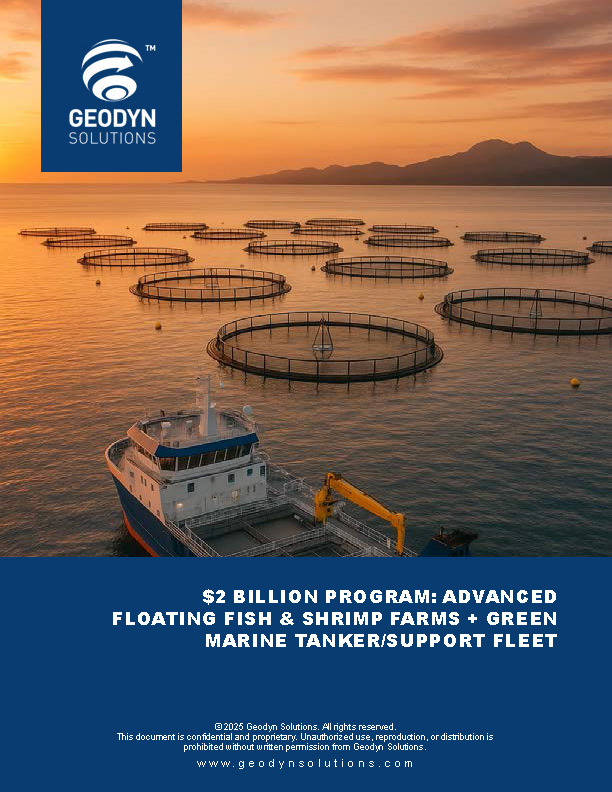

$2 Billion Program: Advanced Floating Fish & Shrimp Farms + Green Marine Tanker/Support Fleet

Objective: Build a proprietary, modular, open-ocean aquaculture and logistics fleet using the latest marine science and low-carbon vessel technology to maximize food security and ROI, while cutting CAPEX risk, emissions, and permitting friction.

Contingency: 20% of program CAPEX embedded (scope below).

Horizon: 10-year build-out in three phases with milestone gates.

1) Executive Summary

- Demand tailwinds:Sustainable aquaculture is on track to be a trillion-dollar industry by 2050 and could generate ~22 million jobs globally.

- Tech maturity:Offshore cages, submersible systems, and land-based RAS hatcheries are commercially proven; hybrid/methanol-ready propulsion, air-lubrication, and wind-assist technologies yield verified savings.

- Policy pull:IMO 2023 GHG targets, EU ETS for maritime, and national “blue economy” programs support the economics of green fleets and farms.

Thesis: Combine deep-water floating/submersible farms and coastal RAS hatcheries with a green logistics fleet (live-fish wellboats, feed/reefer tankers, service craft) to secure biological performance, biosecurity, and premium-grade seafood while lowering delivered cost per kilogram.

2) Portfolio Architecture

- Aquaculture Production

- Open-ocean pens (salmon, seriola, cobia): Submersible, storm-resistant systems for thermal refuge and reduced parasite pressure.

- Warm-water shrimp modules (IMTA-ready): Floating raceways with solids capture and optional seaweed/mollusk co-culture for nutrient recycling.

- RAS hatchery & nursery hubs:AI-controlled feeding/aeration, biochar filtration for nutrient recovery, and high survival rates.

- Marine Logistics & Service Fleet

- Live-fish wellboatswith RSW chilling, UV/ozone treatment, and sludge recovery.

- Hybrid/methanol-capable tankers and reefersfor feed, harvest, and cold chain operations.

- Energy-saving retrofits: rotor sails, air-lubrication systems, advanced hull coatings, and voyage optimization software.

