Proposal for Large-Scale Organic Cacao Farming and High-Value Processing in the Dominican Republic

Executive Summary

Geodyn Solutions proposes developing a 10,000-hectare organic cacao plantation and a state-of-the-art processing factory in the Dominican Republic to produce high-value cacao products (chocolate bars, cocoa powder, cocoa butter, and cocoa liquor) for export to the United States and Europe. Leveraging advanced agricultural technologies, biofertilizers, and sustainable agroforestry, this project will maximize yield, enhance quality, and improve nutrient profiles. The initiative will create 25,000–30,000 jobs, deliver a 15–20% return on investment (ROI), and provide significant environmental benefits, with a 20% contingency fee to mitigate risks.

Project Overview

Objectives

- Agricultural Development: Cultivate 10,000 hectares of organic cacao using advanced technologies and biofertilizers to achieve high yields and superior quality.

- Processing Facility: Build a factory to produce premium chocolate bars, cocoa powder, cocoa butter, and cocoa liquor for export to high-value markets.

- Economic Impact: Generate 25,000–30,000 direct and indirect jobs, including farmworkers, factory staff, and technical roles.

- Environmental Benefits: Enhance biodiversity, sequester carbon, and improve soil health through organic agroforestry and biofertilizer use.

- Financial Viability: Achieve a projected ROI of 15–20% annually after Year 6, with a payback period of 8–9 years.

Location

The project will be located across multiple provinces (Duarte, Sánchez Ramírez, and María Trinidad Sánchez), selected for their fertile soils, tropical climate, and proximity to export ports. Sites will comply with the European Union Deforestation Regulation (EUDR) and avoid protected areas.

Agricultural Plan

Farm Design

- Size: 10,000 hectares, divided into 200 plots of 50 hectares for scalable management.

- Agroforestry Model: Cacao trees will be intercropped with shade trees (e.g., banana, citrus, mahogany) and high-value crops (e.g., vanilla, turmeric) to diversify income, enhance biodiversity, and improve soil health.

- Cacao Varieties: Fine-flavor Trinitario and Criollo hybrids, sourced from certified nurseries, optimized for premium markets.

- Organic Certification: Adherence to USDA Organic, EU Organic, Fairtrade, and Rainforest Alliance standards to access high-value markets.

Advanced Agricultural Technologies

- Biofertilizers: Use of microbial biofertilizers (e.g., mycorrhizal fungi, rhizobacteria) to enhance nutrient uptake, increase yields by 20–30%, and improve cacao bean nutrient profiles (e.g., higher polyphenol content).

- Precision Agriculture: Deploy drones for aerial monitoring, soil sensors for real-time nutrient analysis, and AI-driven yield prediction models to optimize planting and harvesting.

- Irrigation: Solar-powered drip irrigation systems with IoT integration to reduce water use by 40% and ensure consistent soil moisture.

- Pest Management: Integrated pest management (IPM) with biopesticides and pheromone traps to control diseases like Moniliasis and Witch’s Broom, reducing chemical use.

- Automation: Robotic pruning and harvesting systems to improve efficiency and reduce labor costs by 15%.

Cultivation Practices

- Planting: 1,200 cacao trees per hectare, with 100 shade trees per hectare. Planting will occur in phases over Years 1–3, with first harvests in Year 4.

- Yield Projections: Average yield of 1,200–1,500 kg/ha of dried cocoa beans by Year 6, increasing to 1,800 kg/ha by Year 10 with biofertilizer and technology enhancements.

- Sustainability: Biofertilizers and organic practices will reduce synthetic inputs, while agroforestry sequesters 12–18 tons CO2/ha annually.

- Training: 5,000 farmers trained in advanced techniques, biofertilizer application, and technology use, building on IICA’s success in boosting yields.

Processing Factory

Facility Design

- Location: Centralized facility near San Francisco de Macorís, with proximity to farms and Puerto Plata port for efficient logistics.

- Capacity: Process 20,000 metric tons of dried cocoa beans annually, producing 4,000 tons of chocolate bars, 6,000 tons of cocoa powder, 5,000 tons of cocoa butter, and 3,000 tons of cocoa liquor.

- Equipment: Advanced machinery (e.g., automated roasters, conching machines, tempering units) from Buhler Group, with blockchain-enabled traceability systems.

- Certifications: Compliance with FDA, EU Organic, Fairtrade, and EUDR standards, ensuring market access and consumer trust.

Production Process

- Fermentation and Drying: Beans fermented for 5–7 days in automated, climate-controlled units and dried to 7% moisture using solar-assisted dryers.

- Processing: Beans cleaned, roasted, and ground into liquor, then processed into powder, butter, or liquor. Chocolate bars produced with customizable formulations (e.g., 70% dark, single-origin).

- Packaging: Eco-friendly, biodegradable packaging with QR codes linking to farm traceability data, appealing to premium consumers.

