financial Risks: 20% contingency covers overruns. PPAs secure revenue.

- Social Risks: Community campaigns highlight low emissions and jobs, supported by partner credibility.

- Environmental Risks: Independent audits ensure compliance. Co-developed spill and fire prevention systems enhance LNG safety.

Conclusion

Geodyn Solutions, with its strategic partner, offers two LNG-based solutions using proprietary technologies: a land-based CCGT plant with superior efficiency and lower costs, and a power barge with rapid deployment and zero land use. The land-based plant delivers a 2.0-year payback and 889% ROI, while the barge offers a 2.5-year payback and 699% ROI, both at $0.14/kWh. The choice depends on priorities: cost and efficiency (land-based) or speed and land preservation (barge). Both support the Dominican Republic’s sustainable energy goals, deployable by 2028-2029.