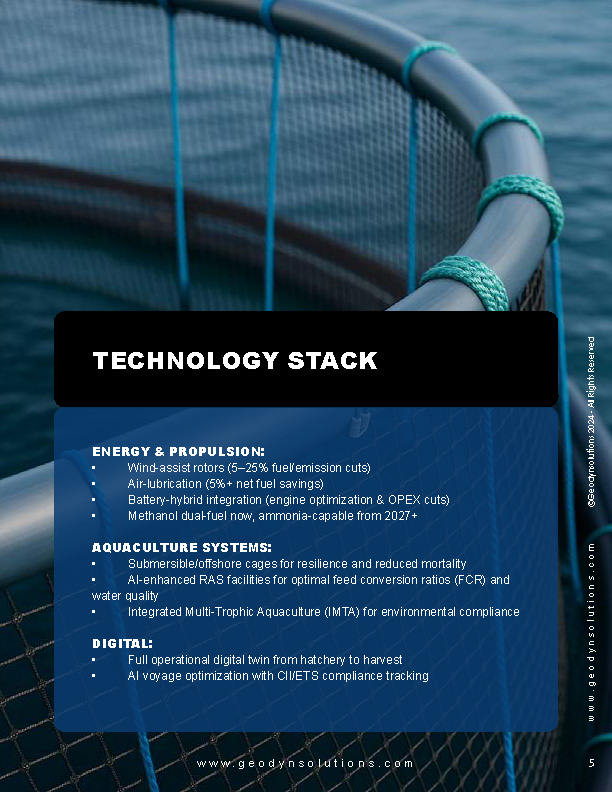

3) Technology Stack

Energy & Propulsion:

- Wind-assist rotors (5–25% fuel/emission cuts)

- Air-lubrication (5%+ net fuel savings)

- Battery-hybrid integration (engine optimization & OPEX cuts)

- Methanol dual-fuel now, ammonia-capable from 2027+

Aquaculture Systems:

- Submersible/offshore cages for resilience and reduced mortality

- AI-enhanced RAS facilities for optimal feed conversion ratios (FCR) and water quality

- Integrated Multi-Trophic Aquaculture (IMTA) for environmental compliance

Digital:

- Full operational digital twin from hatchery to harvest

- AI voyage optimization with CII/ETS compliance tracking

4) ESG & Environmental Safeguards

- IMTA and effluent polishing to limit nutrient discharge

- Closed-loop biosecurity from hatchery to harvest

- IMO 2030 carbon-intensity compliance with class-verified emission reductions

5) Sites & Incentives Comparison

Region | Incentives | Pros | Cons |

U.S. | NOAA Sea Grant, MARAD Title XI, USDA B&I | Large market, vessel finance support | Complex permitting, Jones Act limits |

Norway/EU | Enova grants, EU ETS cost savings | Mature aquaculture tech, strong subsidies | ETS compliance admin |

Singapore/SEA | MPA grants, IFC blue finance | Strategic location, lower OPEX | Tropical disease risk (mitigable) |