- Quality Enhancement: Biofertilizer use increases bean polyphenol and flavonoid content, improving flavor and health benefits for high-value products.

Export Markets

- Target Markets: United States (health-conscious and premium chocolate segments) and Europe (Germany, France, Belgium), where organic chocolate demand grows 5–7% annually.

- Pricing: Organic cocoa beans at $4,500–$5,500/ton, cocoa butter at $7,000–$9,000/ton, cocoa powder at $6,000–$7,000/ton, and chocolate bars at $12,000–$15,000/ton (wholesale).

- Logistics: Partner with exporters like Rizek Cacao and logistics firms like Maersk to streamline shipping to Miami and Rotterdam.

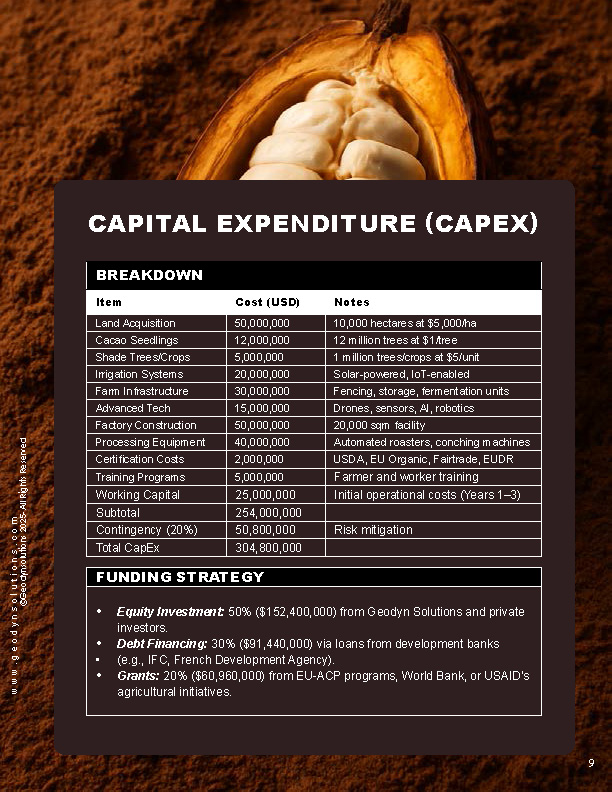

Capital Expenditure (CapEx)

Breakdown

Item | Cost (USD) | Notes |

Land Acquisition | 50,000,000 | 10,000 hectares at $5,000/ha |

Cacao Seedlings | 12,000,000 | 12 million trees at $1/tree |

Shade Trees/Crops | 5,000,000 | 1 million trees/crops at $5/unit |

Irrigation Systems | 20,000,000 | Solar-powered, IoT-enabled |

Farm Infrastructure | 30,000,000 | Fencing, storage, fermentation units |

Advanced Tech | 15,000,000 | Drones, sensors, AI, robotics |

Factory Construction | 50,000,000 | 20,000 sqm facility |

Processing Equipment | 40,000,000 | Automated roasters, conching machines |

Certification Costs | 2,000,000 | USDA, EU Organic, Fairtrade, EUDR |

Training Programs | 5,000,000 | Farmer and worker training |

Working Capital | 25,000,000 | Initial operational costs (Years 1–3) |

Subtotal | 254,000,000 | |

Contingency (20%) | 50,800,000 | Risk mitigation |

Total CapEx | 304,800,000 |

Funding Strategy

- Equity Investment: 50% ($152,400,000) from Geodyn Solutions and private investors.

- Debt Financing: 30% ($91,440,000) via loans from development banks (e.g., IFC, French Development Agency).

- Grants: 20% ($60,960,000) from EU-ACP programs, World Bank, or USAID’s agricultural initiatives.

Financial Projections

Revenue Projections

- Year 4 (Initial Harvest): 5,000 tons of dried beans at $5,000/ton = $25,000,000.

- Year 6 (Full Production): 15,000 tons processed into 3,000 tons chocolate bars ($14,000/ton), 4,500 tons powder ($6,500/ton), 3,750 tons butter ($8,000/ton), 2,250 tons liquor ($6,000/ton) = $94,250,000.

- Year 10 (Optimized): 18,000 tons processed into 3,600 tons bars, 5,400 tons powder, 4,500 tons butter, 2,700 tons liquor = $113,100,000.

Operating Expenses (Annual, Year 6)

- Labor: $50,000,000 (25,000 workers at $2,000/year average)

- Maintenance: $10,000,000

- Utilities: $5,000,000

- Packaging/Transport: $15,000,000

- Certifications: $2,000,000

- Total: $82,000,000

ROI Calculation

- Net Profit (Year 6): $94,250,000 (revenue) – $82,000,000 (OpEx) = $12,250,000.

- Net Profit (Year 10): $113,100,000 – $82,000,000 = $31,100,000.