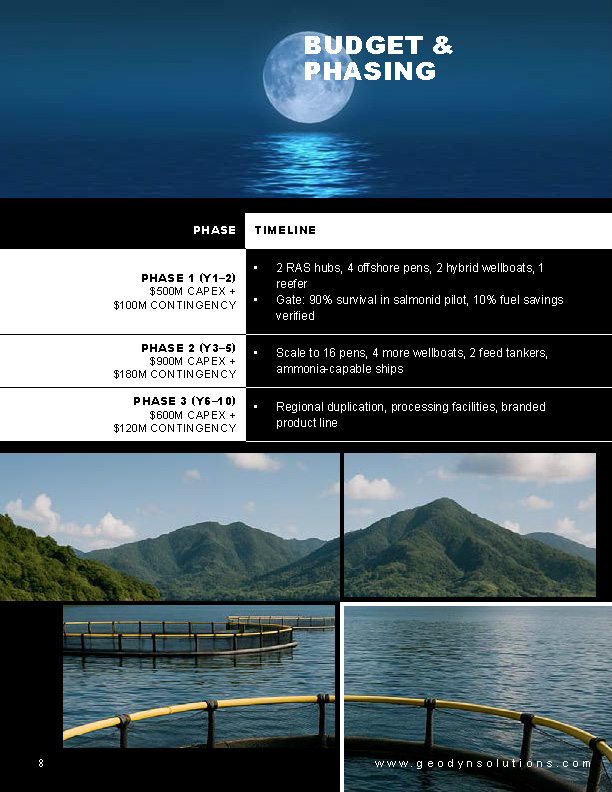

6) Budget & Phasing

Phase 1 (Y1–2): $500M CAPEX + $100M contingency

- 2 RAS hubs, 4 offshore pens, 2 hybrid wellboats, 1 reefer

- Gate: 90% survival in salmonid pilot, 10% fuel savings verified

Phase 2 (Y3–5): $900M CAPEX + $180M contingency

- Scale to 16 pens, 4 more wellboats, 2 feed tankers, ammonia-capable ships

Phase 3 (Y6–10): $600M CAPEX + $120M contingency

- Regional duplication, processing facilities, branded product line

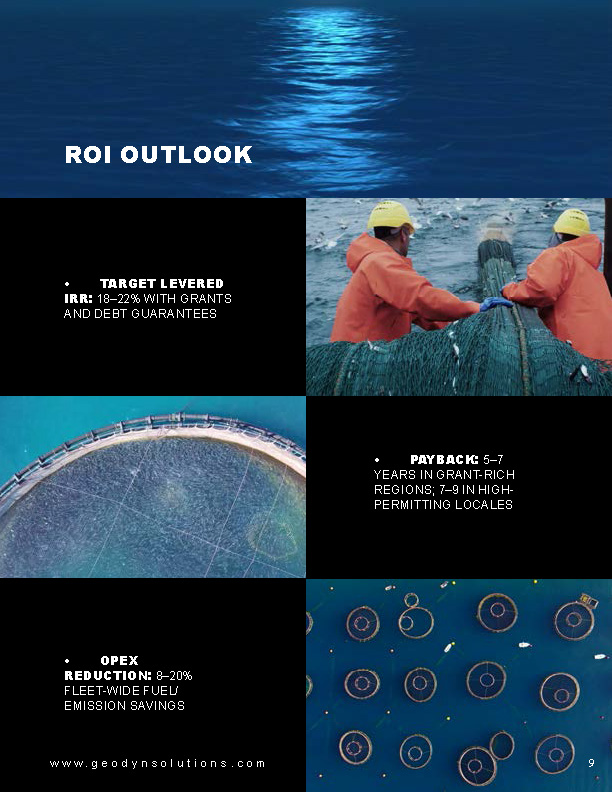

7) ROI Outlook

- Target levered IRR:18–22% with grants and debt guarantees

- Payback:5–7 years in grant-rich regions; 7–9 in high-permitting locales

- OPEX reduction:8–20% fleet-wide fuel/emission savings

8) Jobs & Economic Benefits

- Direct jobs:1,500–2,500 FTEs globally at scale

- Indirect jobs:shipbuilding, feed supply, cold chain logistics, port services

- Stimulates local economies and supports coastal communities

9) Risk Management

- Biological risk: mitigated by submersible cages, IMTA, RAS biosecurity

- Weather risk: deep-water moorings, dynamic positioning, multi-region siting

- Fuel price risk: green tech stack, ETS compliance strategies

- Permitting risk: launch in regions with streamlined processes first

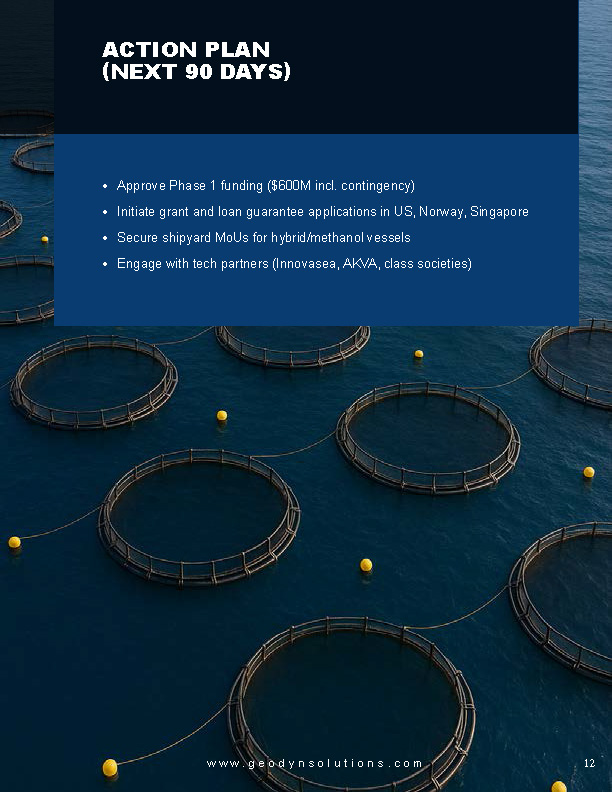

10) Action Plan (Next 90 Days)

- Approve Phase 1 funding ($600M incl. contingency)

- Initiate grant and loan guarantee applications in US, Norway, Singapore

- Secure shipyard MoUs for hybrid/methanol vessels

- Engage with tech partners (Innovasea, AKVA, class societies)

Copyright © 2025 Geodyn Solutions . All Rights Reserved.

This document and its contents are confidential and proprietary. No part of this work may be reproduced, distributed, or transmitted in any form or by any means without prior written permission.