- Cumulative Cash Flow: Positive by Year 8, with ROI of 15–20% annually by Year 10, driven by high-value products and yield improvements.

Payback Period

- Initial investment ($304,800,000) recovered by Year 8–9, assuming stable market prices and optimized yields.

Job Creation

- Farmworkers: 20,000 full-time workers for planting, maintenance, and harvesting ($1,500–$2,000/year).

- Factory Staff: 4,000 workers for processing, packaging, and quality control ($2,500–$3,500/year).

- Technical/Administrative: 1,000 roles (agronomists, engineers, export managers) at $5,000–$15,000/year.

- Total Jobs: 25,000 direct jobs, plus 5,000 indirect jobs (e.g., logistics, equipment suppliers).

- Social Impact: Prioritize local hiring, with 40% of roles for women and youth to address labor shortages and promote inclusivity.

Environmental Benefits

- Biodiversity: Agroforestry supports native species, with shade trees and intercrops creating habitats for pollinators and wildlife.

- Carbon Sequestration: 10,000 hectares sequester 120,000–180,000 tons CO2 annually, equivalent to offsetting emissions from 30,000 cars.

- Soil Health: Biofertilizers increase soil microbial activity, improving nutrient cycling and reducing erosion by 50%.

- Water Efficiency: IoT irrigation and shade trees reduce water use by 40%, preserving local watersheds.

- Deforestation Compliance: EUDR-compliant site selection ensures no forest loss, aligning with global sustainability goals.

Risk Mitigation

- Market Risks: Diversified high-value products and long-term contracts with buyers (e.g., Mars, Nestlé) stabilize revenue.

- Disease: Advanced IPM and resistant hybrids, supported by IICA protocols, minimize crop losses.

- Technology Failure: Redundant systems and local technician training ensure operational continuity.

- Contingency Fund: 20% ($50,800,000) allocated for unforeseen costs (e.g., climate events, equipment delays).

Implementation Timeline

Year | Activity |

Year 1–2 | Land acquisition, phased planting, factory construction, technology deployment |

Year 3 | Complete planting, factory setup, worker training |

Year 4 | First harvest, initial processing, export trials |

Year 5–6 | Scale production, optimize yields, secure export contracts |

Year 7–10 | Full capacity, continuous improvement, reinvestment |

Conclusion

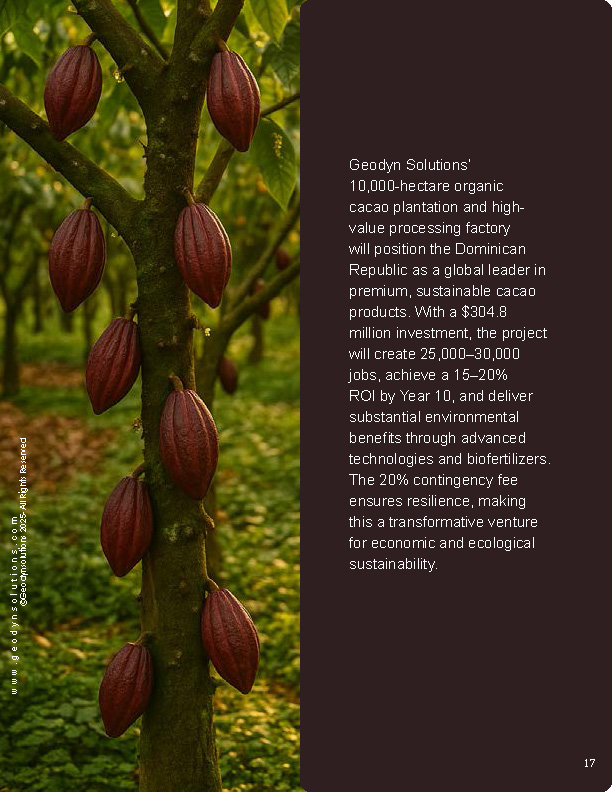

Geodyn Solutions’ 10,000-hectare organic cacao plantation and high-value processing factory will position the Dominican Republic as a global leader in premium, sustainable cacao products. With a $304.8 million investment, the project will create 25,000–30,000 jobs, achieve a 15–20% ROI by Year 10, and deliver substantial environmental benefits through advanced technologies and biofertilizers. The 20% contingency fee ensures resilience, making this a transformative venture for economic and ecological sustainability.

References

- IICA, Dominican Republic Cocoa Sector.

- Cacao Forest Initiative, Agroforestry Models.

- USDA, Organic Cacao Market Trends.

- Buhler Group, Cocoa Processing Technology.

- World Bank, South-South Exchange Programs.

Notice: This message contains confidential information intended only for the individual named. You should not disseminate, distribute, or copy this email if you are not the named addressee. Please notify the sender immediately by email if you have received this email by mistake and delete this email from your system. Email transmission cannot be guaranteed secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender, therefore, does not accept liability for any error(s) or omission(s) in the contents of this message arising from email transmission.